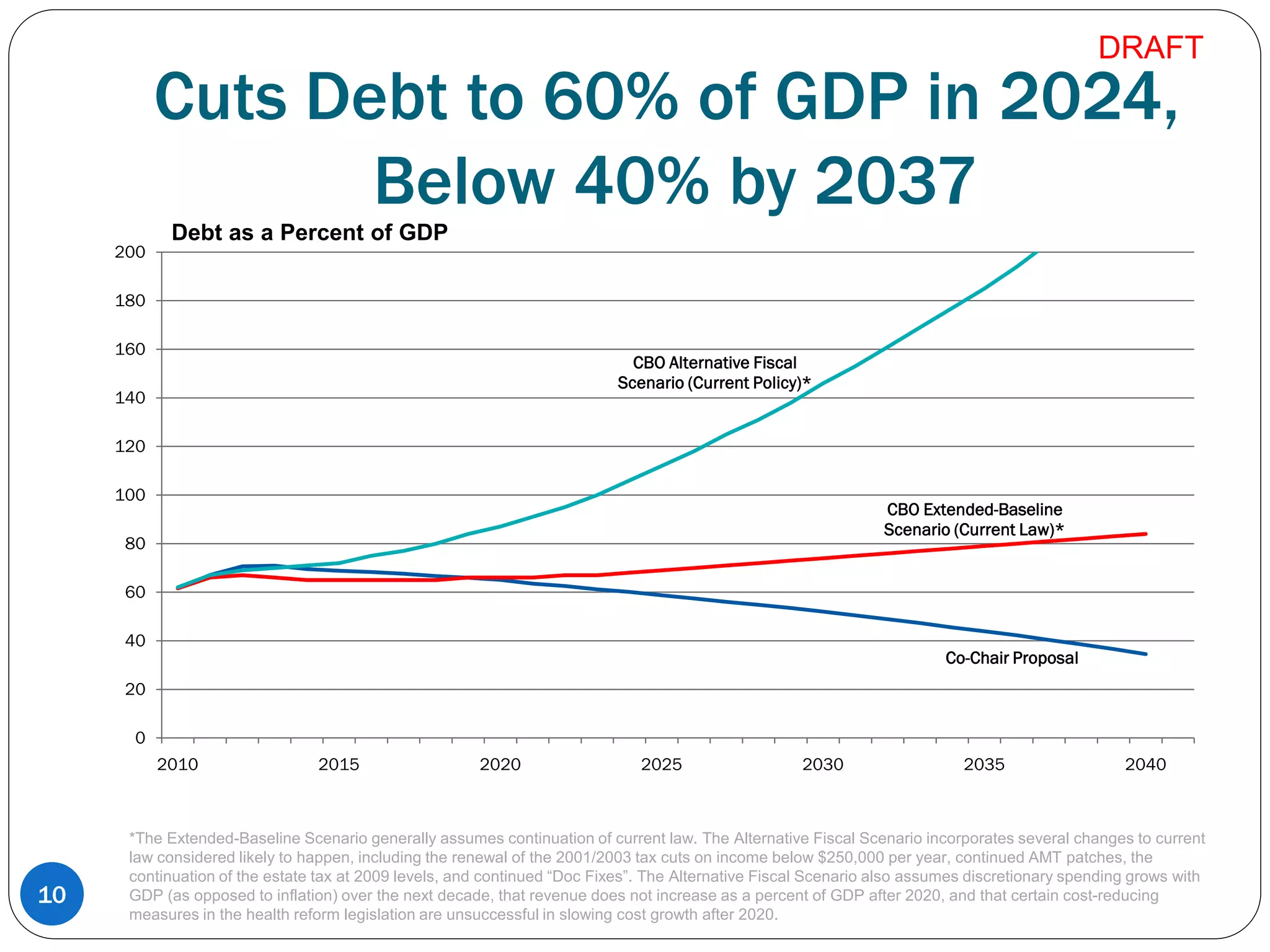

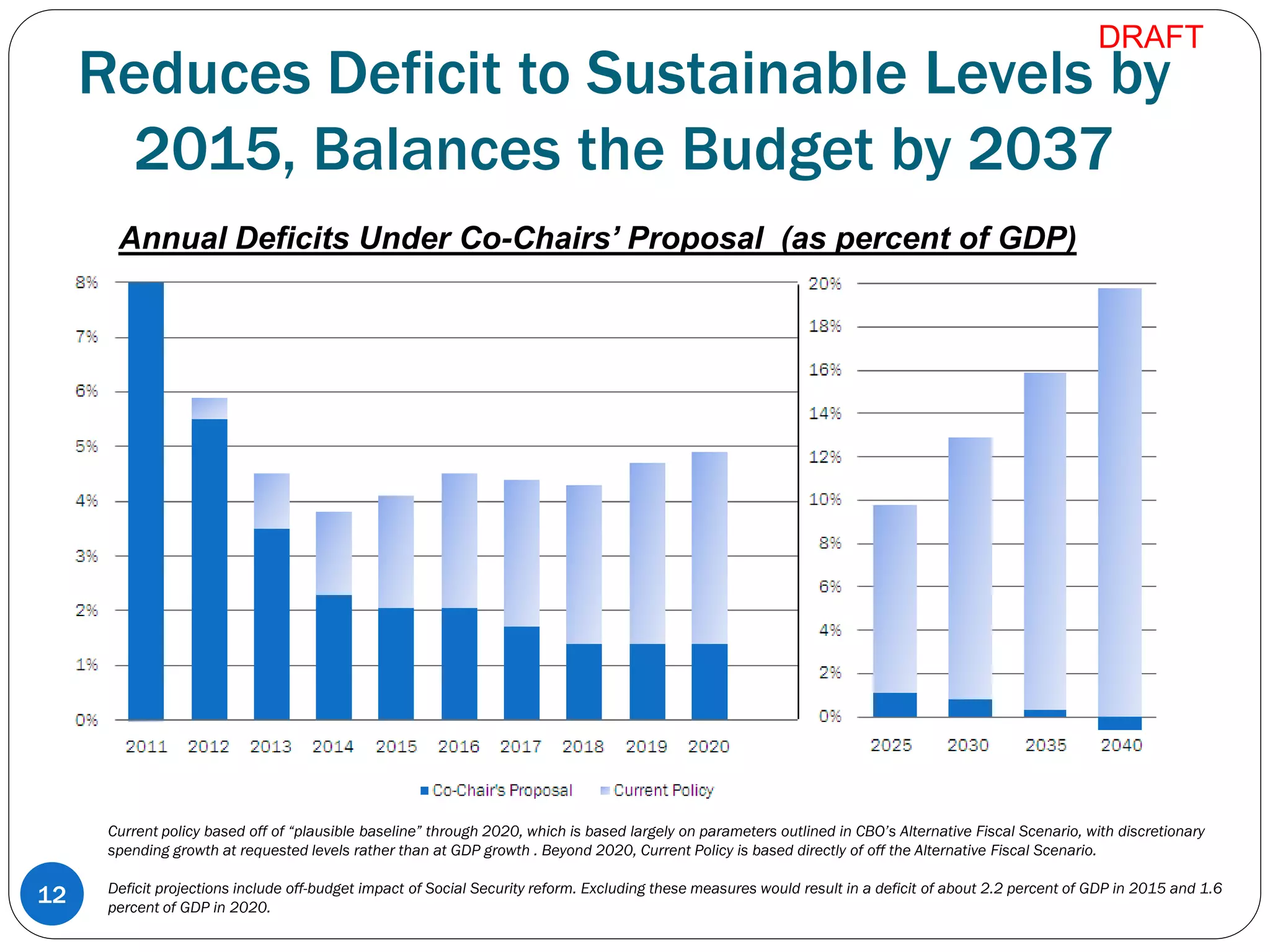

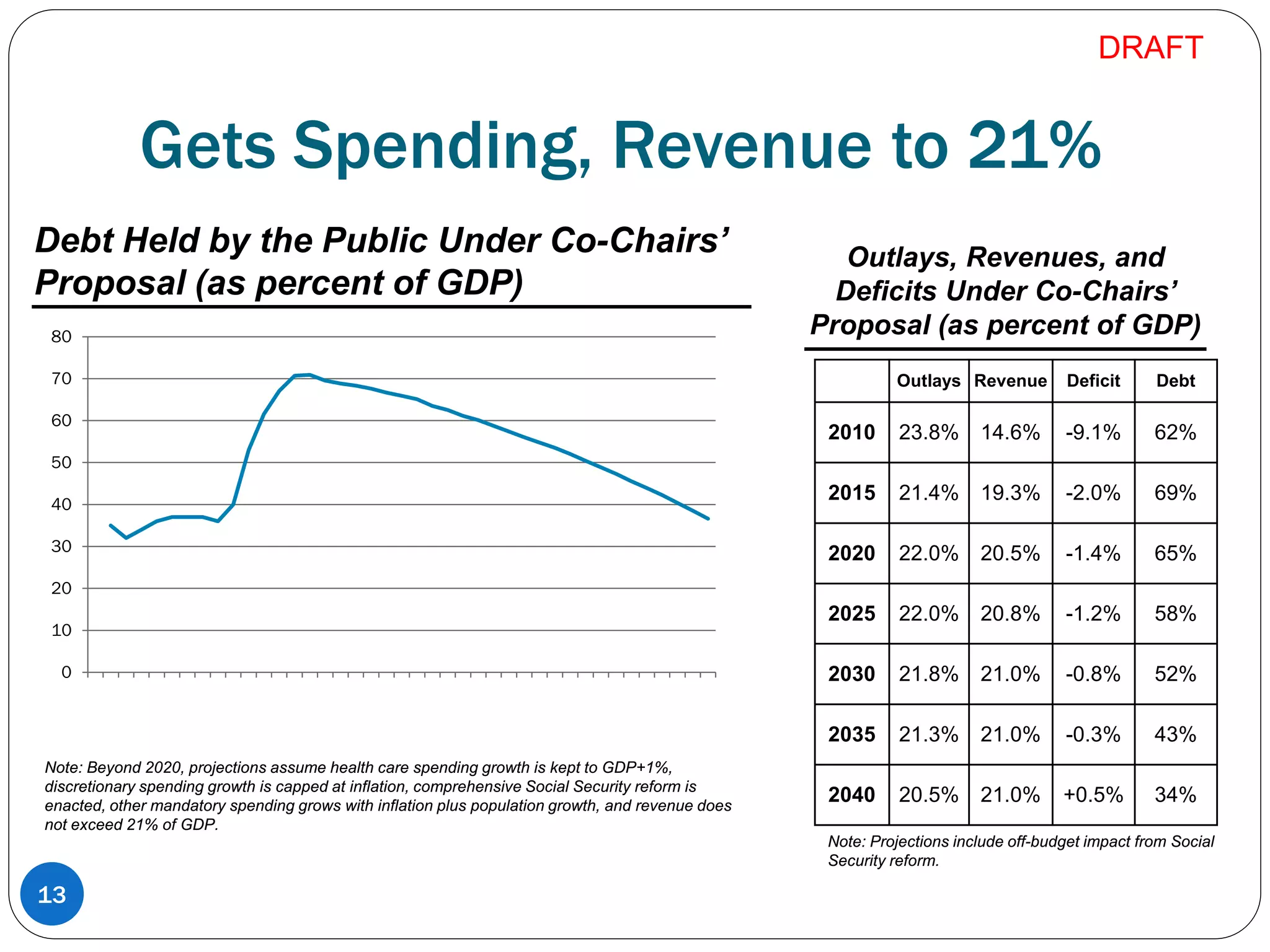

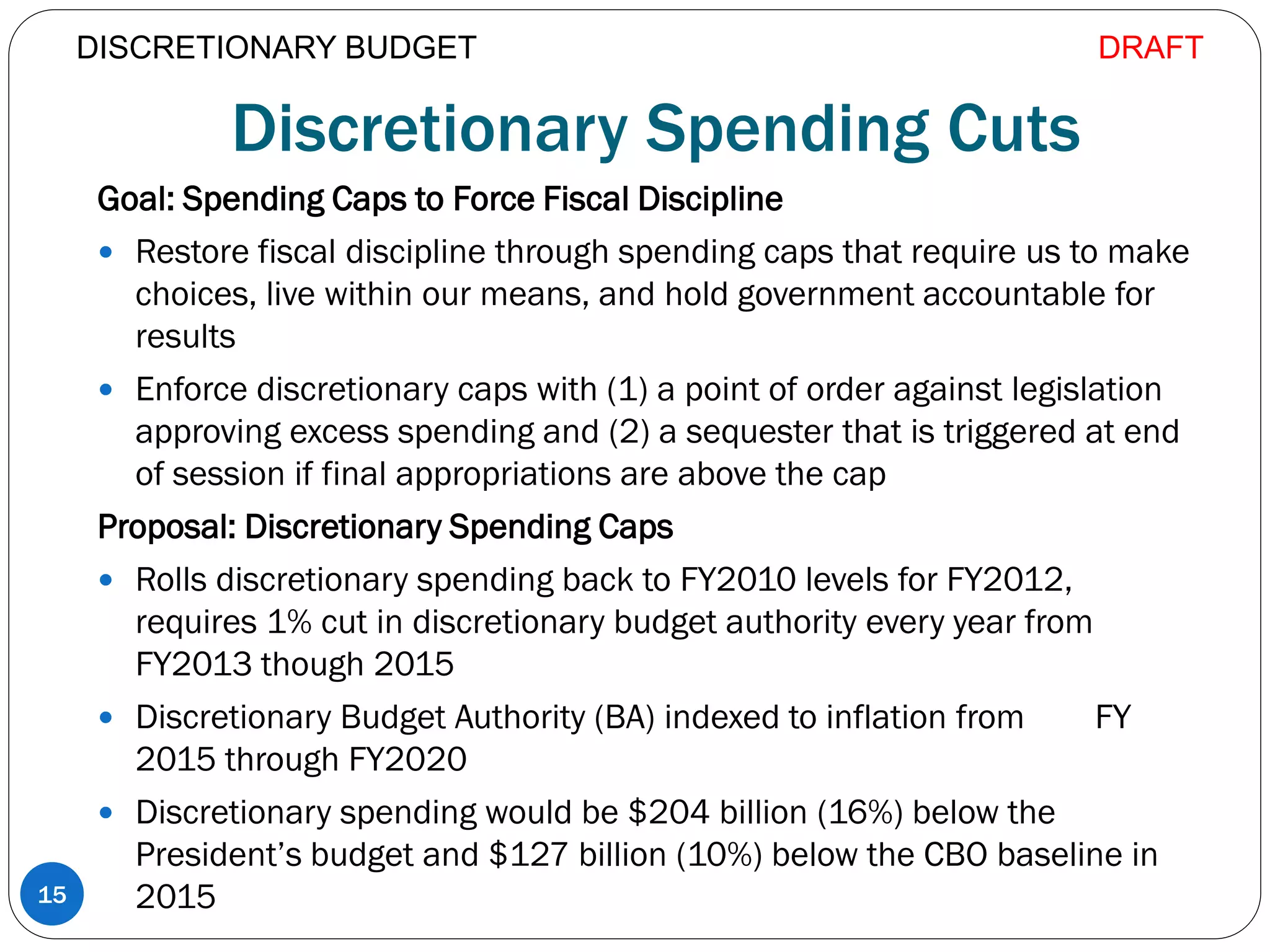

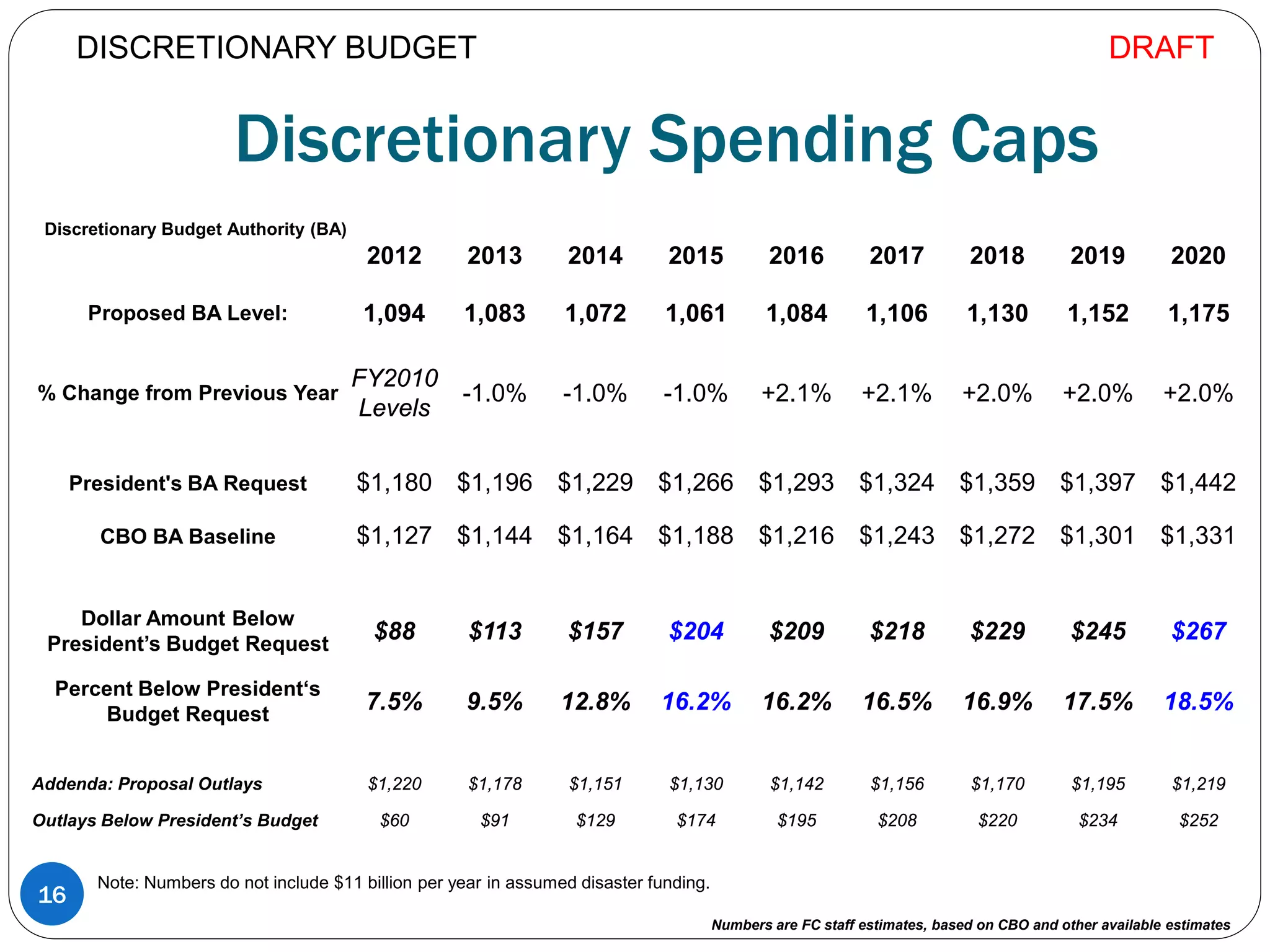

The document outlines a proposal from congressional co-chairs to reduce the federal deficit and debt through 2020. It proposes:

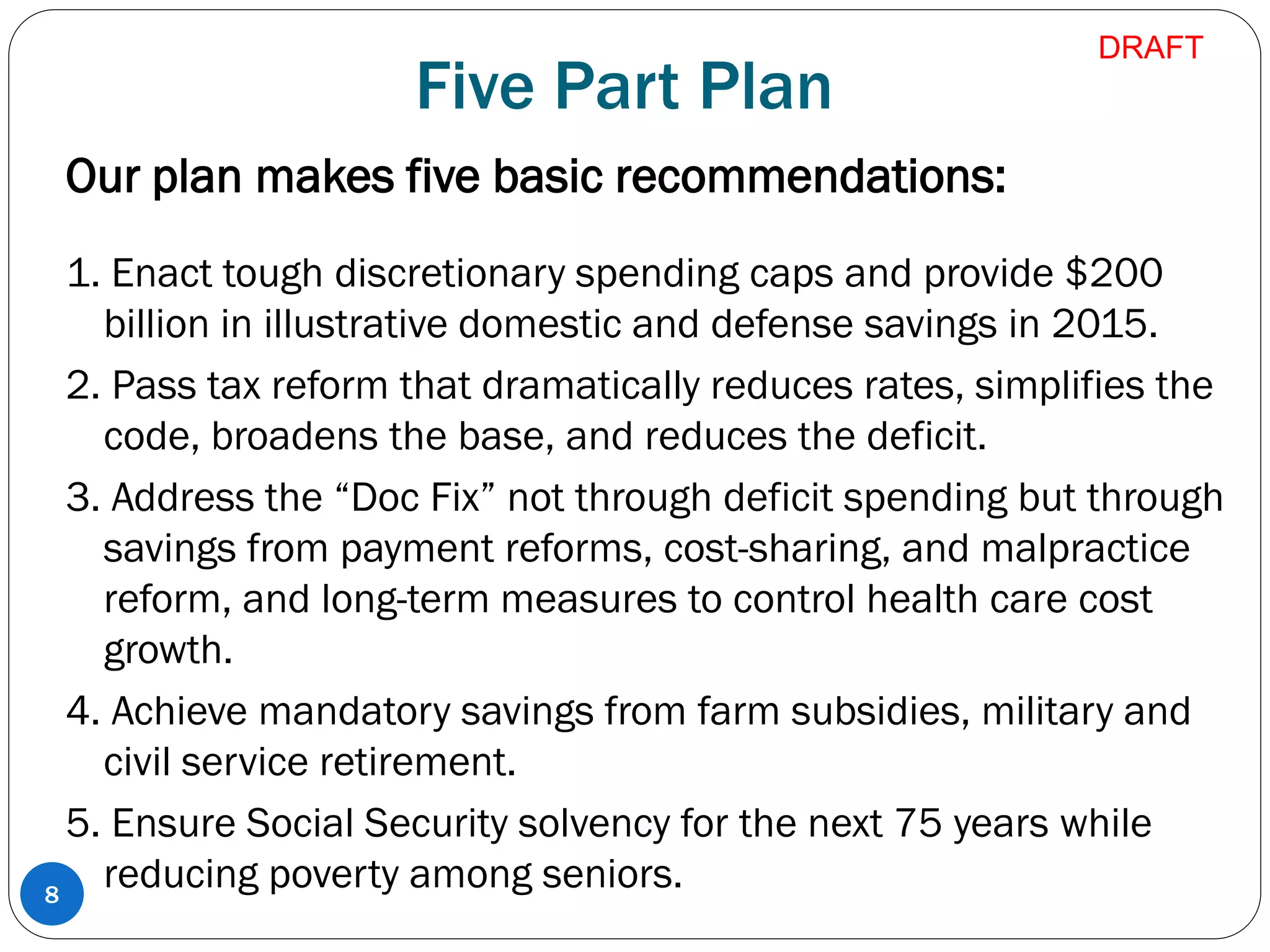

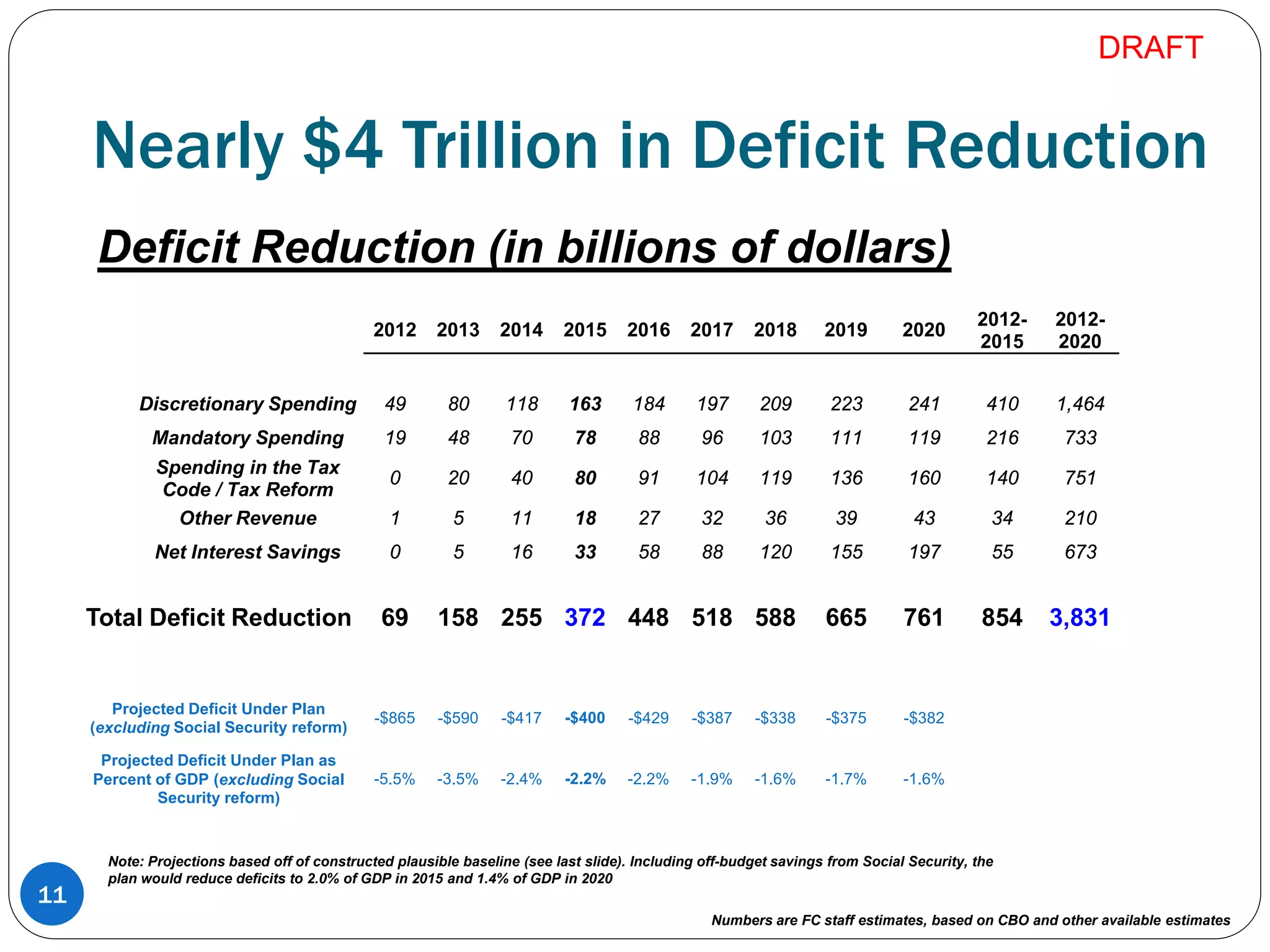

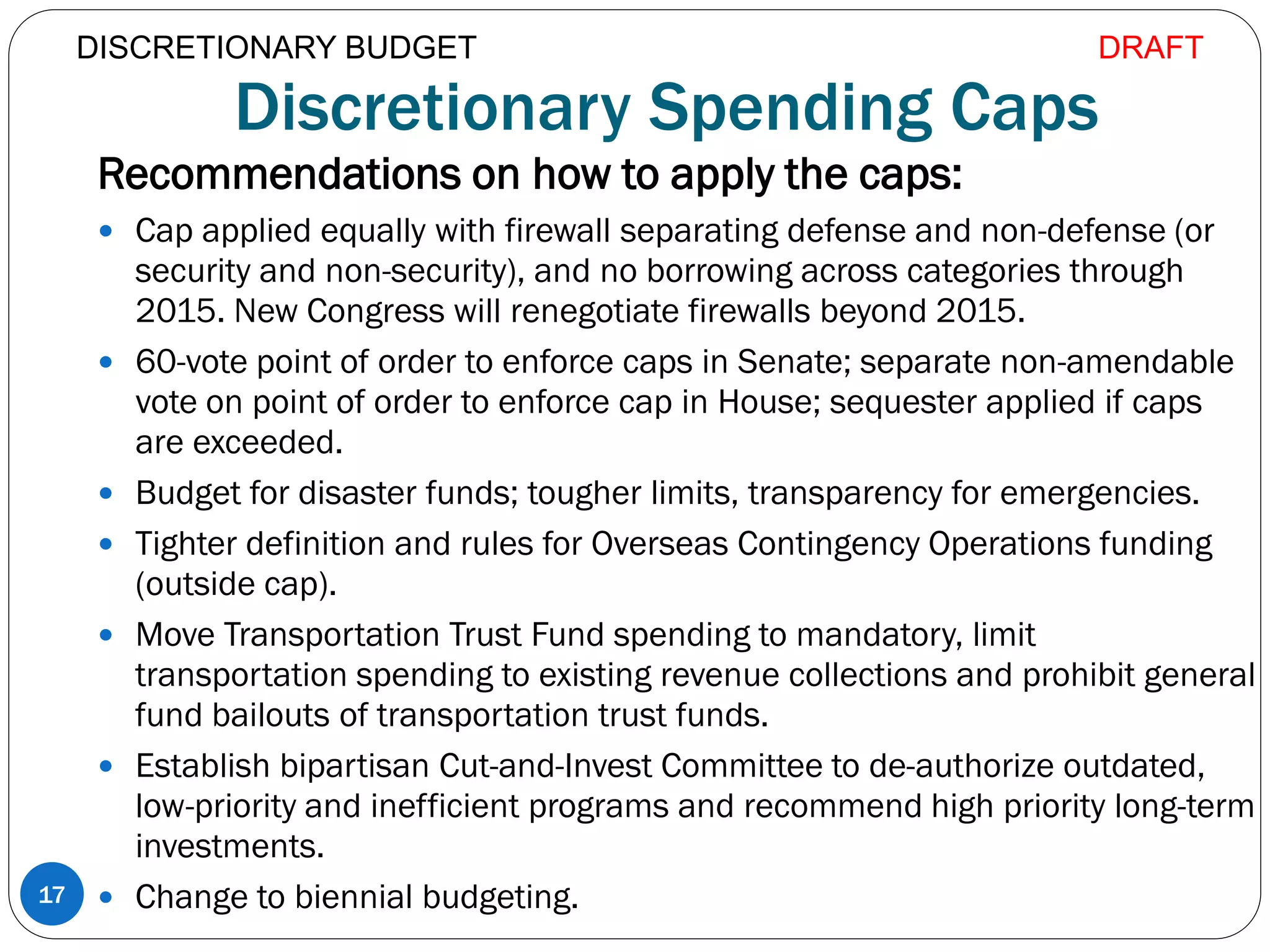

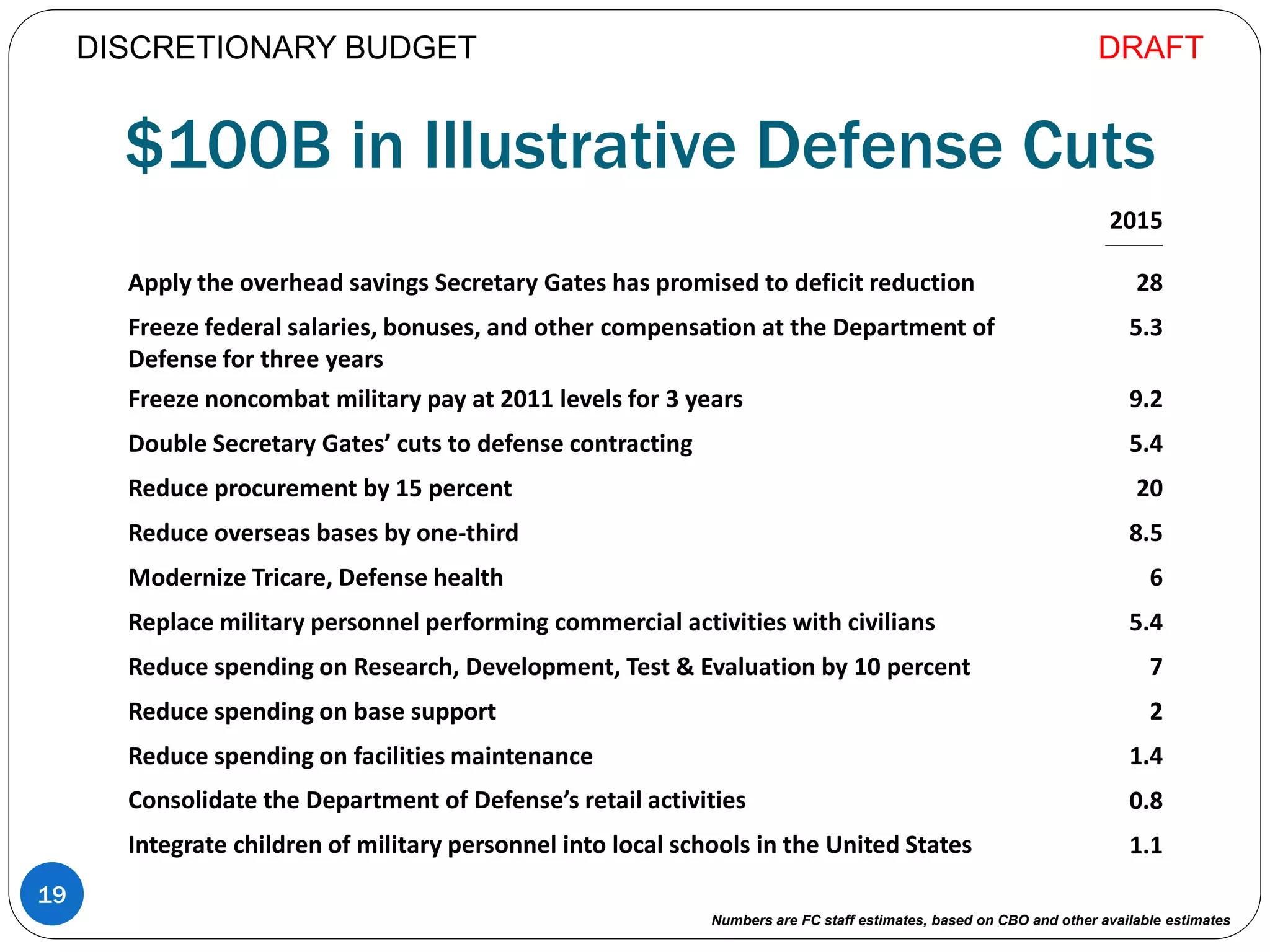

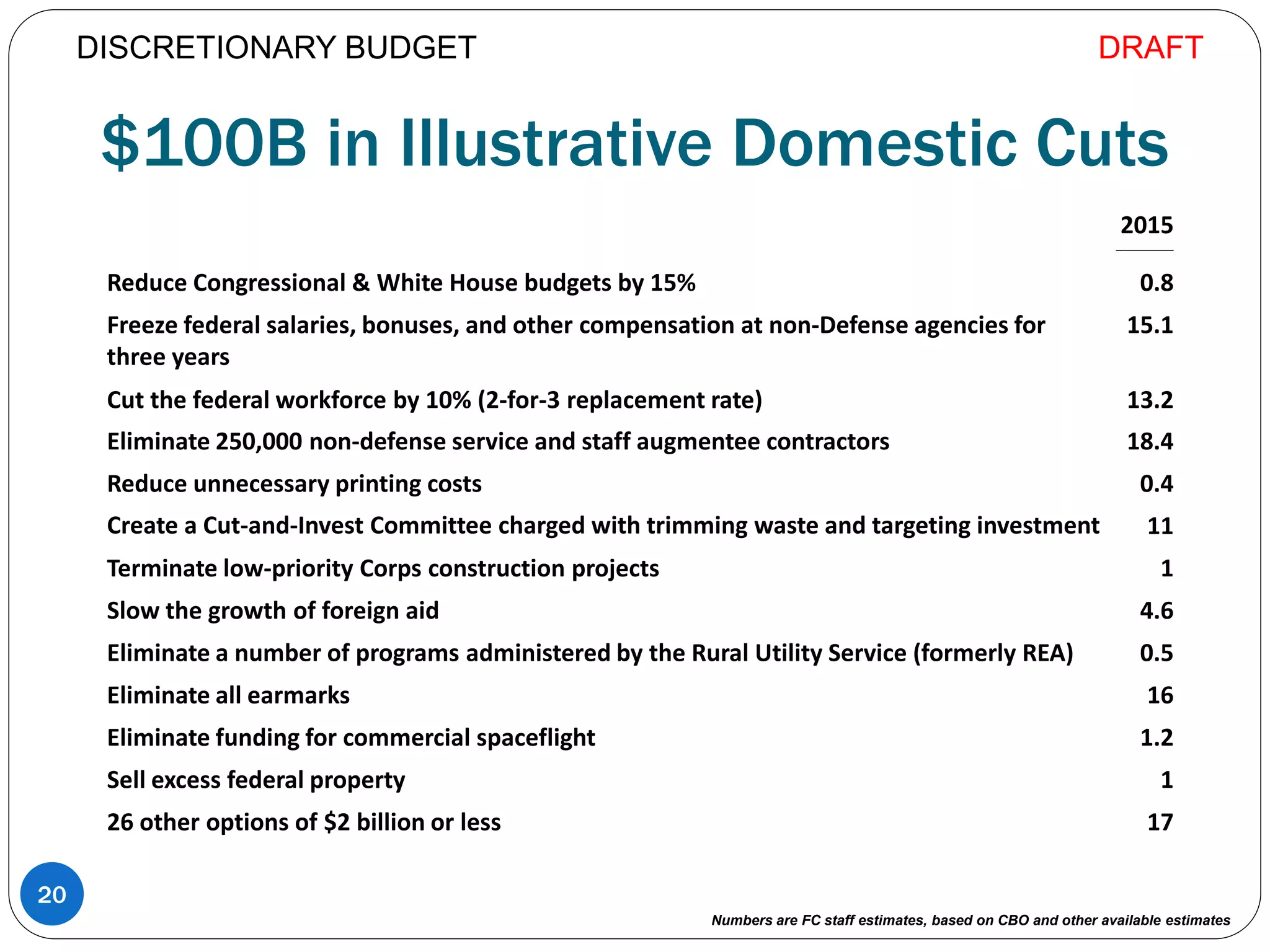

1. Enacting tough discretionary spending caps that would save $200 billion in domestic and defense spending in 2015.

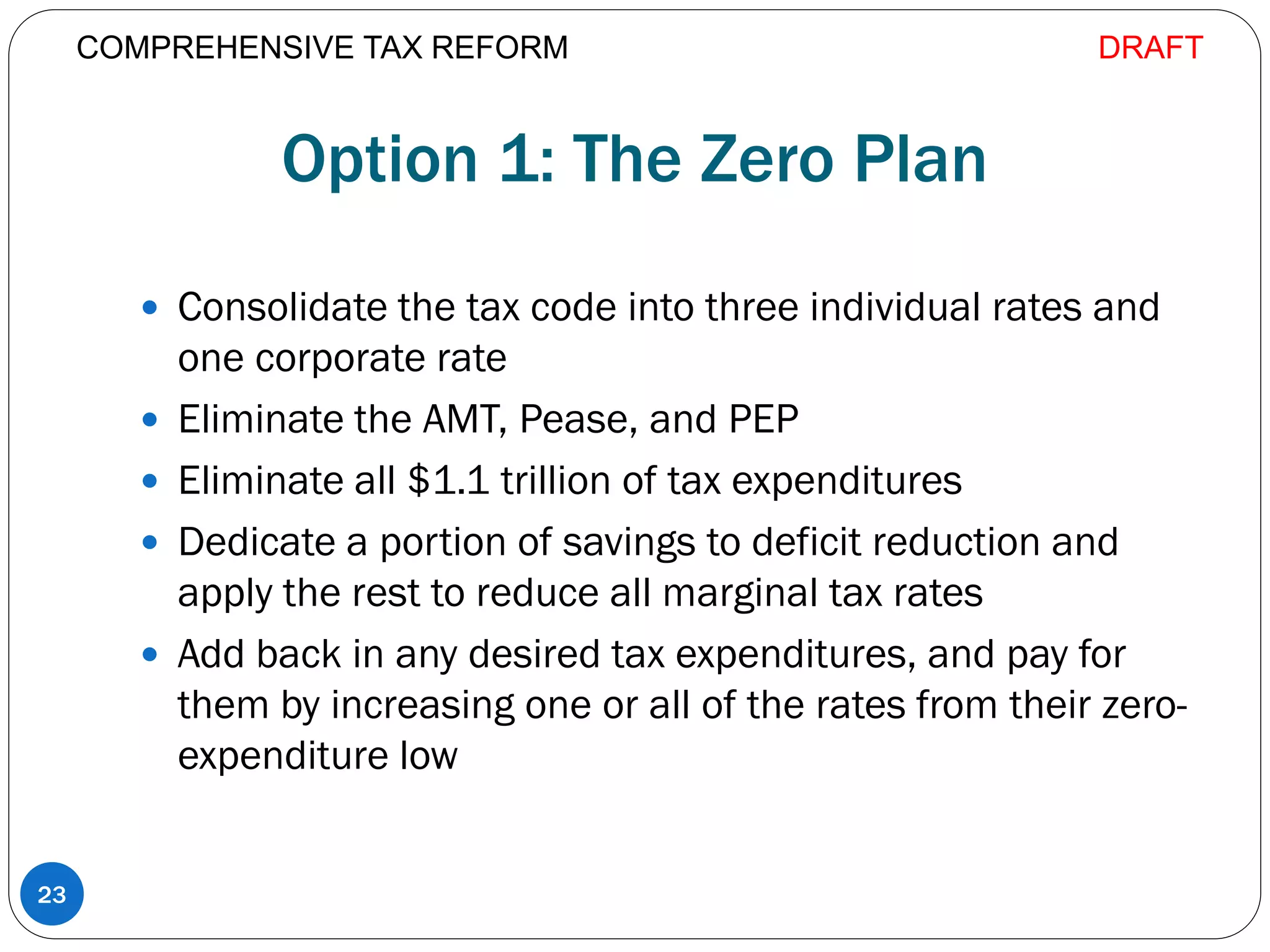

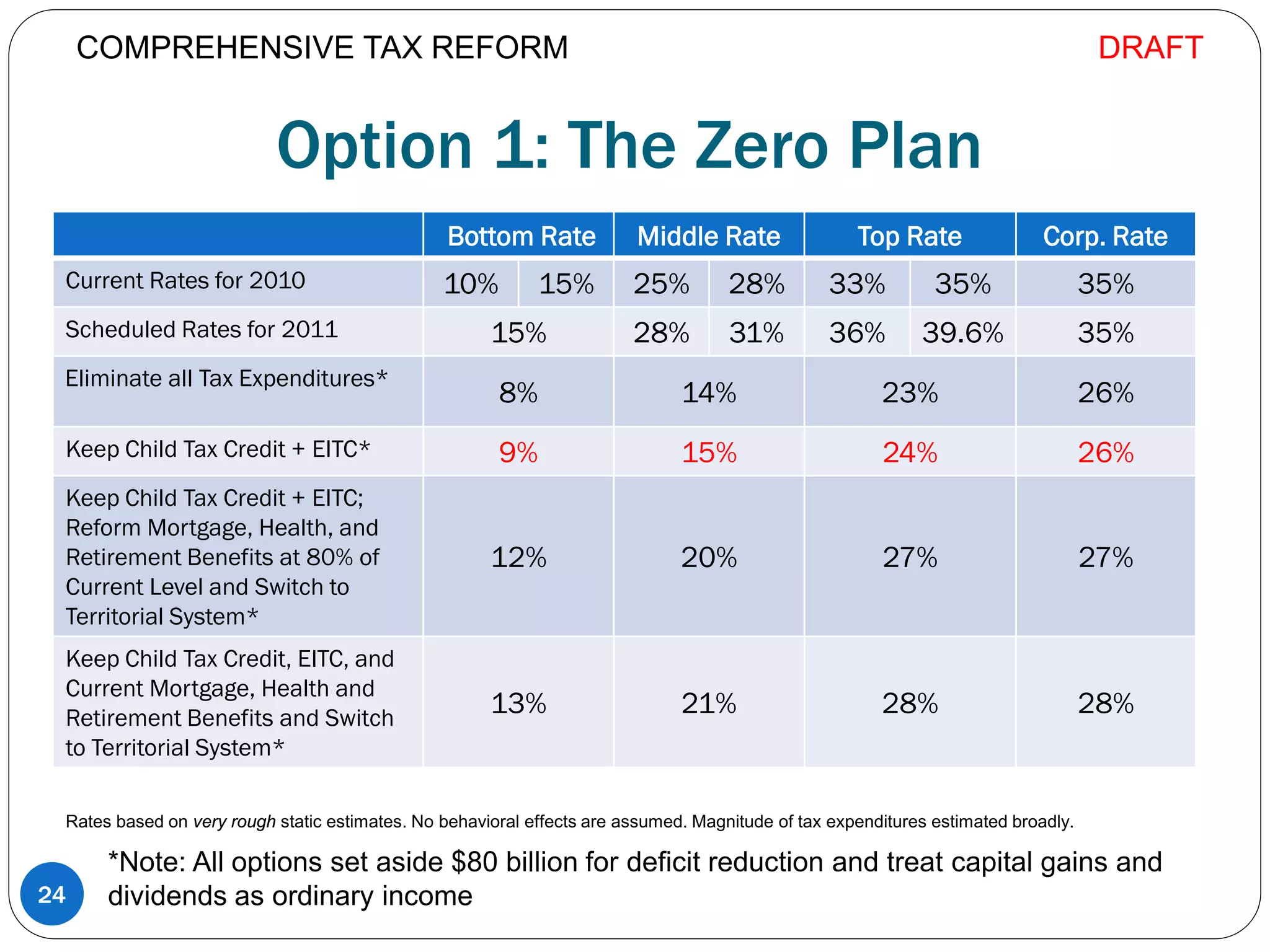

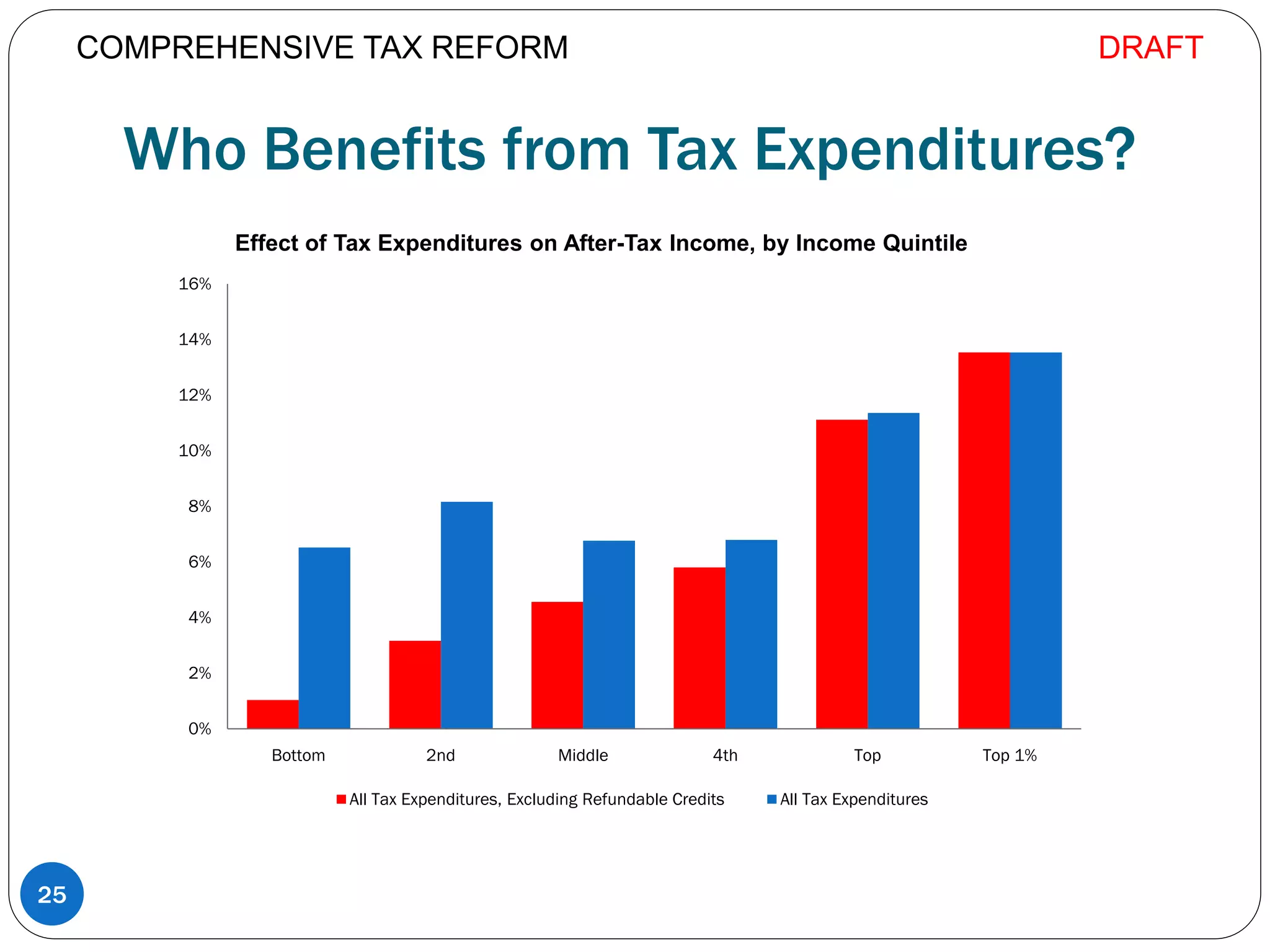

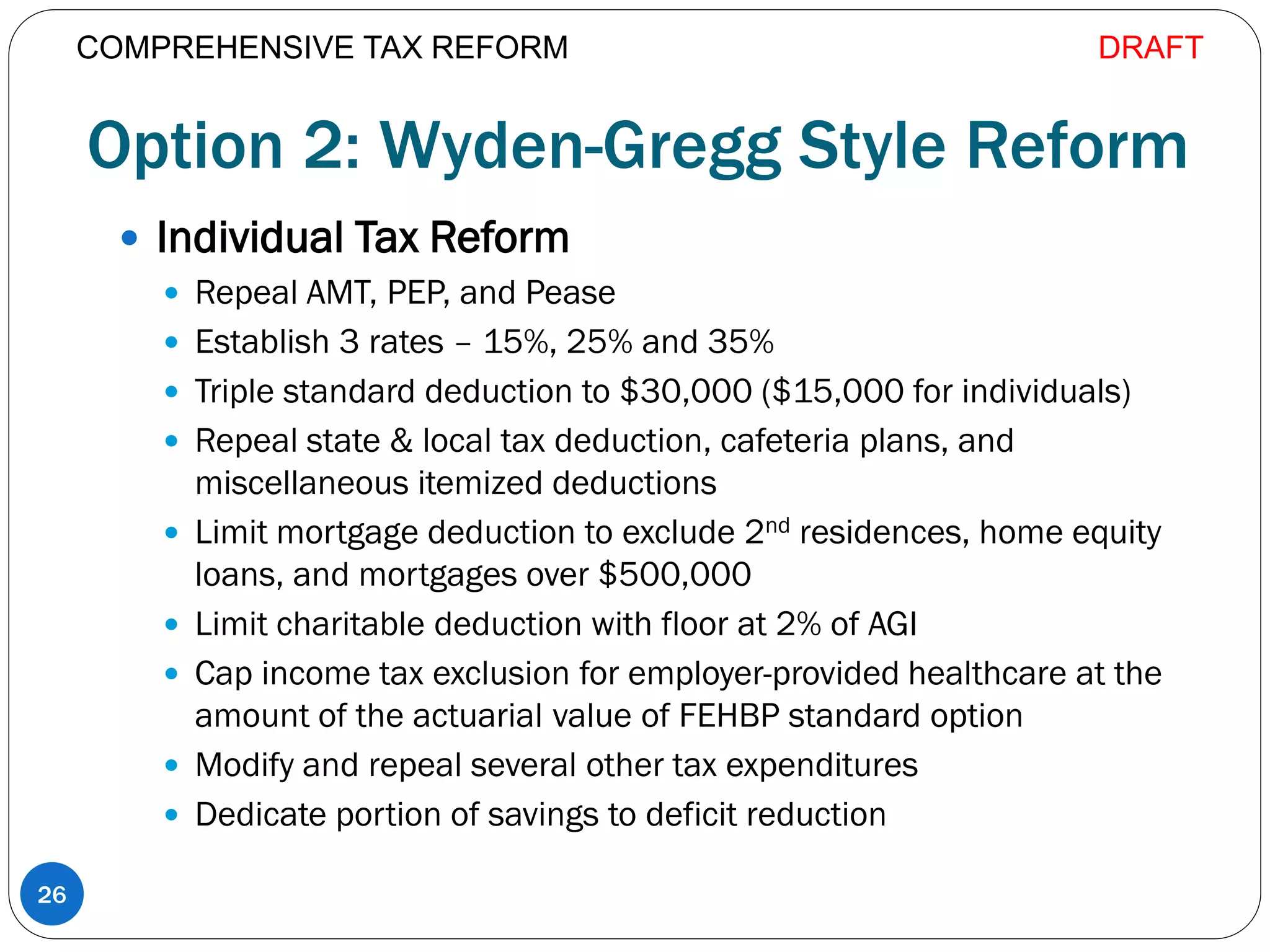

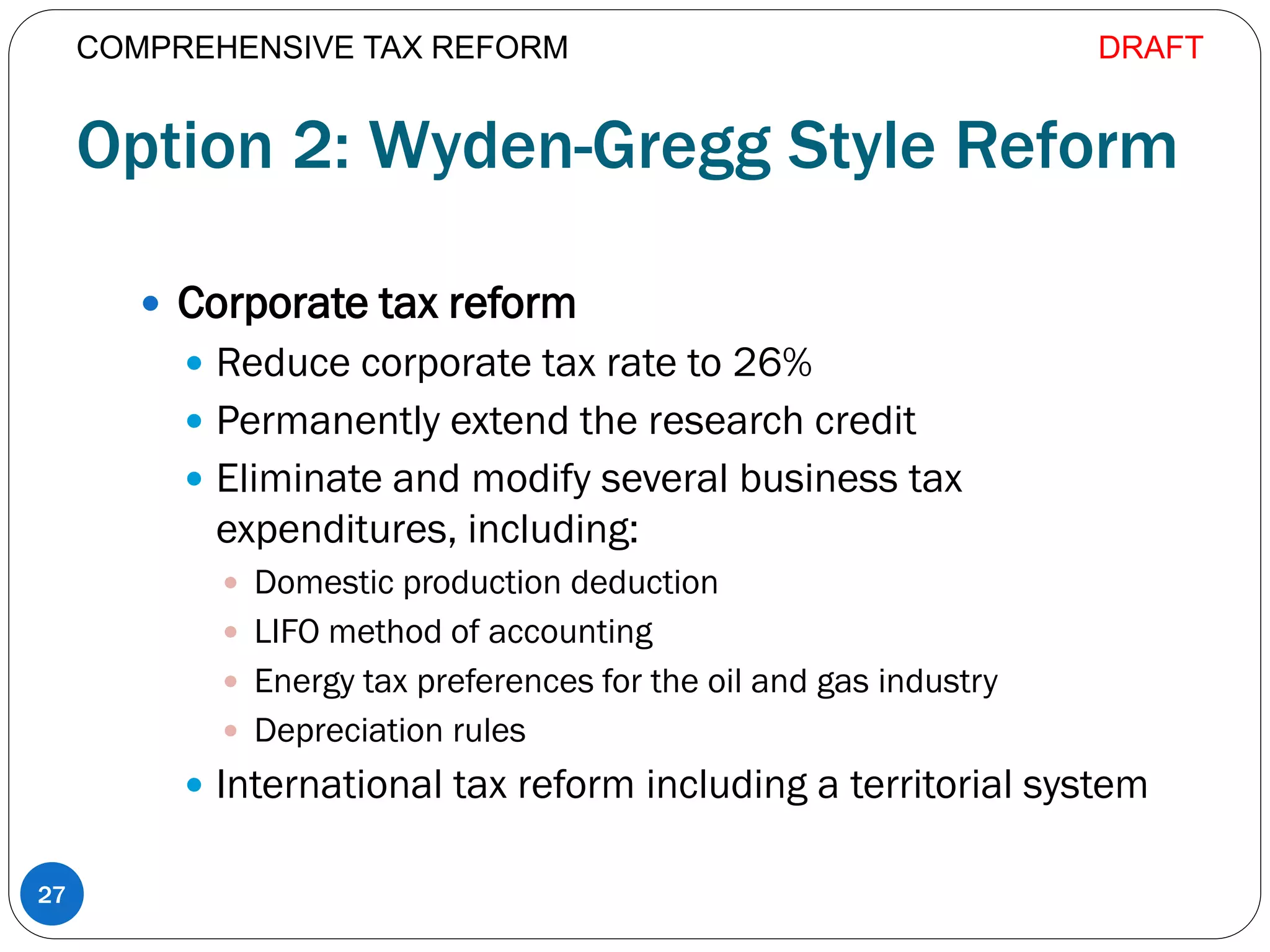

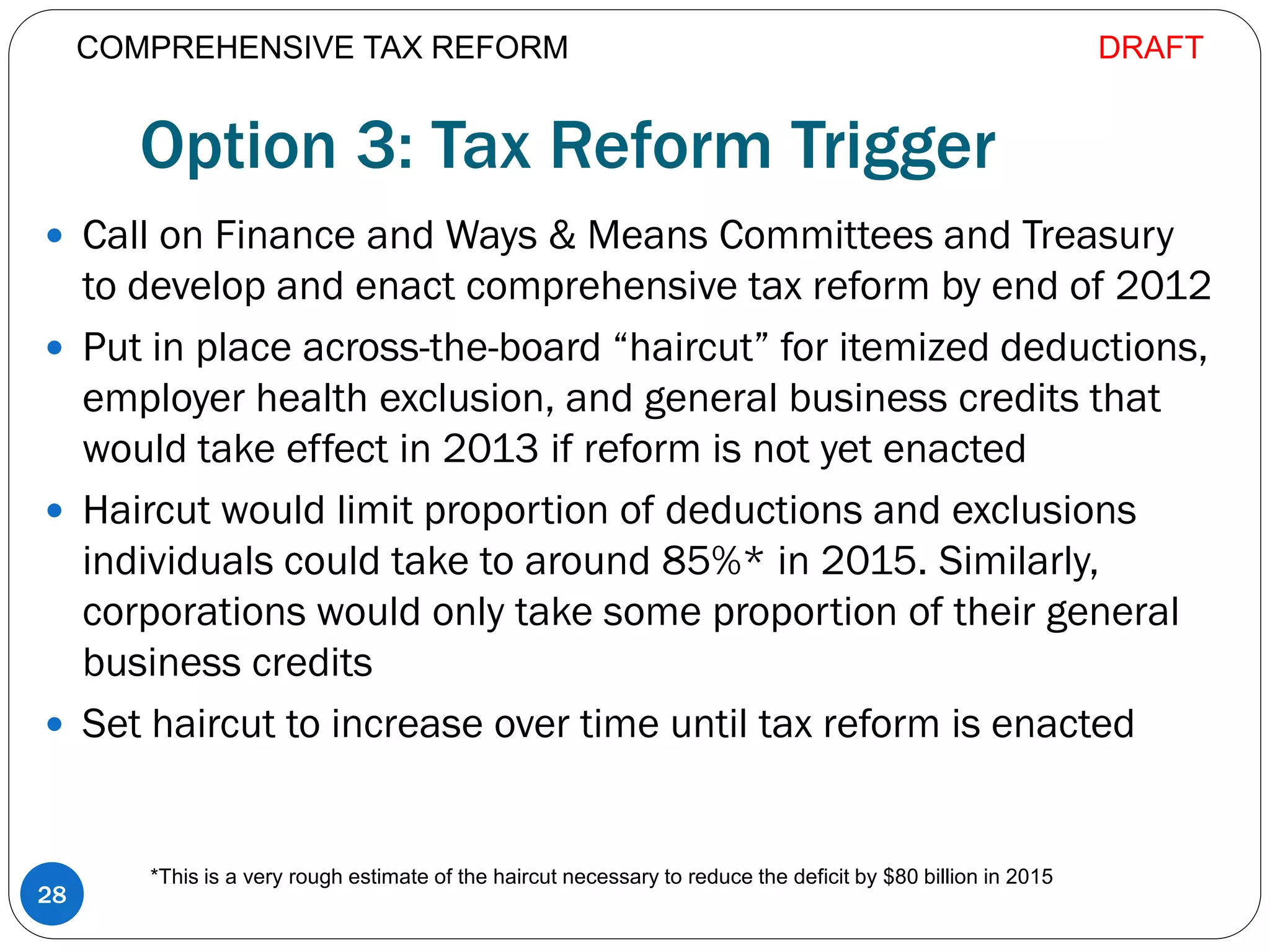

2. Passing comprehensive tax reform that lowers rates, simplifies the code, and broadens the tax base to reduce the deficit.

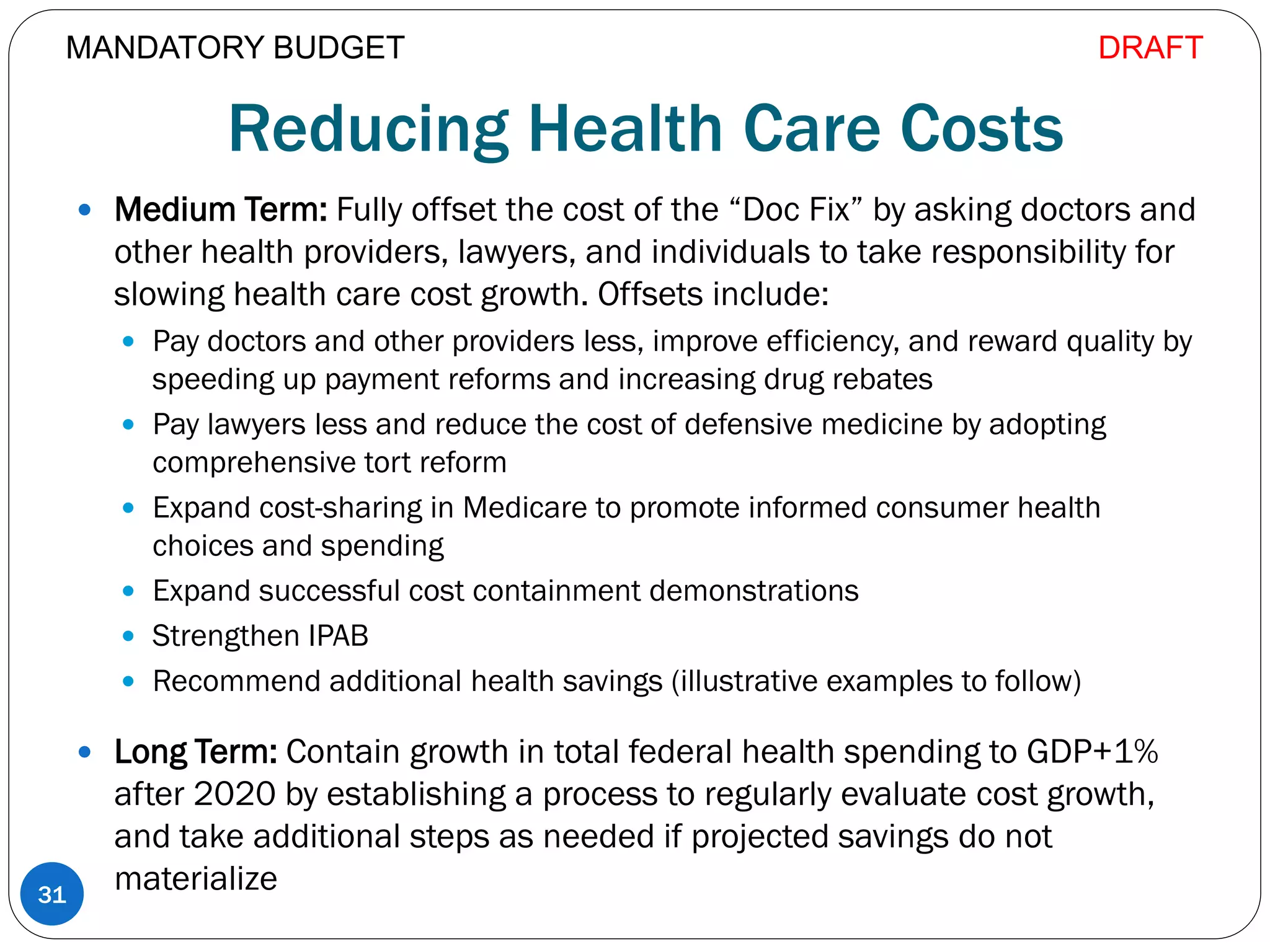

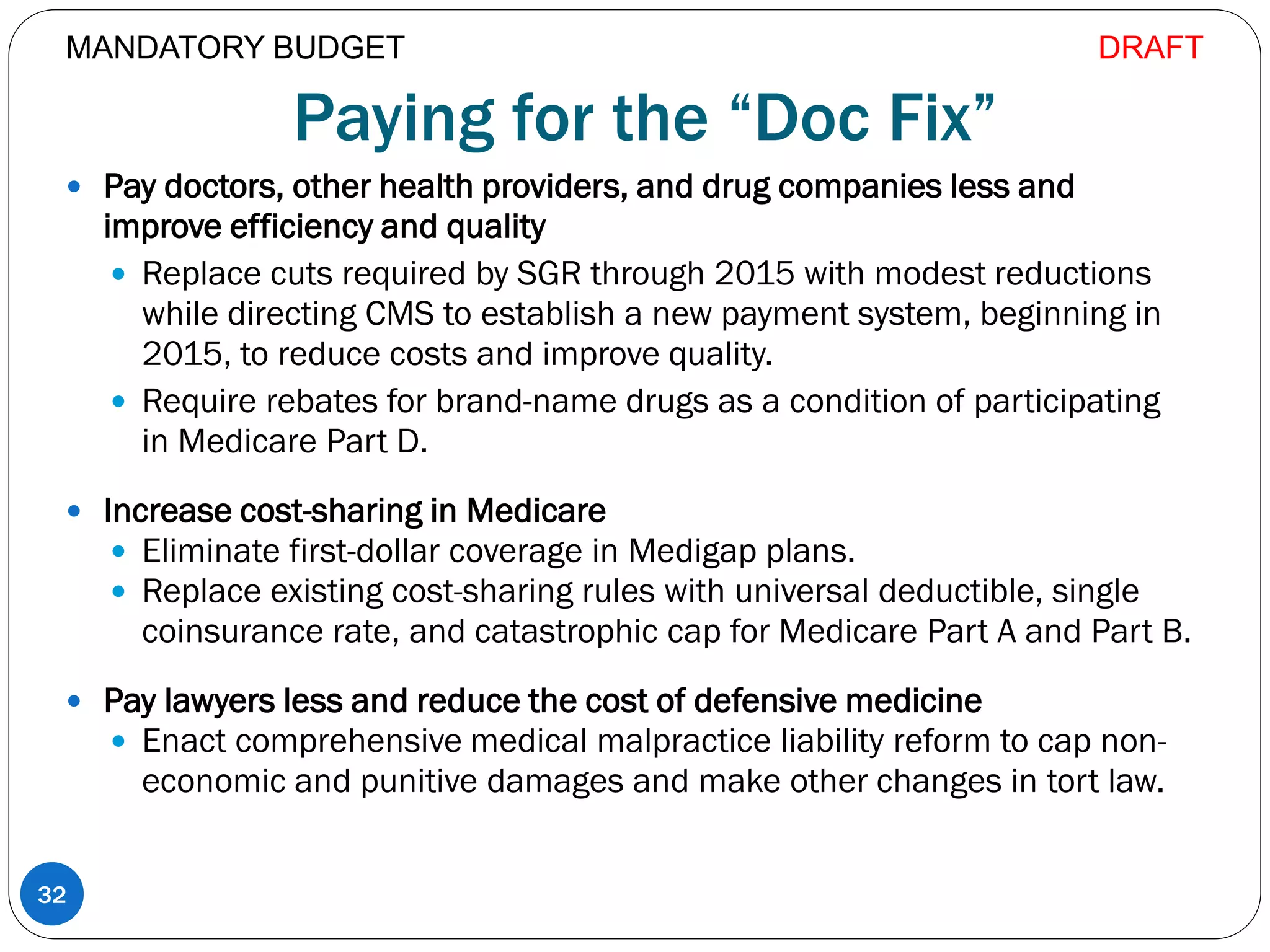

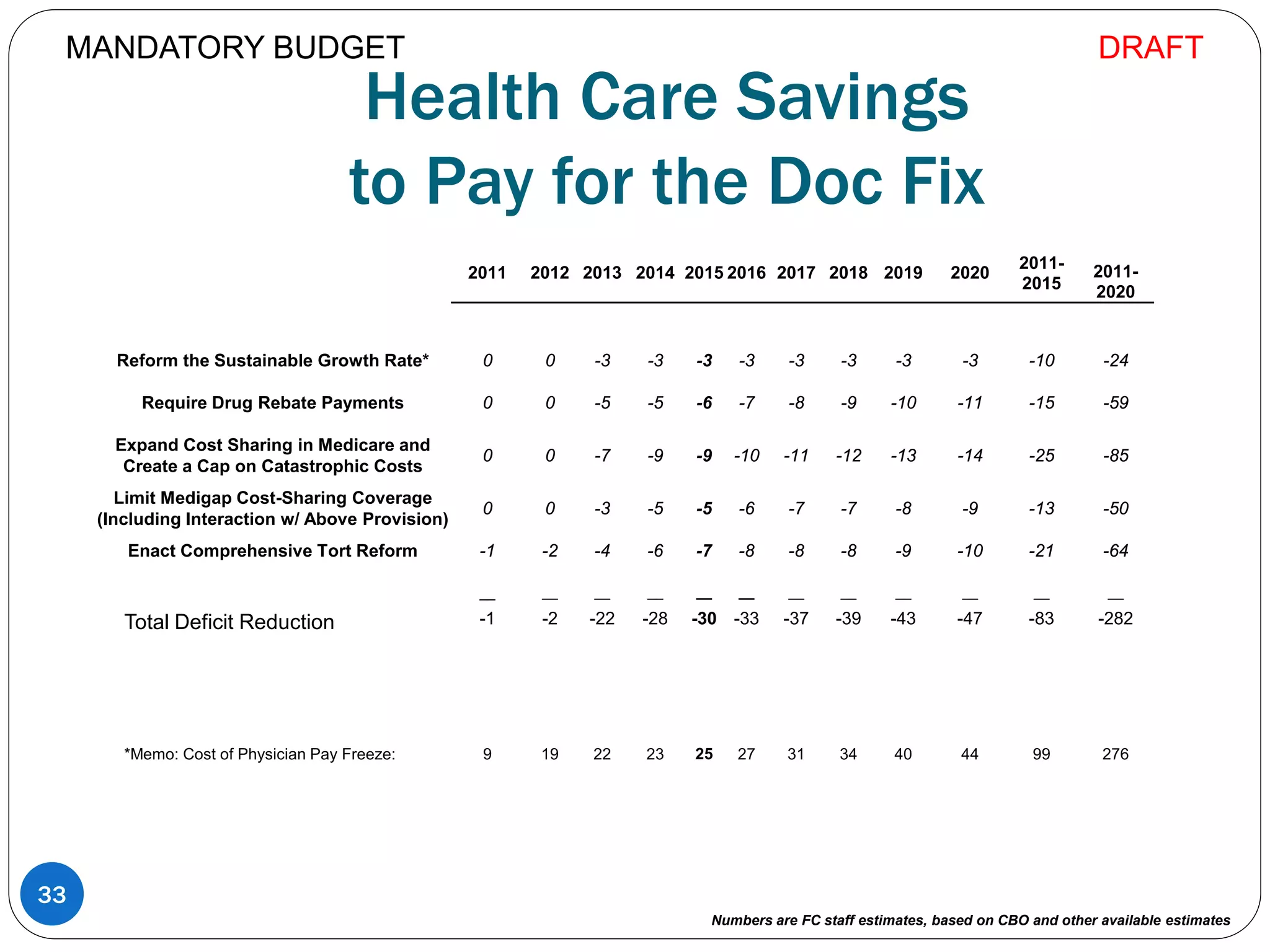

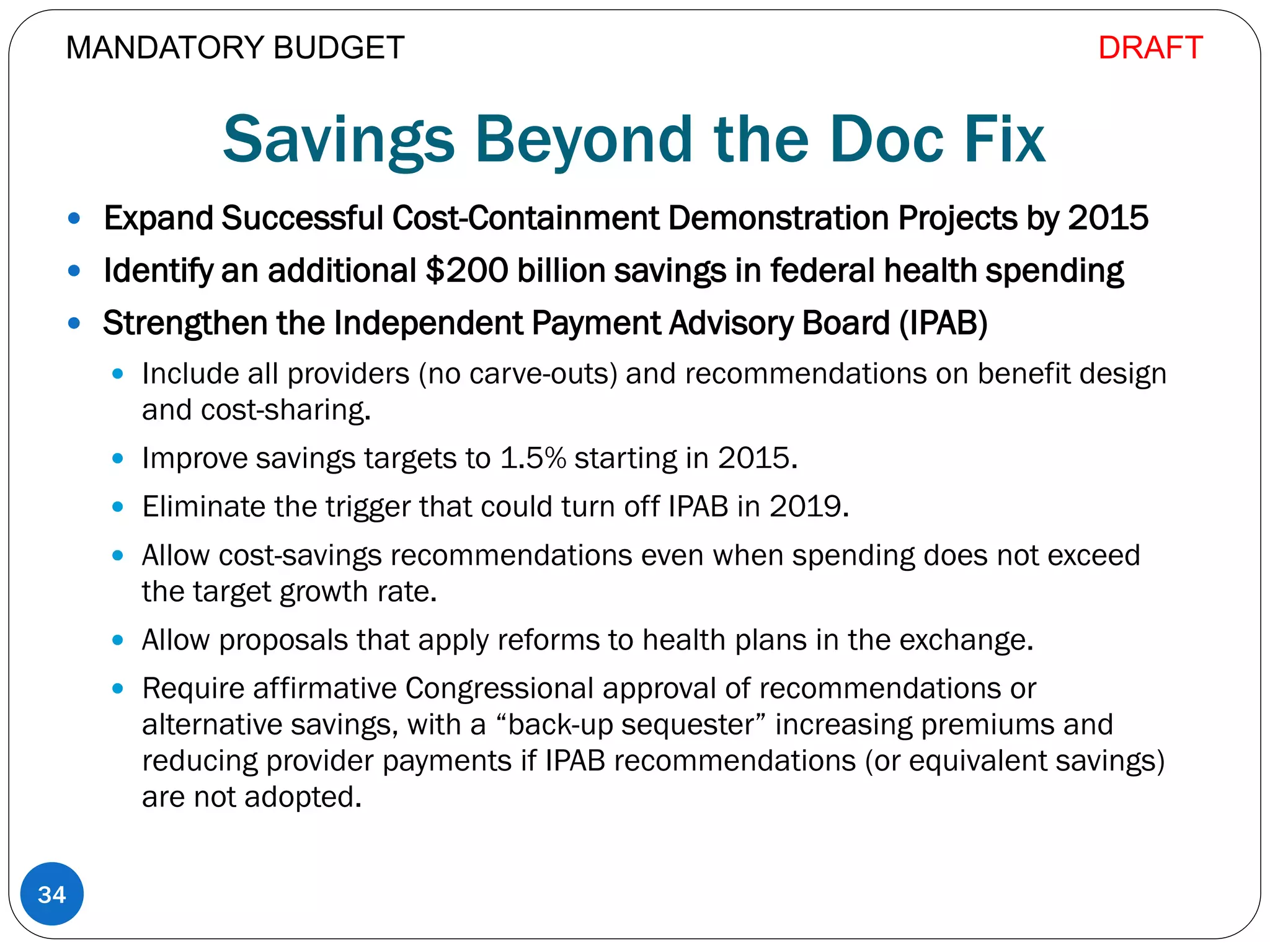

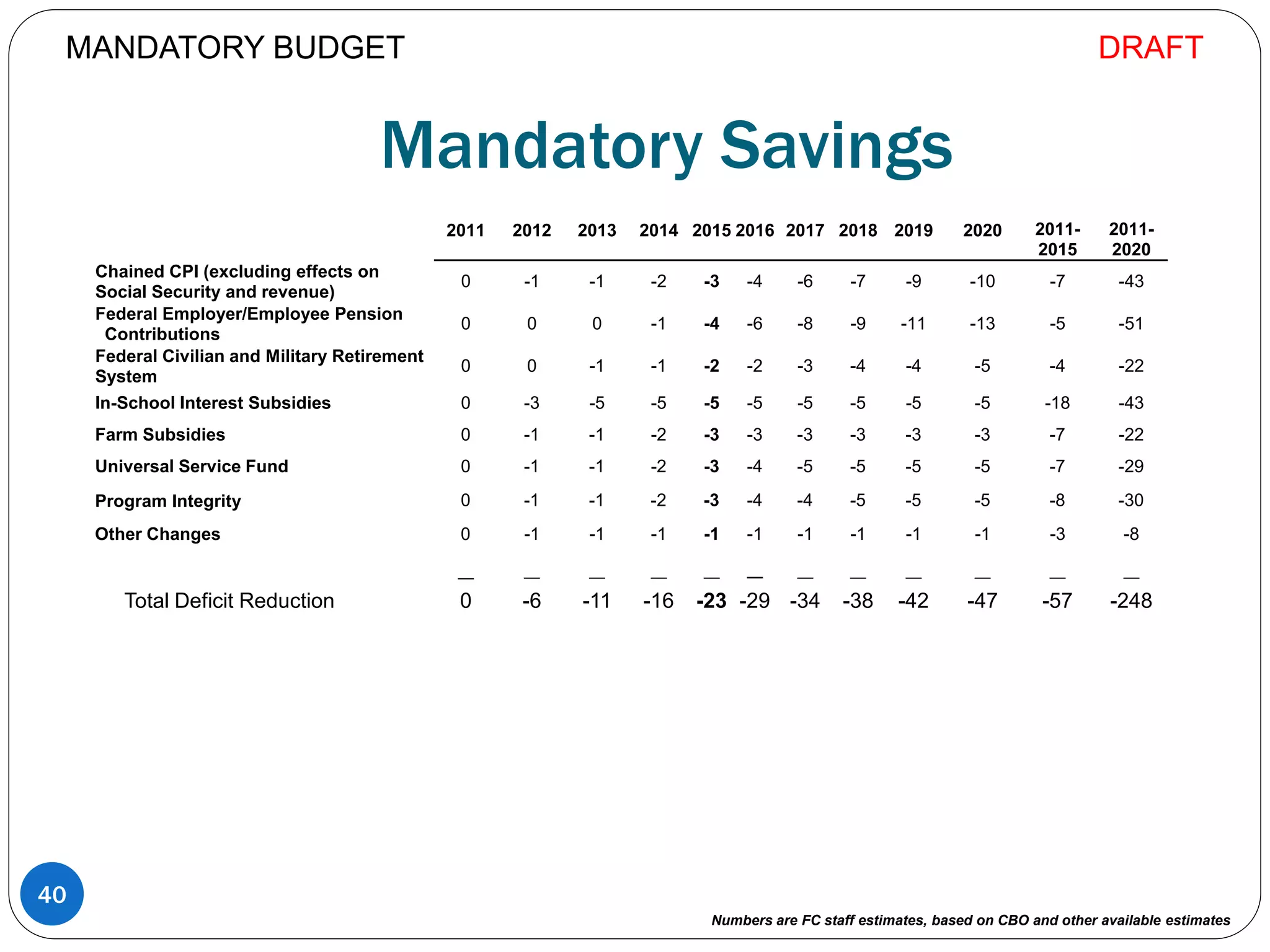

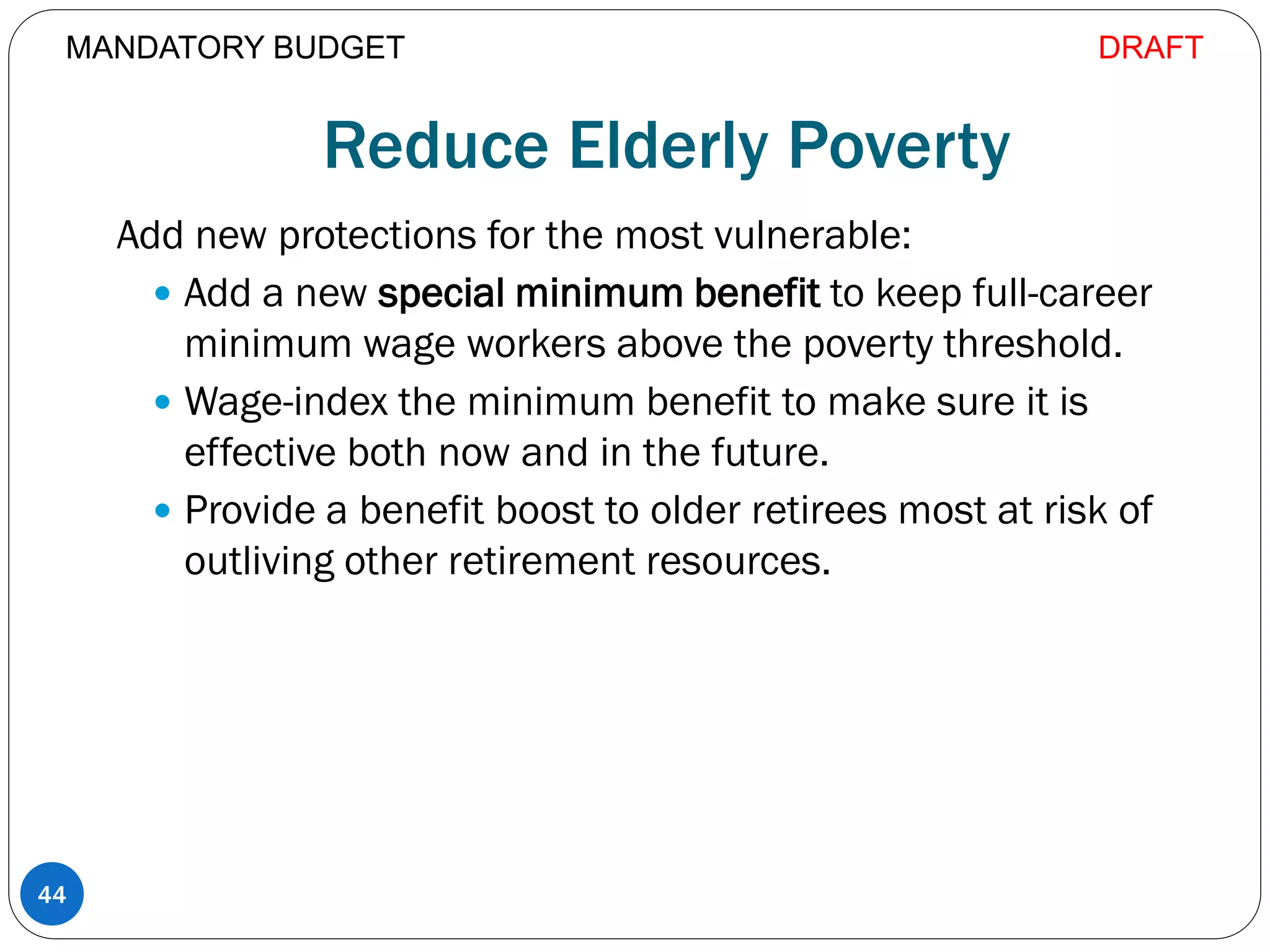

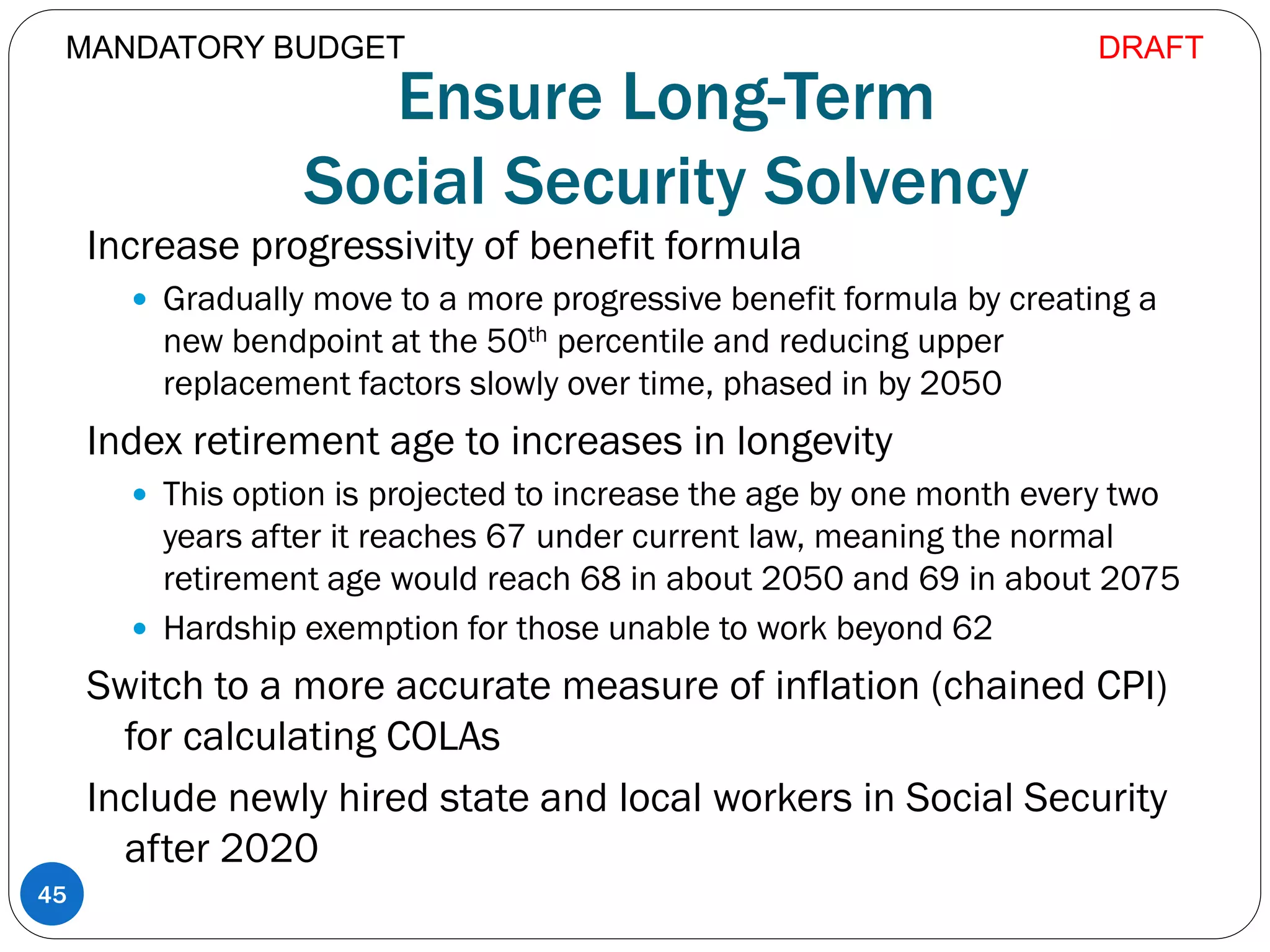

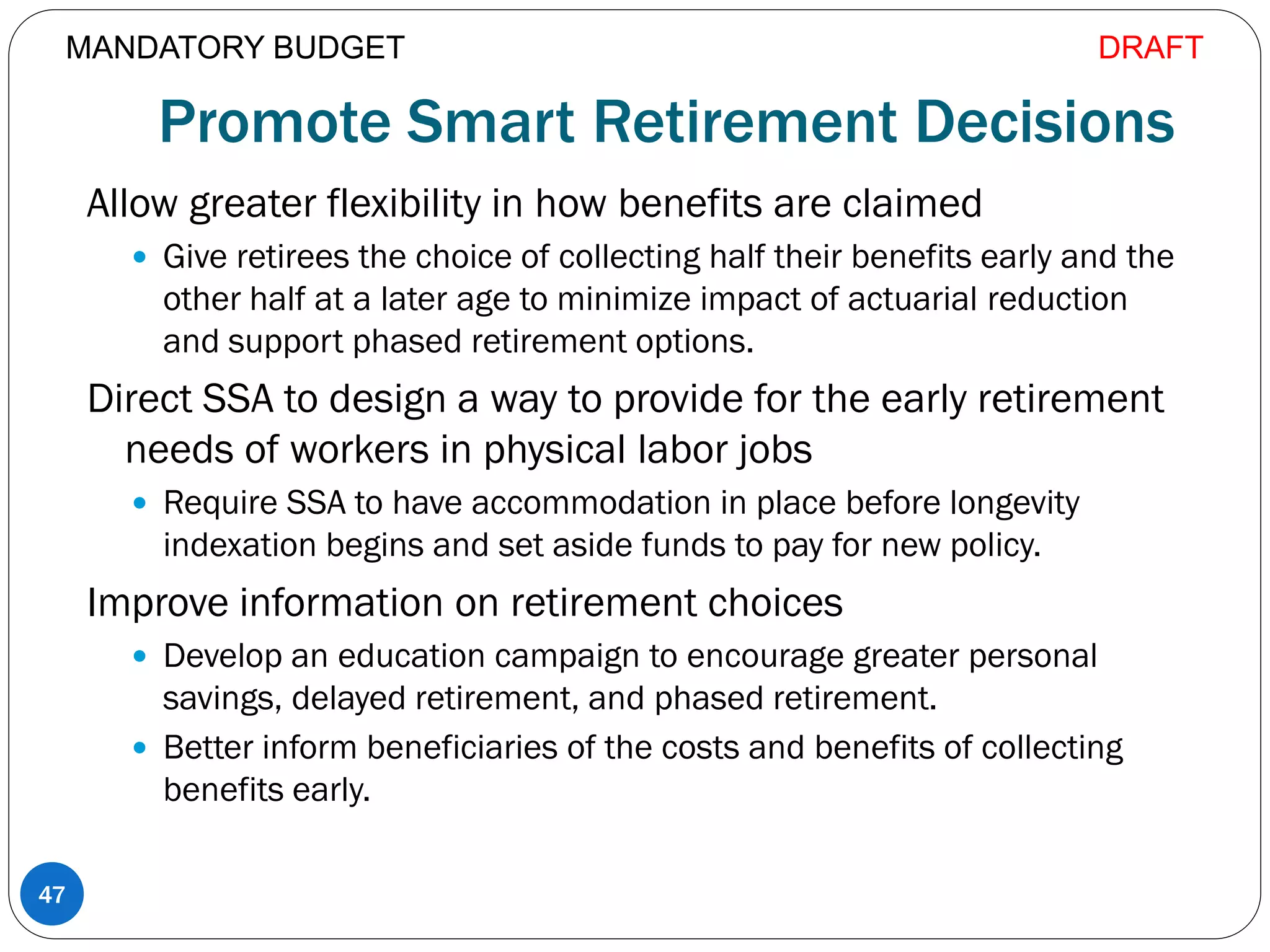

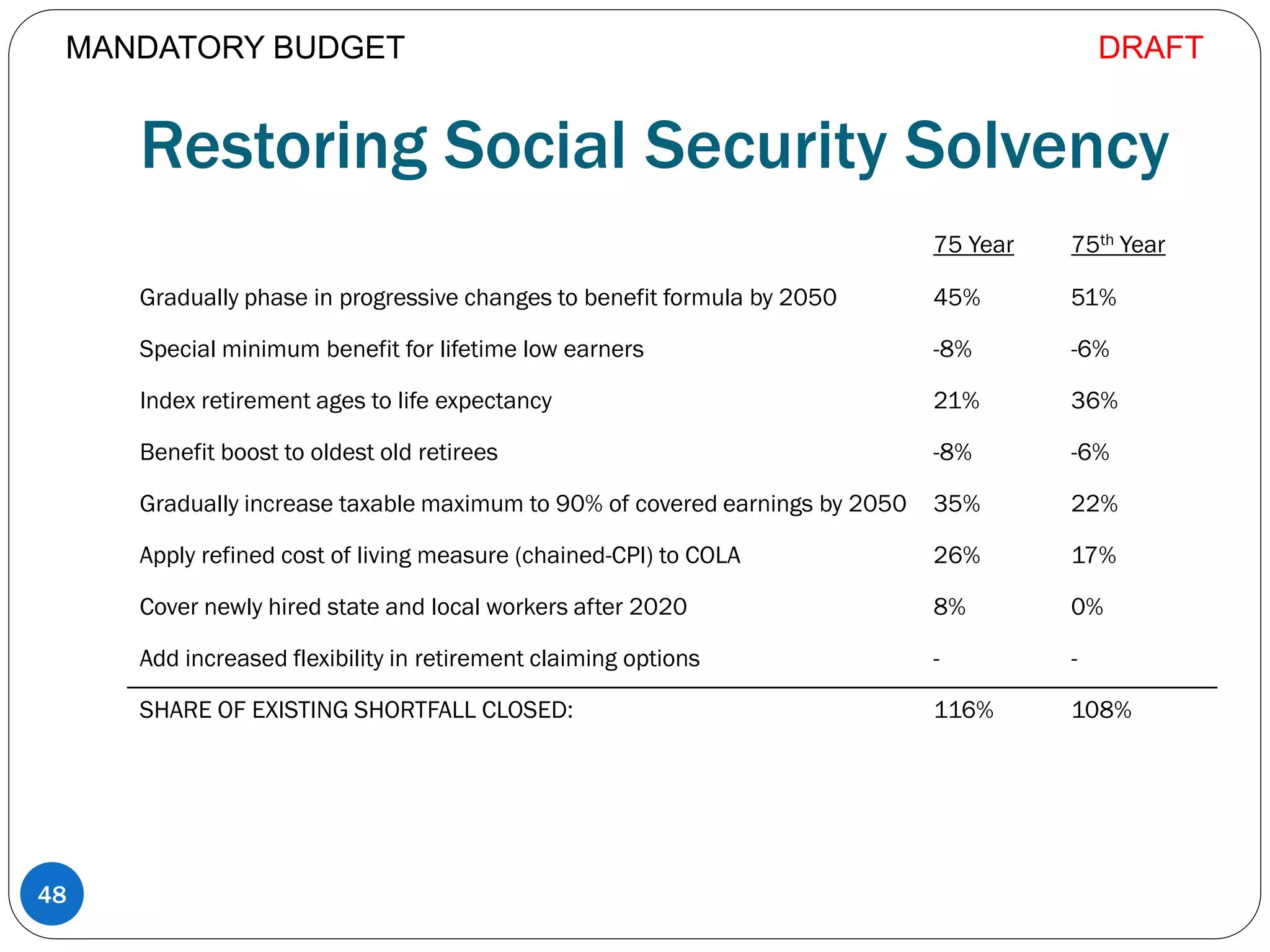

3. Achieving nearly $4 trillion in total deficit reduction through a combination of spending cuts, tax reform, and changes to mandatory programs like healthcare, farm subsidies, and retirement benefits.