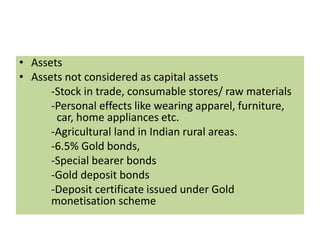

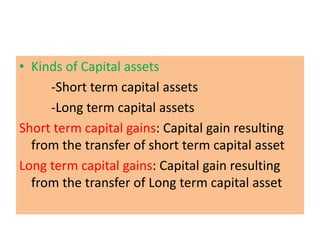

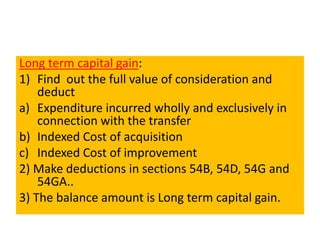

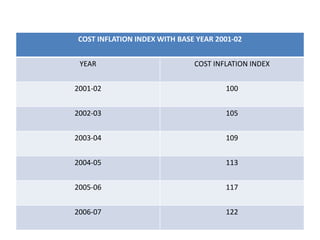

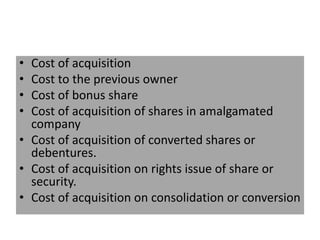

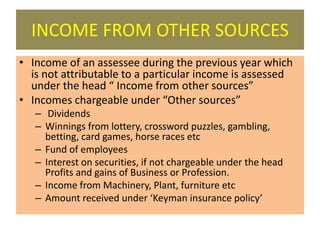

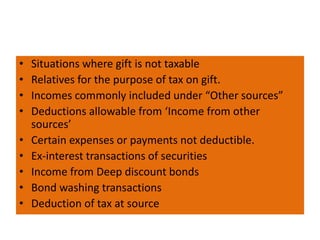

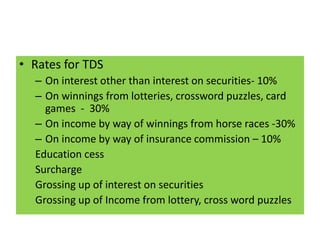

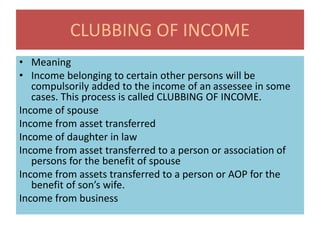

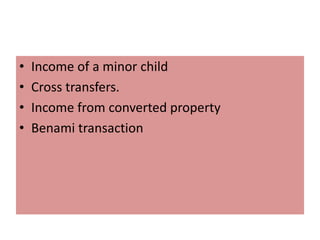

This document summarizes key aspects of capital gains and income tax law in India. It discusses that capital gains are profits from the transfer of capital assets and outlines what qualifies as a capital asset. It then explains the different types of capital assets and how to calculate short-term and long-term capital gains. The document also summarizes the taxation of other sources of income not covered under other heads. It discusses allowable deductions and situations where income may be clubbed or losses can be set off. The overall summary provides an overview of capital gains taxation and other income tax concepts in India.