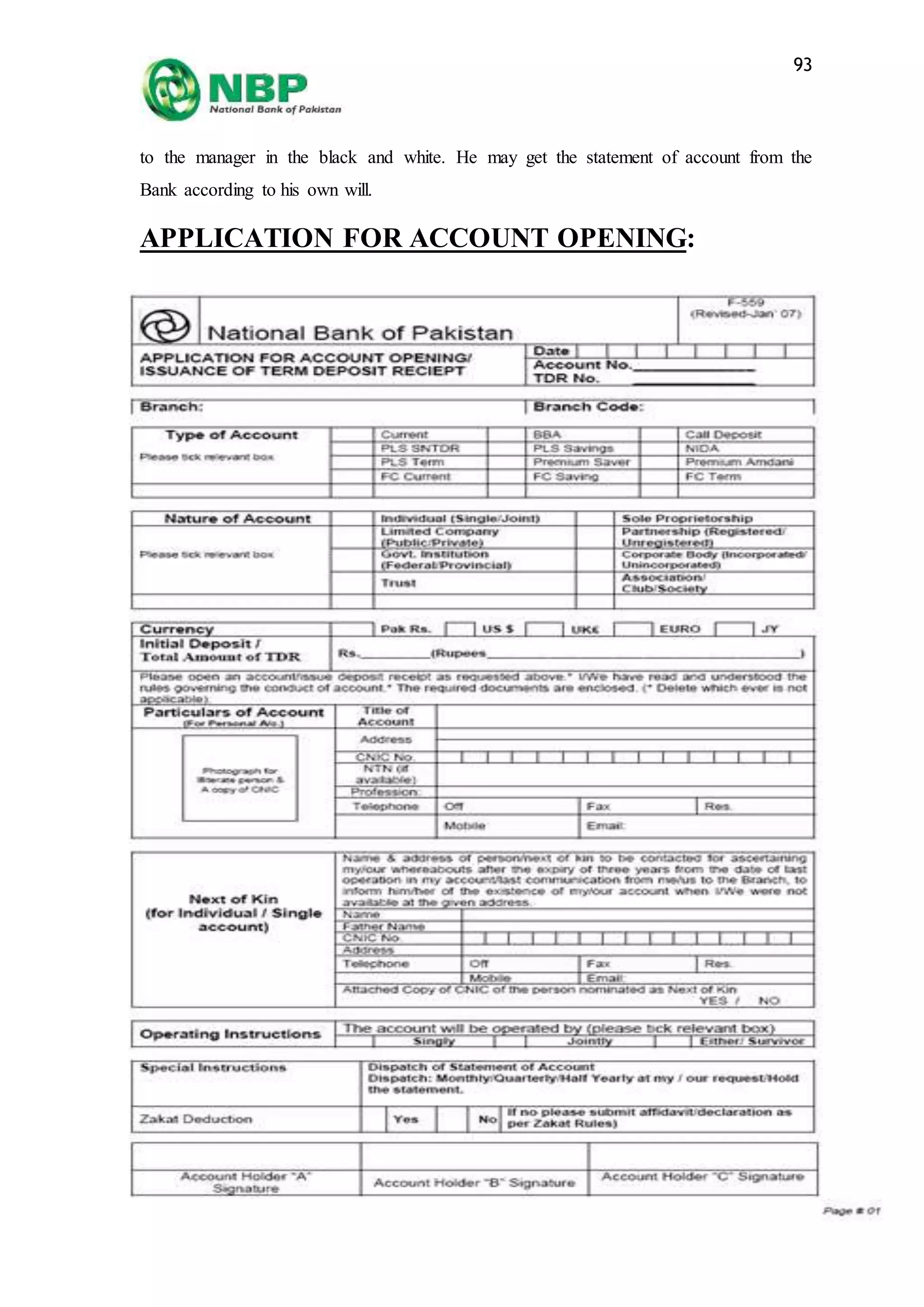

The document provides background information on the history and establishment of National Bank of Pakistan (NBP). Some key points:

- NBP was established in 1949 through an ordinance due to a crisis in Pakistan's jute trade and devaluation of the Indian rupee. It started with 6 branches focused on financing the jute crop.

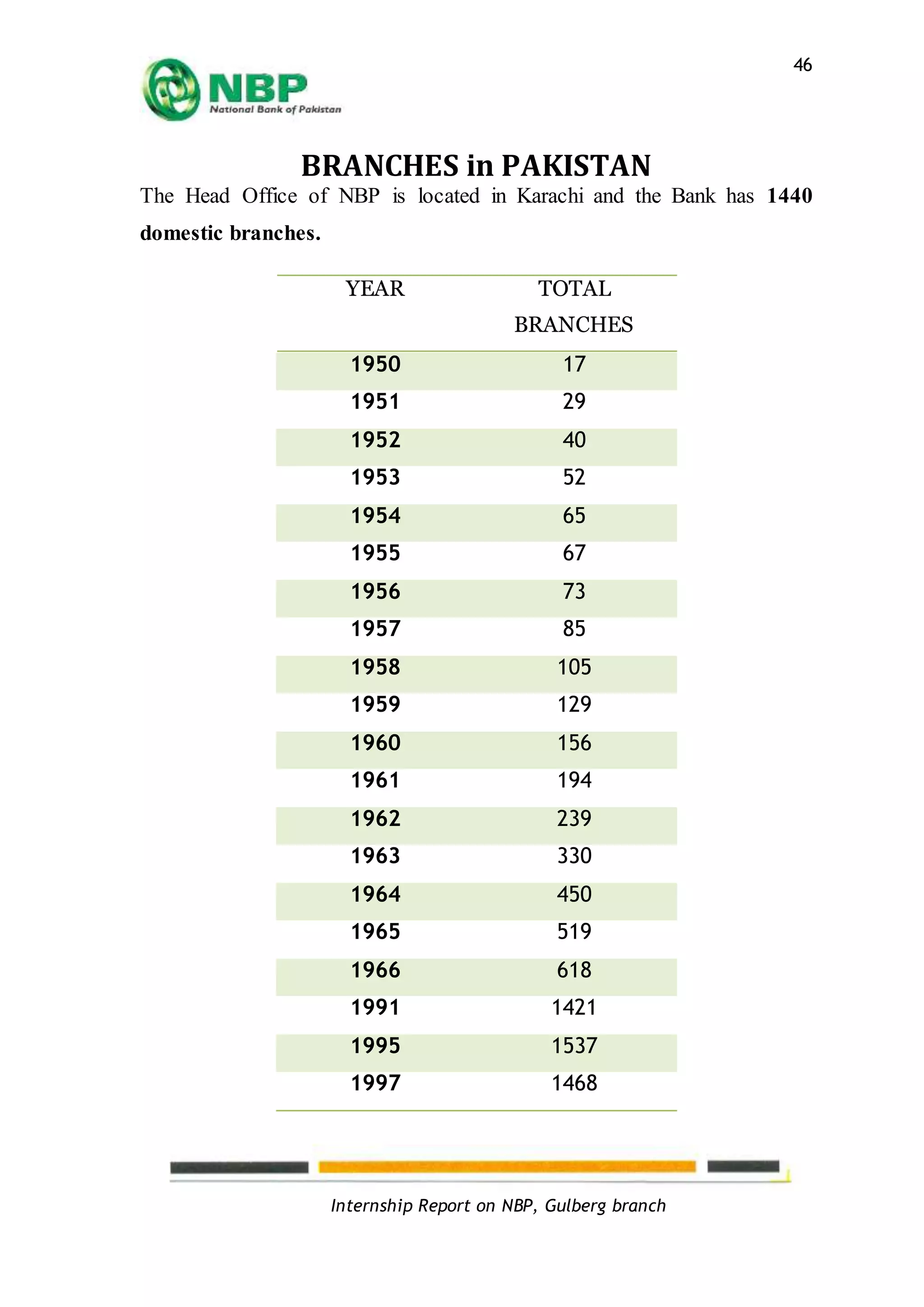

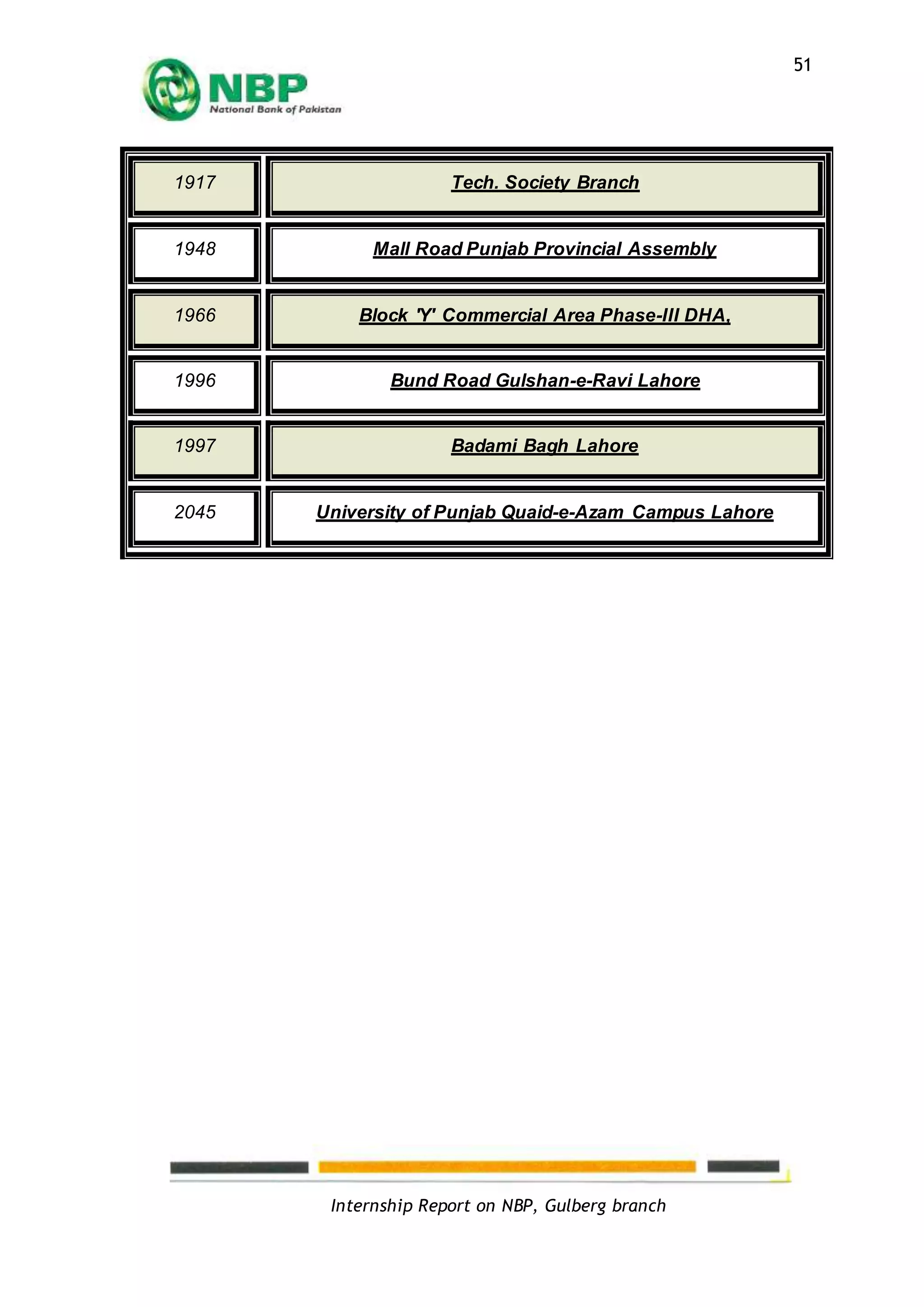

- Over time, NBP expanded its branch network and operations beyond jute to other commodities and services. By 1962 it had grown to 239 branches serving over 1 billion rupees in deposits.

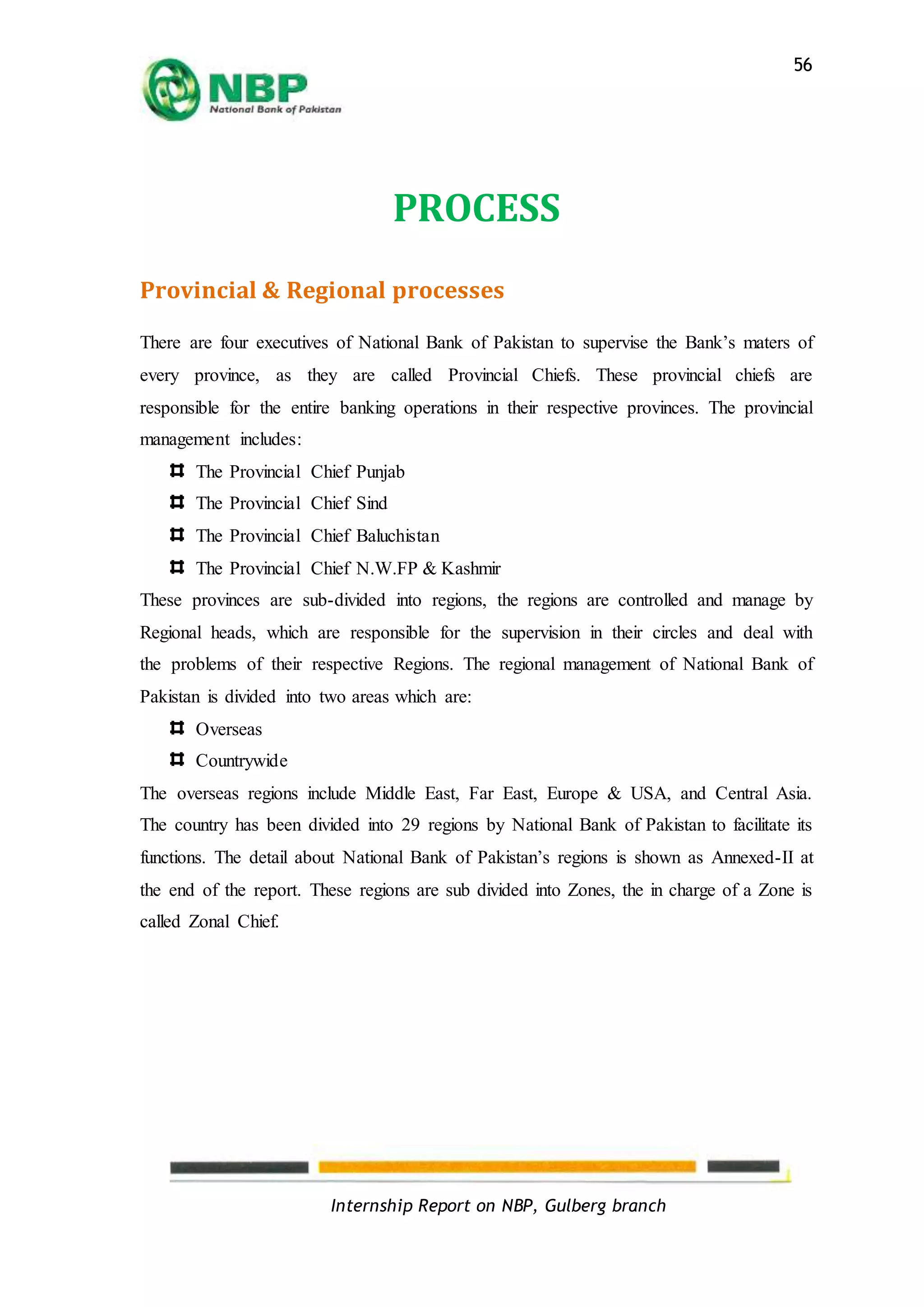

- NBP originally acted as an agent for the State Bank of Pakistan and took on the government's treasury operations where SBP did not have its own branches. It continues