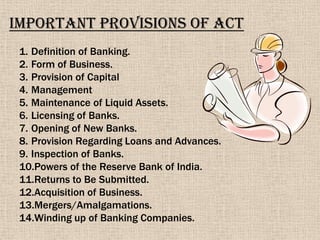

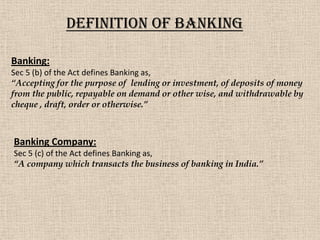

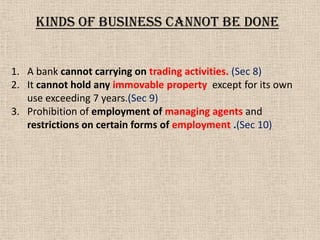

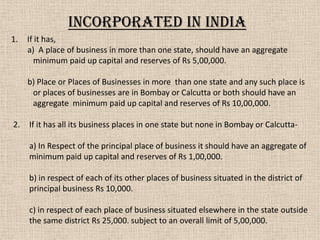

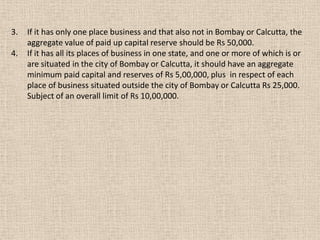

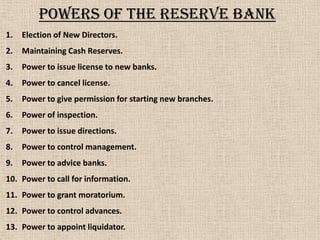

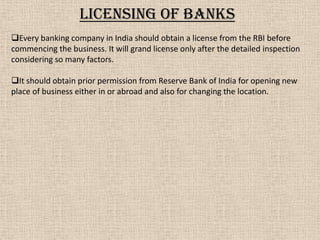

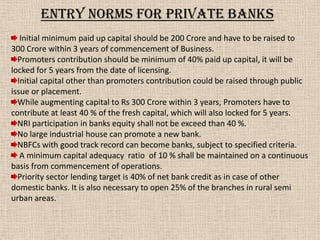

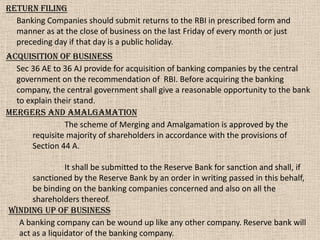

The Banking Regulation Act of 1949 was introduced to regulate banks in India through separate legislation, as previously banks were controlled by the Indian Companies Act. Key provisions of the Act include defining banking and forms of business, capital requirements, management structure, liquidity requirements, licensing of new banks, and powers granted to the Reserve Bank of India to supervise banks. The Act aimed to establish a framework to promote a sound and healthy banking system in the country.