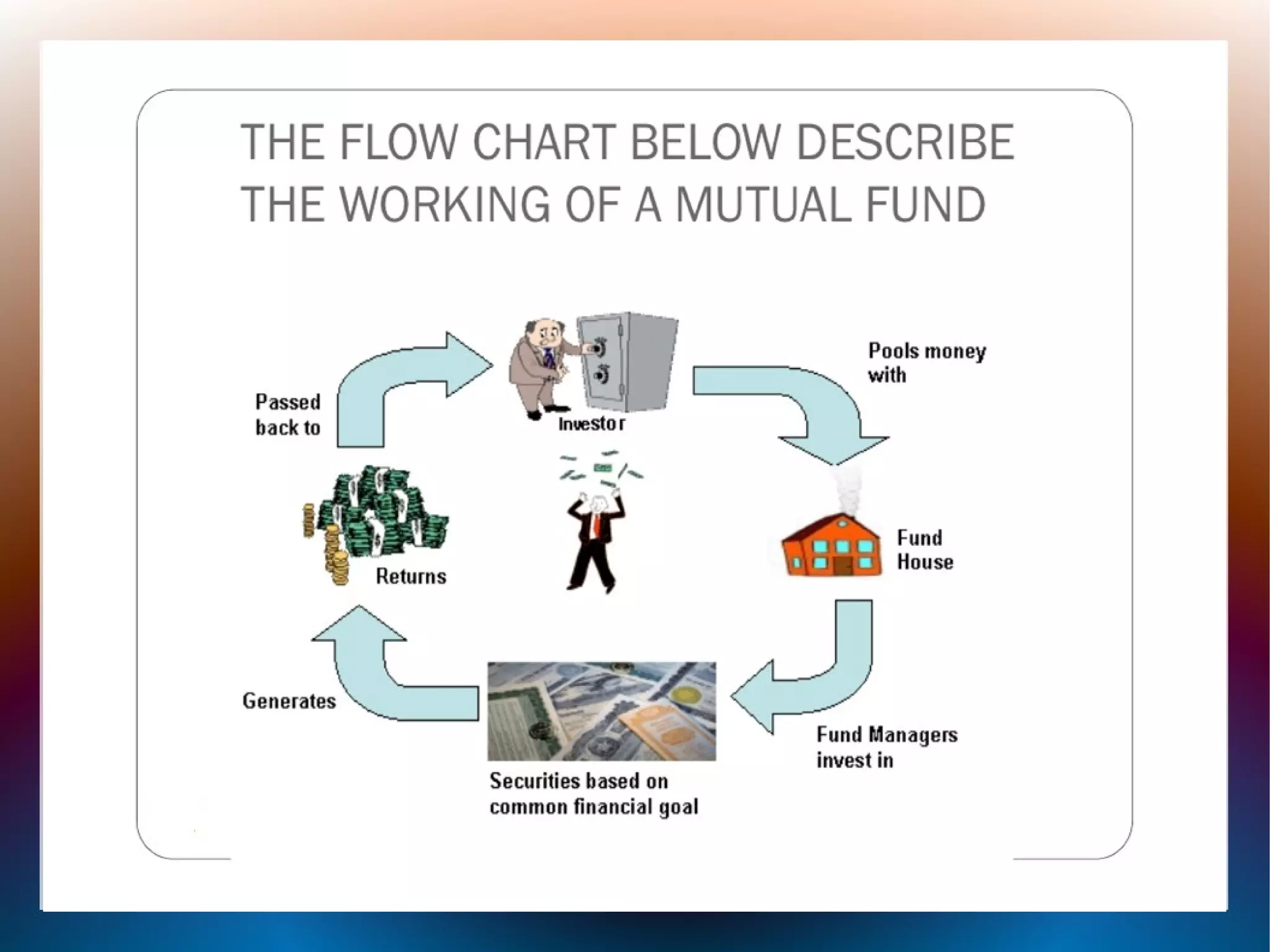

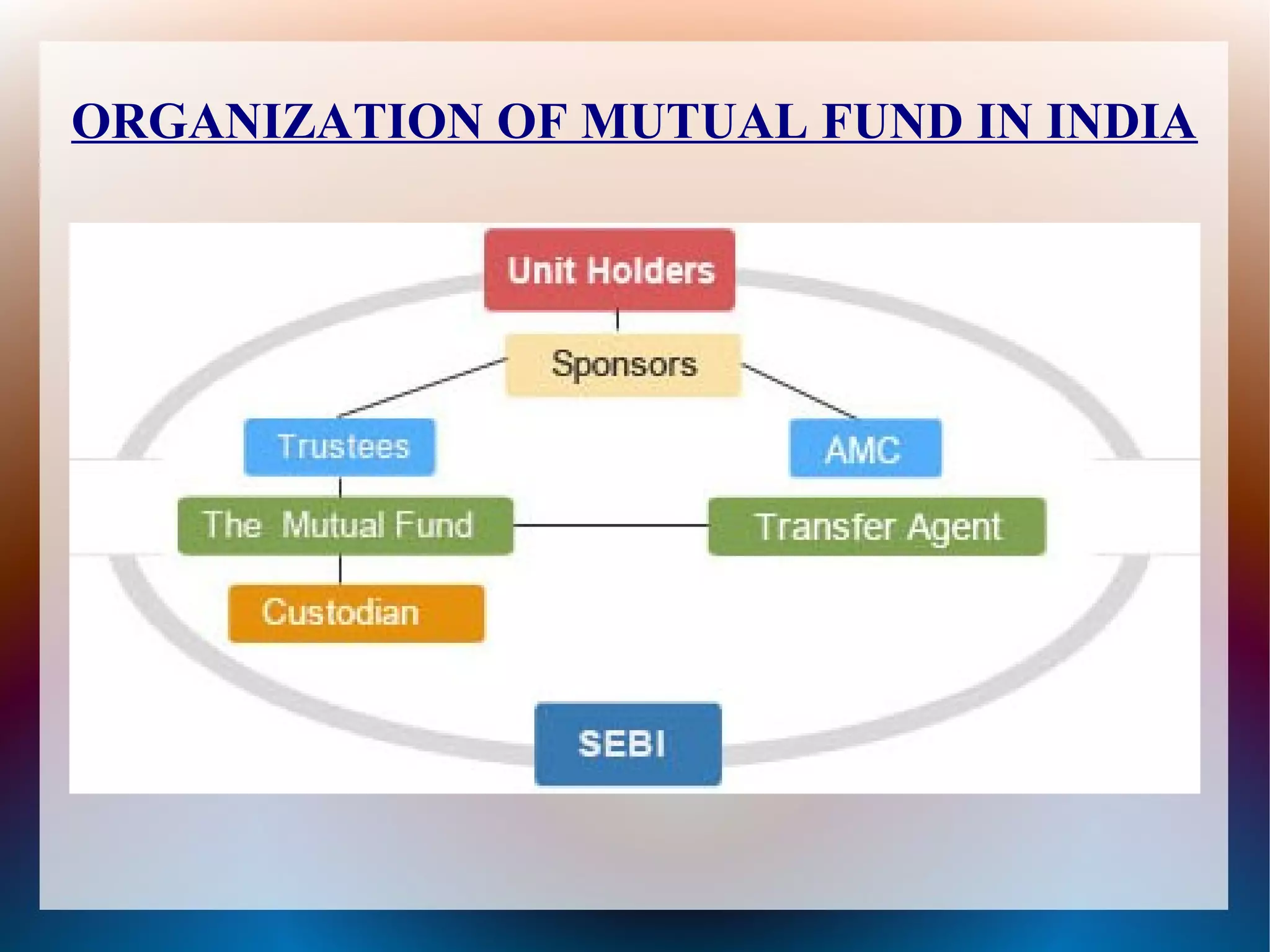

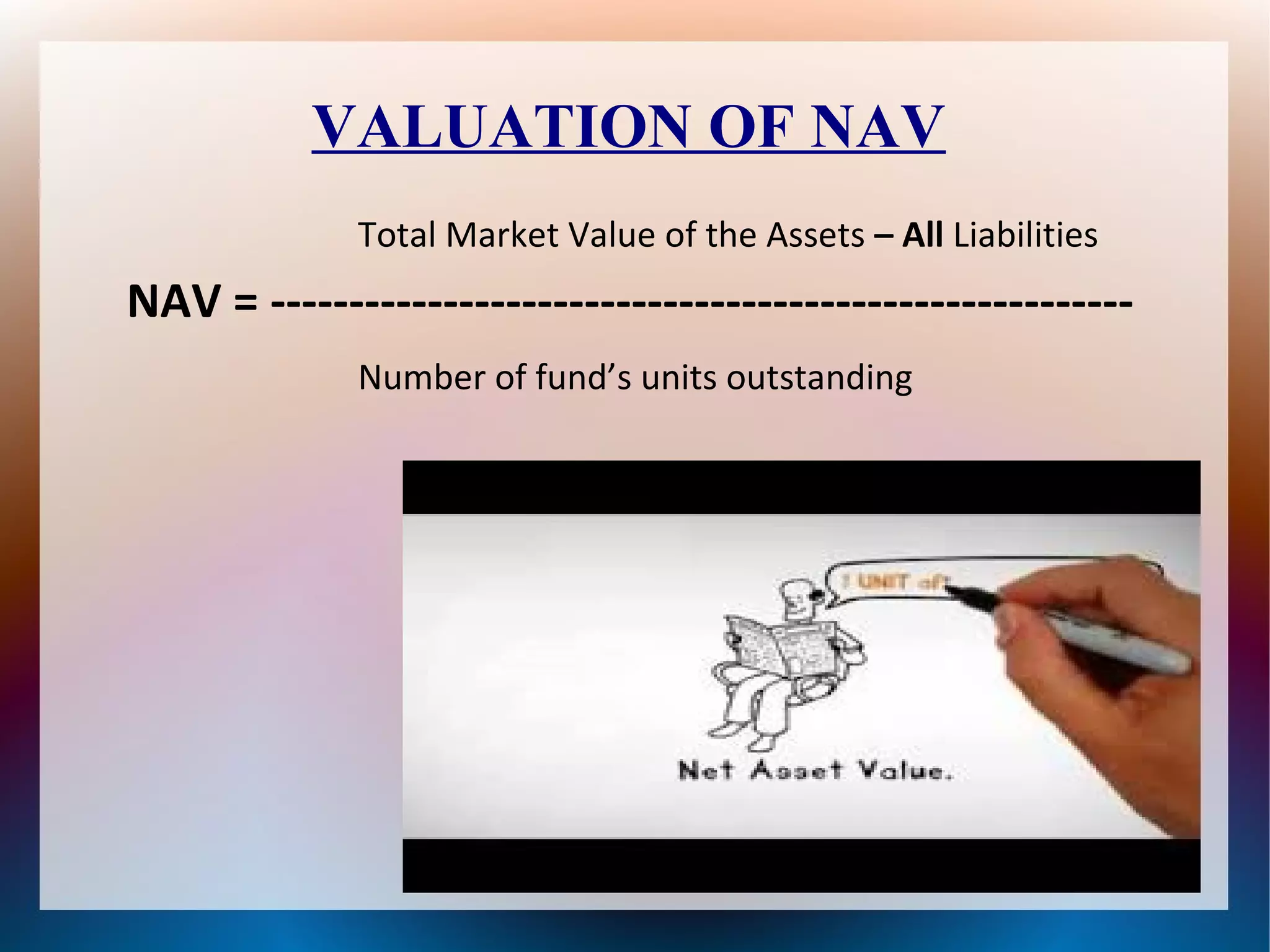

The document discusses mutual funds in India. It defines a mutual fund as a trust that pools savings from investors who share common financial goals. The money is invested in stocks, bonds, and other securities. It then discusses the history of mutual funds in India, from the formation of UTI in 1963 to the current phases of growth. It also outlines the various types of mutual fund schemes, including by structure (open-ended and closed-ended) and investment objective (growth, income, balanced). The document concludes by discussing the advantages and disadvantages of investing in mutual funds in India.