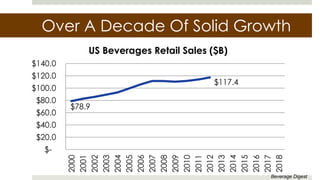

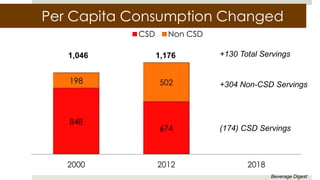

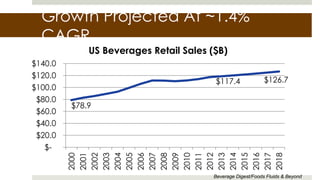

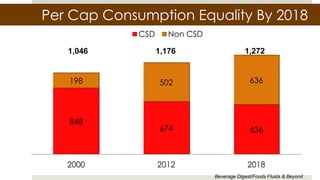

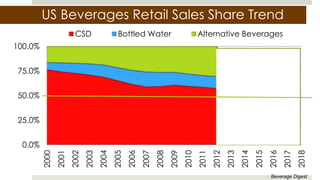

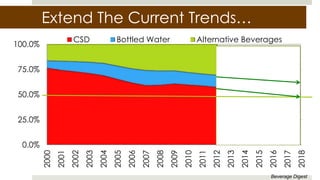

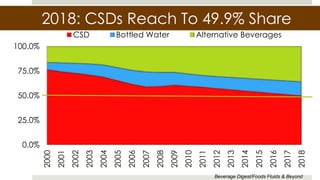

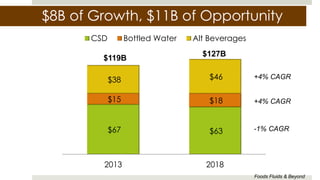

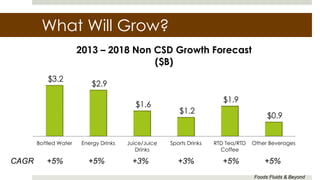

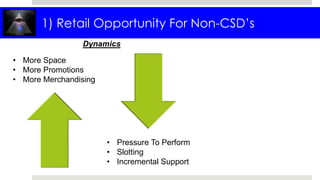

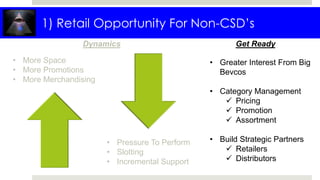

The document discusses projections for growth in the US beverage market over the next five years. It notes that while carbonated soft drinks have declined as a percentage of sales, total beverage sales have grown steadily over the past decade and are projected to continue moderate growth of around 1.4% annually through 2018. Non-carbonated beverages have been the driver of overall category growth and are expected to continue outpacing carbonated drinks. The document outlines five key opportunities for beverage companies to capitalize on this trend, including expanding retail space and promotions for non-CSDs, evolving consumer preferences, opportunities in value price segments, changing product forms and sales channels, and potential impacts from changes in sweetener formulation.