The document discusses the National Bank of Pakistan (NBP), including its establishment, ownership structure, operations, and recruitment/selection processes. Some key points:

- NBP was established in 1949 and was originally government-owned, now has private and government ownership. It operates 1280 local branches and 18 overseas branches.

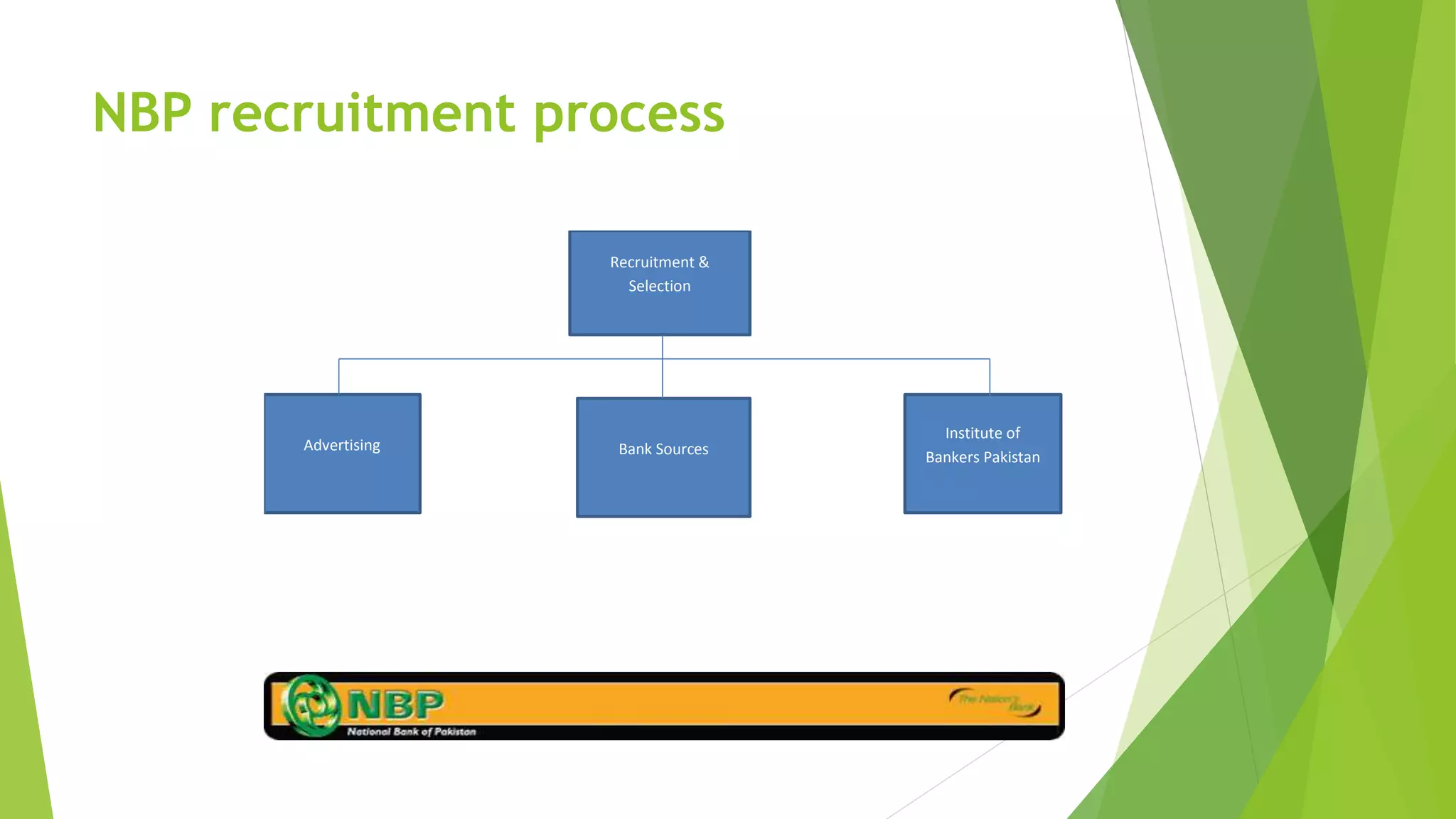

- Recruitment involves job analysis, consultants, and screening applicants based on merit. Sources include internal recruitment, industry, educational institutions, and the Institute of Bankers in Pakistan.

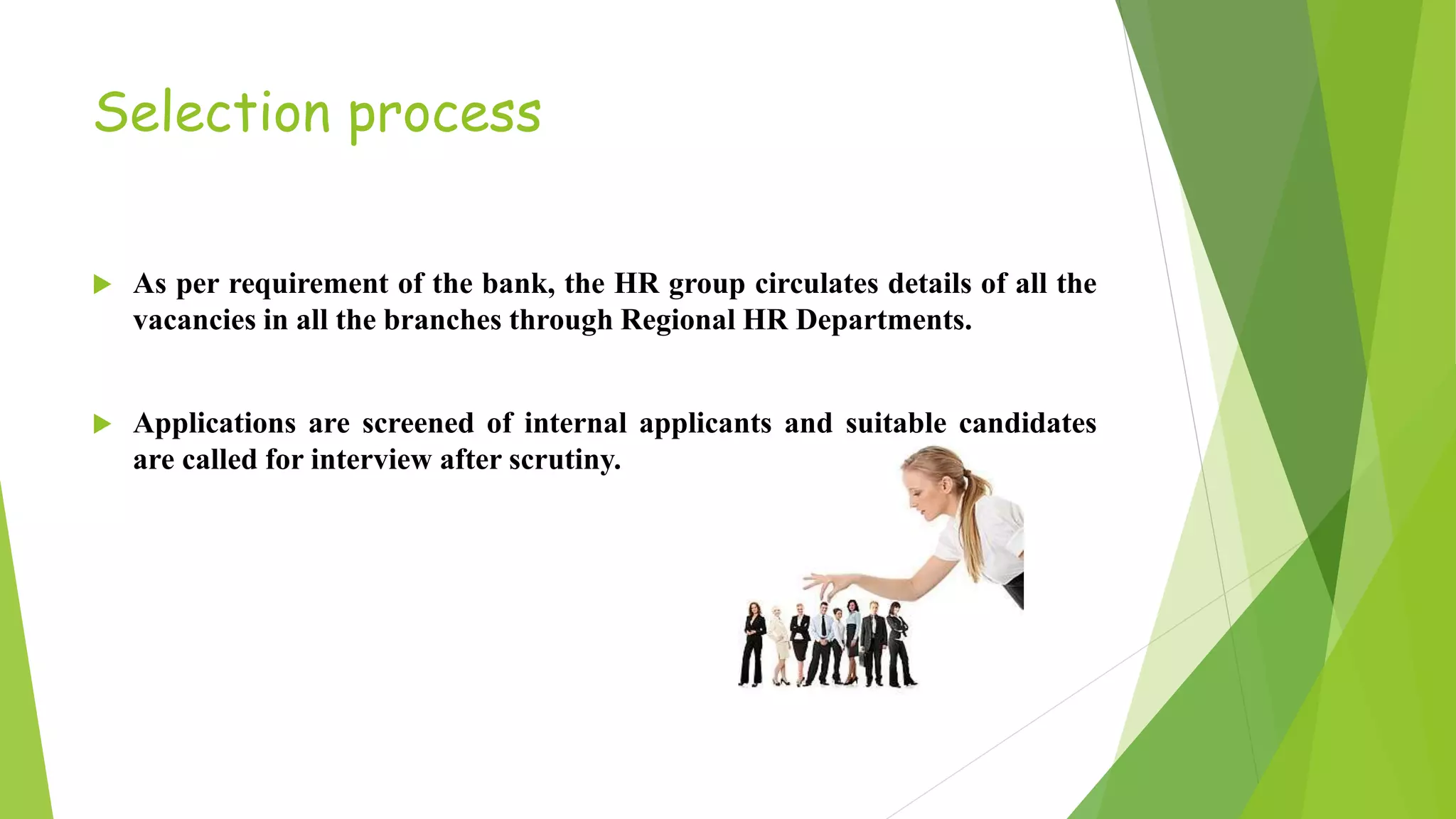

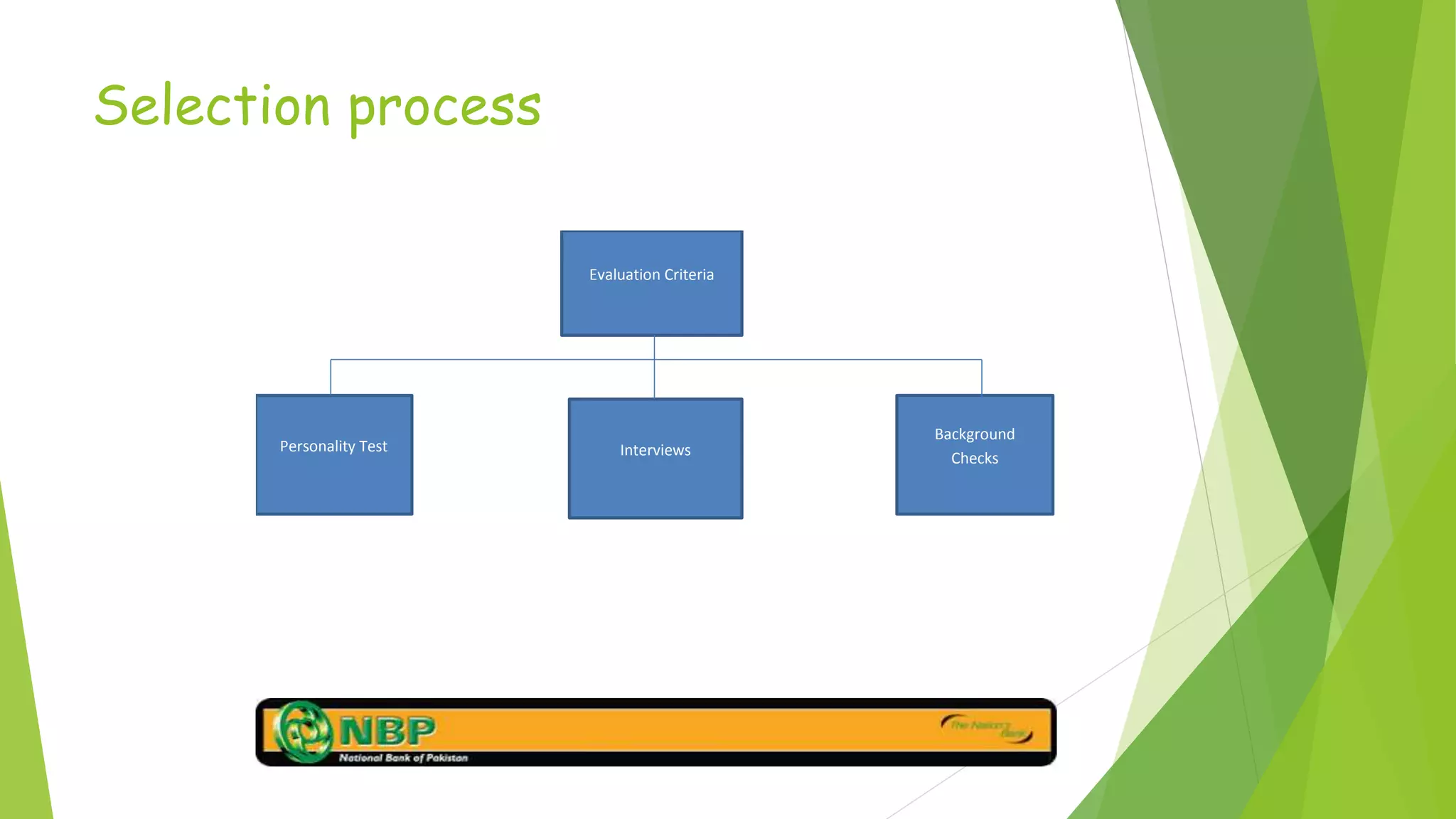

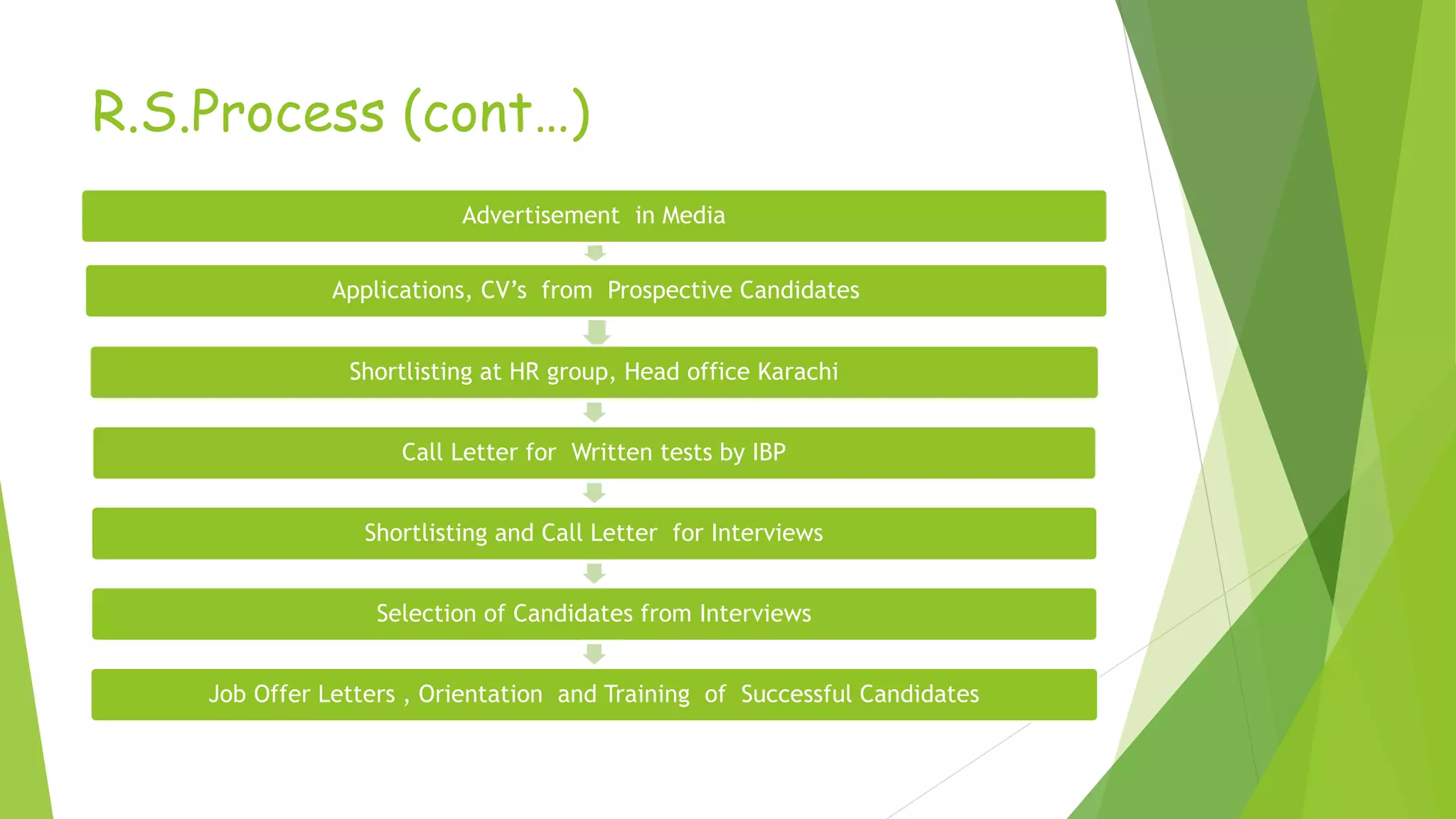

- The selection process includes application screening, written tests, interviews, background checks, and job offers/training for successful candidates.

- Benefits include insurance, medical, leave, retirement, and tax benefits