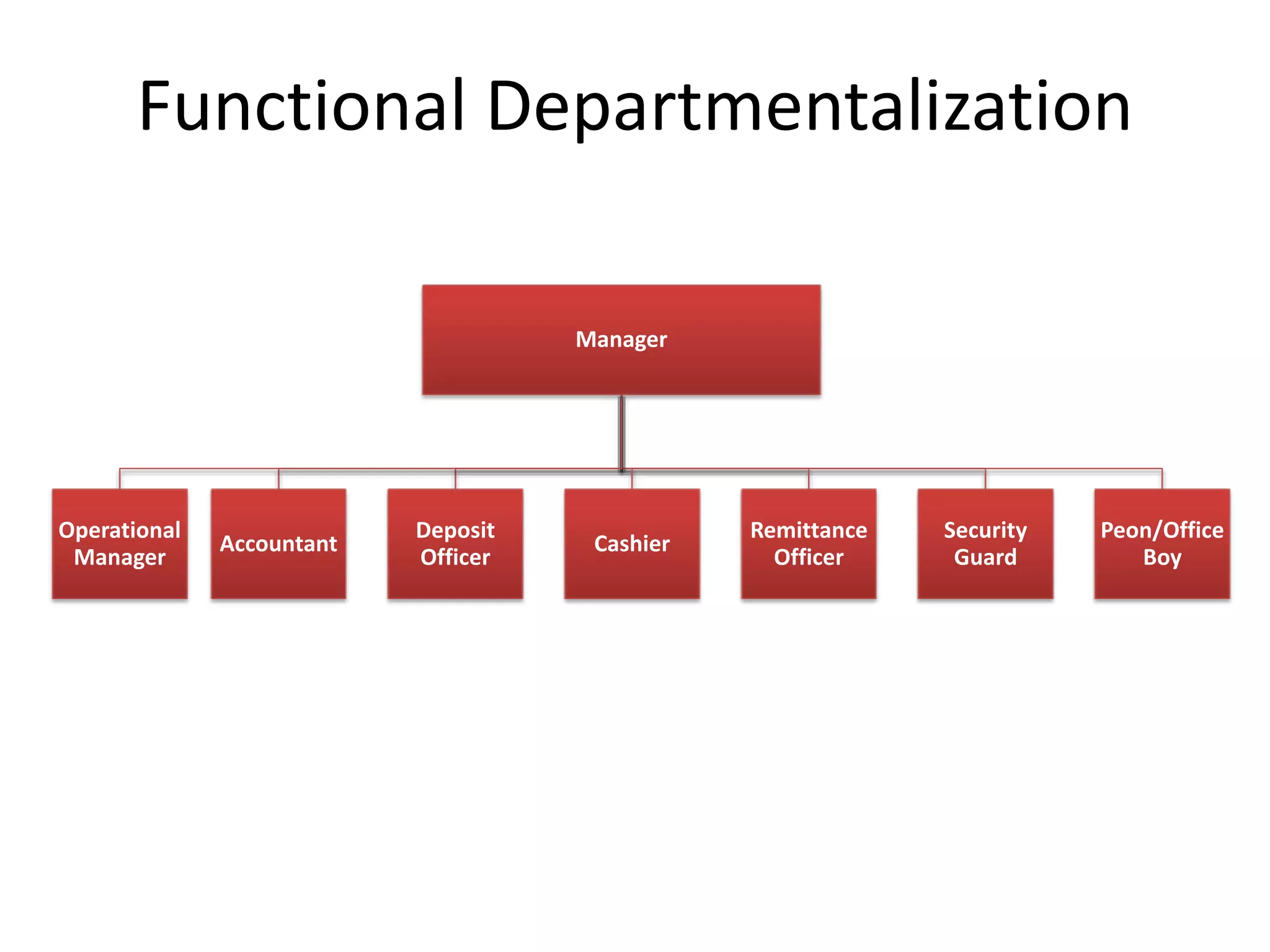

National Bank of Pakistan (NBP) was established in 1949 to finance trade between East and West Pakistan after partition from India. NBP provides banking services including deposits, loans, and investments. It has a hierarchical management structure led by a president and board of directors. NBP aims to be the leading bank in Pakistan through excellent customer service, use of new technologies, and social responsibility initiatives.