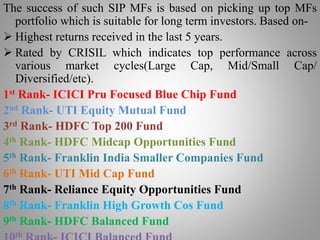

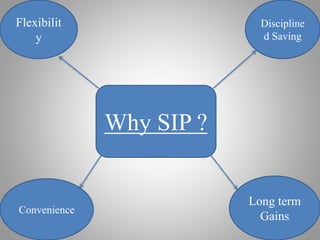

The document discusses mutual funds, including their advantages, types of schemes based on maturity period and investment objectives, investment strategies, systematic investment plans, net asset value, and asset management companies. Mutual funds offer benefits like professional management, diversification, convenience, potential returns, low costs, and transparency. Schemes can be open-ended or close-ended, and categorized by their focus on income, growth, balanced investments, real estate, foreign securities, or new industries. Systematic investment plans allow regular, disciplined investing. Net asset value is calculated daily based on the fund's holdings and shares outstanding. Asset management companies incorporate and manage mutual fund portfolios.

![Net Asset Value

NAV is the total asset value per unit of the fund and is

calculated by the Asset Management Company

(AMC) at the end of every business day. Net asset

value on a particular date reflects the realisable

value that the investor will get for each unit that he

is holding if the scheme is liquidated on that date.

NAV=

[(Market Value of Securities + Cash and Equivalent Holdings) - Fund

Liabilities]

Total Fund Shares Outstanding](https://image.slidesharecdn.com/mutualfunds-laxman-160524180841/85/Mutual-funds-14-320.jpg)