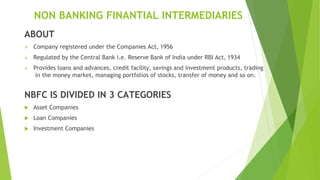

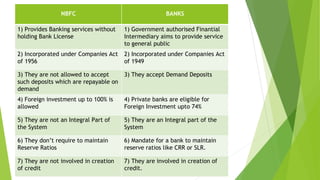

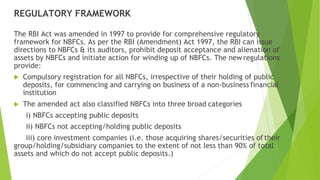

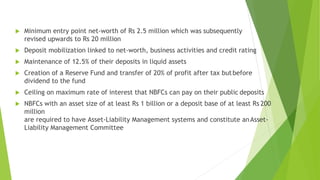

This document discusses non-banking financial institutions (NBFCs) in India. It notes that NBFCs are regulated by the Reserve Bank of India and provide various financial services like loans, savings products, and money transfers. NBFCs are divided into three categories: asset companies, loan companies, and investment companies. The document then compares NBFCs to banks, outlines the roles of NBFCs, and discusses the regulatory framework for NBFCs in India established by the Reserve Bank of India.