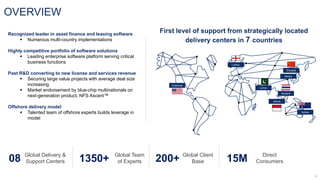

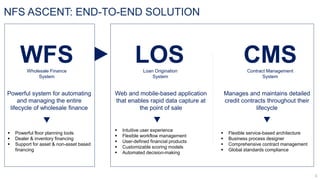

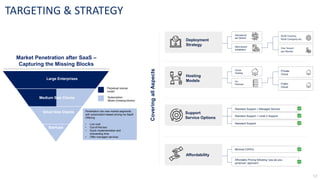

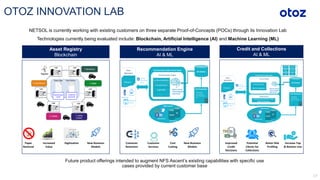

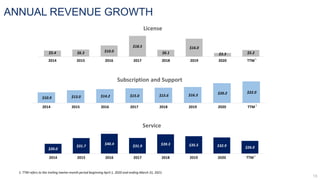

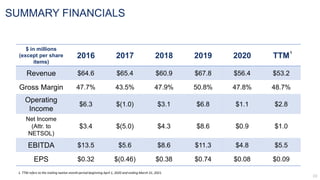

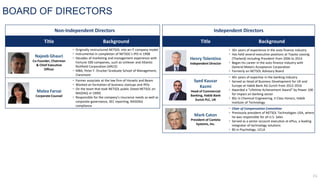

Netsol Technologies' September 2021 investor presentation outlines their position as a leading provider of software solutions in the global leasing and finance industry, highlighting their strong market presence, client base, and innovative products such as the NFS Ascent platform. The document discusses the company's financial performance, growth strategy, and the success of their offshore delivery model, which enhances operational efficiency. It emphasizes the importance of recurring revenue from cloud deployments and investment in research and development for future technology innovations including AI and blockchain.