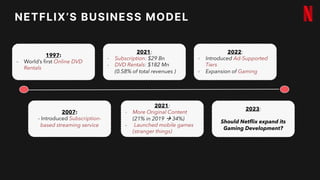

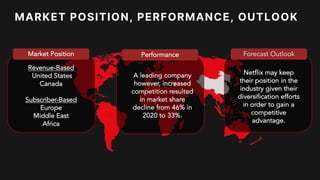

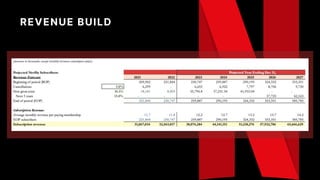

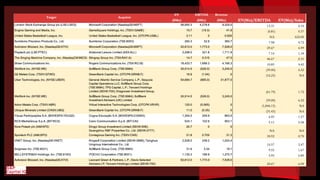

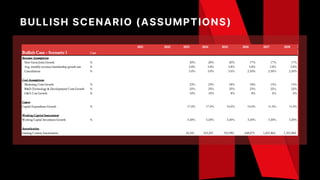

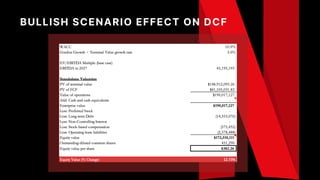

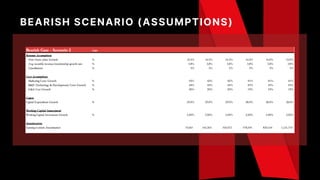

The document analyzes Netflix's business model and market position, highlighting its growth from online DVD rentals to a leading subscription-based streaming platform with over 220 million subscribers. Despite a decline in market share from 46% to 33% due to increasing competition, Netflix is diversifying and focusing on original content and gaming. The report also discusses potential strategic alternatives and buyers, indicating opportunities for expansion through collaborations and acquisitions.