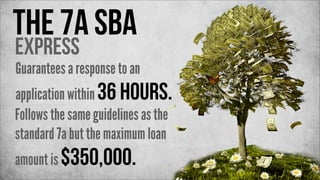

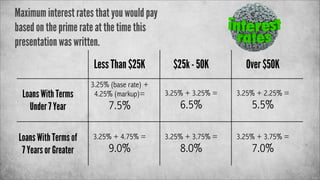

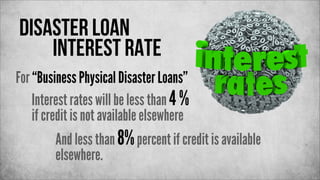

The document provides an overview of the different types of loans offered by the Small Business Administration (SBA). It describes SBA's 7a loans which include general business loans and SBA Express loans. These loans offer lower interest rates, longer repayment periods, and more favorable terms than non-SBA loans. It also outlines SBA's CDC/504 loans which are for large capital investments in equipment and property, and SBA's disaster loans for businesses damaged by a declared disaster or experiencing substantial economic injury from a disaster. The document explains eligibility requirements and terms for each loan type.