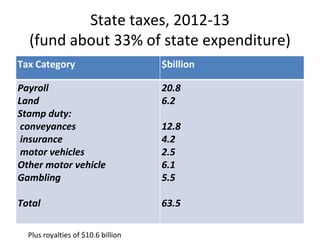

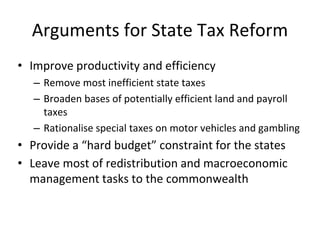

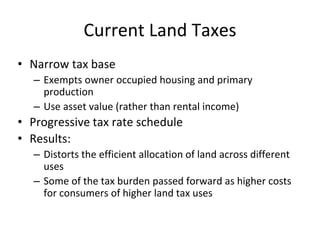

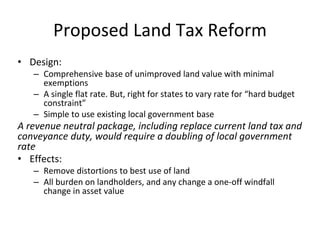

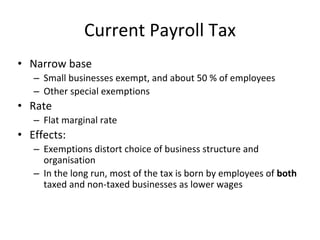

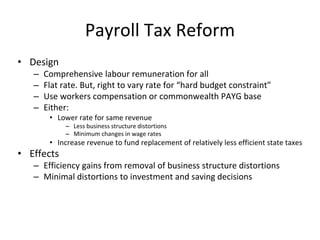

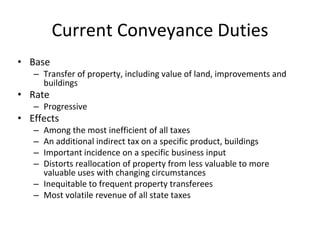

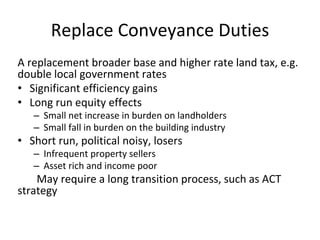

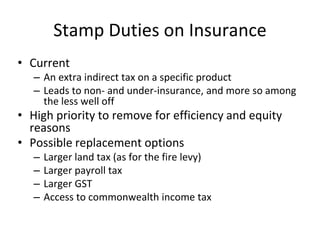

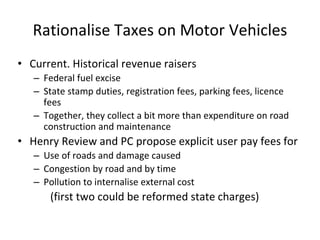

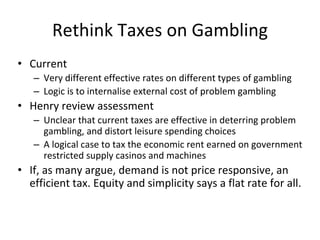

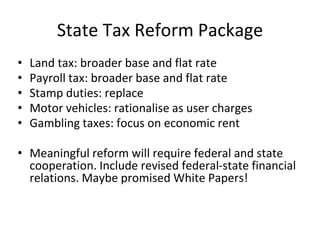

This document outlines arguments for reforming state taxes in Australia and proposes several options. It describes the current major state taxes, critiques their inefficiencies, and suggests alternatives. The proposed reforms aim to broaden tax bases, lower rates, and remove distortions. Specific options include expanding land and payroll taxes while replacing conveyance duties and rationalizing other taxes. An overall reform package could significantly improve productivity and efficiency across states.