This document provides an overview of mutual funds, including:

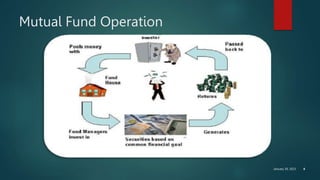

- A mutual fund is a trust that pools money from investors and invests it in stocks, bonds, and other securities. Income and capital gains are shared proportionally among investors.

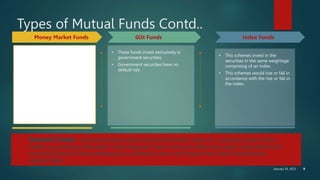

- There are various types of mutual funds categorized by investment objectives (equity, debt, hybrid/balanced) and maturity periods (open-ended, closed-ended).

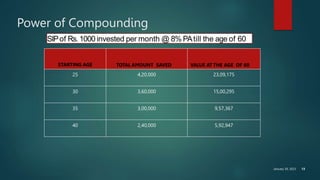

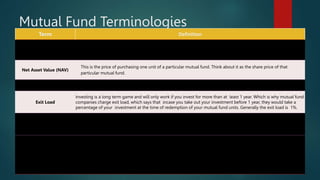

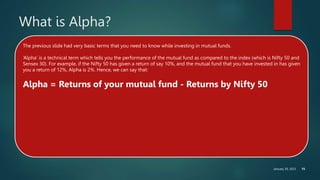

- Key terms include net asset value (NAV), expense ratio, exit loads, growth vs. dividend options, and alpha which measures a fund's return compared to its benchmark index.

- Advantages of mutual funds include liquidity, diversification, professional management, flexibility, and tax benefits for some funds