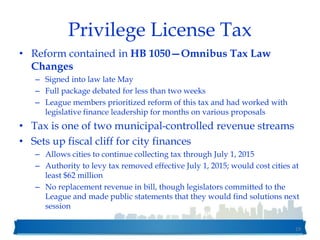

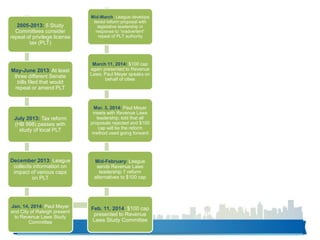

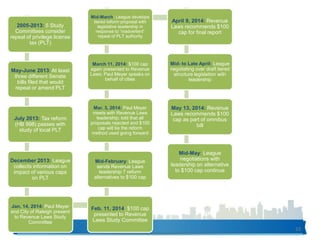

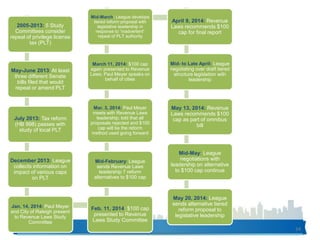

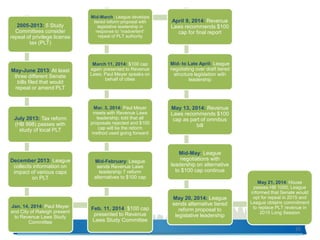

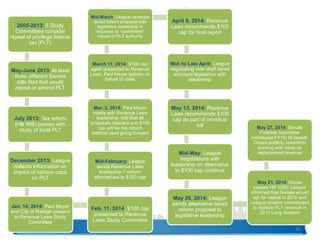

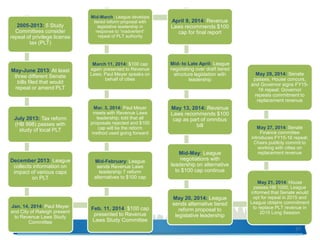

The document summarizes the legislative process around reforming North Carolina's privilege license tax. It details numerous proposals and discussions between the N.C. League of Municipalities and legislative leadership over the past several years. Ultimately, the Revenue Laws Study Committee recommended including a $100 cap on the tax as part of an omnibus bill, despite the League pushing for alternative reform options. Cities stood to lose at least $62 million in revenue if the tax authority was removed without replacement funding.