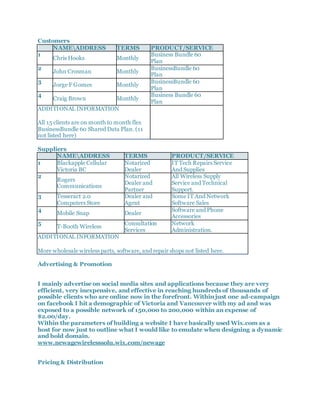

New Age Wireless Solutions is a small wireless airtime provider in Victoria aiming for corporate recognition to expand its customer base from 15 to over 50 in the next quarter. The document discusses the rapid growth in the wireless communication industry, highlighting market trends and the impact of advanced technologies like 4G, while analyzing the competitive landscape among various providers in Canada. It also outlines the importance of consumer-friendly practices in the business and how New Age Wireless plans to differentiate itself by providing affordable services and building strong customer relationships.