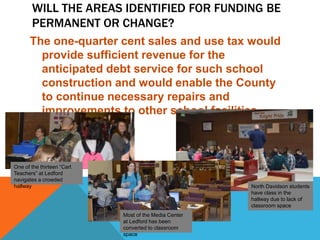

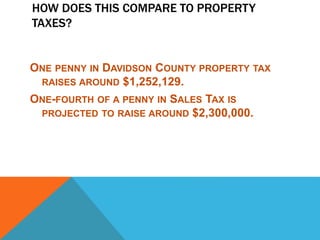

The Davidson County Board of Commissioners has called for a special advisory referendum on May 6, 2014, to vote on a proposed one-quarter cent (1/4¢) sales and use tax to fund a new high school and improve crowded school facilities. The tax is estimated to generate approximately $2.3 million annually, which could ease pressure on property taxes but does not guarantee their reduction. There are no sunset provisions for the tax, which could potentially be repealed by a future vote of the board.

![WHAT IS THE VOTING PROCEDURE?

Yes. Legislation specifies how the question must be presented on

the ballot:

Ballot Question. – The form of the question to be presented on a

ballot for a special election concerning the levy of the tax

authorized by this Article shall be:'[ ] FOR [ ] AGAINST

Local sales and use tax at the rate of one-quarter percent (0.25%) in

addition to all other State and local sales and use taxes.'

Note: The sale tax amount is set at a rate of .25%.](https://image.slidesharecdn.com/maxwalserpresentation-141216092414-conversion-gate01/85/Davidson-County-Sales-Tax-Referendum-Presentation-16-320.jpg)