Multicultural Marketing - Portada Online Magazine 4Q 2011

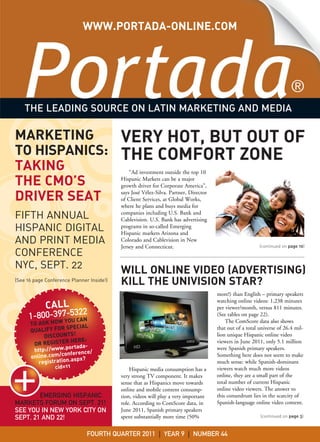

- 1. WWW.PORTADA-ONLINE.COM THE LEADING SOURCE ON LATIN MARKETING AND MEDIA MARKETING VERY HOT, BUT OUT OF TO HISPANICS: THE COMFORT ZONE TAKING “Ad investment outside the top 10 THE CMO’S Hispanic Markets can be a major growth driver for Corporate America”, says José Vélez-Silva. Partner, Director DRIVER SEAT of Client Services, at Global Works, where he plans and buys media for companies including U.S. Bank and FIFTH ANNUAL Cablevision. U.S. Bank has advertising HISPANIC DIGITAL programs in so-called Emerging Hispanic markets Arizona and AND PRINT MEDIA Colorado and Cablevision in New Jersey and Connecticut. (continued on page 10) CONFERENCE NYC, SEPT. 22 WILL ONLINE VIDEO (ADVERTISING) (See 16 page Conference Planner Inside!) KILL THE UNIVISION STAR? more!) than English – primary speakers watching online videos: 1,238 minutes CALL per viewer/month, versus 811 minutes. 2 1-800-397-532N W YOU CA (See tables on page 22). The ComScore data also shows TO ASK HO SPECIAL that out of a total universe of 26.4 mil- QUALIFY FOR DISCOUNTS! lion unique Hispanic online video HERE: viewers in June 2011, only 5.1 million OR REGISTER tada- http://www .por were Spanish primary speakers. onference/ online.com/c spx? Something here does not seem to make registration.a much sense: while Spanish-dominant cid=11 Hispanic media consumption has a viewers watch much more videos very strong TV component. It makes online, they are a small part of the sense that as Hispanics move towards total number of current Hispanic online and mobile content consump- online video viewers. The answer to EMERGING HISPANIC tion, videos will play a very important this conundrum lies in the scarcity of MARKETS FORUM ON SEPT. 21! role. According to ComScore data, in Spanish-language online video content. SEE YOU IN NEW YORK CITY ON June 2011, Spanish primary speakers SEPT. 21 AND 22! spent substantially more time (50% (continued on page 3) FOURTH QUARTER 2011 | YEAR 9 | NUMBER 44

- 3. ONLINE VIDEO (continued from page 1) WHAT INSIDERS HAVE TO SAY “Right now the Hispanic market is still broadcast, there is no time shifting yet as in the general market,” says Lisa Torres, president of Zenith Media Multicultural. In fact, Univision and other major Hispanic broadcasters have not put most of their primetime shows online, something most general market broadcasters have done for years. “There is a LISA TORRES lack of content particularly from Univision. Online video President, Zenith Media advertising is only going to change once Univision primetime Multicultural comes online”, Torres adds. The offering of online advertising options, and online video advertising in particular, still runs short of what adver- “Right now the Hispanic market is still broadcast, tisers and their agencies are looking for. there is no time shifting yet as in the general market. “There is not a lot of online video content inventory. We There is a lack of content particularly from Univision. are seeing more of a drive to generate and consolidate video Online video advertising is only going to change once content. Advertisers and agencies are asking for it,” says Chris Univision primetime comes online” Stanley, CEO of Alcance Media Group, an online ad net- work targeting the U.S. Hispanic and Latin American mar- kets. Jorge Mercado, Associate VP, Marketing and Communications – Americas at Prisa Digital in Miami, KAREN TREYDTE agrees “while video has grown there are still limitations such Director of Media Services, as reach, the increase of subscriber only video (Hulu/Netflix), Casanova Pendrill studios and networks limiting the content out there on ad supported sites, as well as the high cost of rights for profes- sional quality video content.” “Hispanics are embracing online video more than their While online pure plays like Yahoo!, MSN or Terra don’t non-Hispanic counterparts, in part due to the fact that have any conflict of interest, big broadcasting companies like content relevant to them is not prevalent in mainstream Univision and Telemundo have a reason to fear that their bil- broadcasting.” lions of advertising revenues in broadcasting get cannibalized by online video advertising. Univision leads in the Hispanic online video advertising market, but the size of the Hispanic online video advertising market is less than 1% compared to KEVIN CONROY the Hispanic TV advertising market. President, Univision Interactive Asked by Portada why Univision doesn’t stream its Media, Univision primetime schedule on univision.com. Kevin Conroy, presi- Communications Inc. dent of Univision Interactive Media, answers that Univision streams an array of programming, including primetime con- ¨Univision streams an array of programming, inclu- tent from Univision,TeleFutura and Galavisión on its sites, ding primetime content from Univision,TeleFutura and as well as on the Univision channel on YouTube. Conroy Galavisión on its sites, as well as on the Univision adds that “In fact, the first Univision Studios produced hit channel on YouTube. Conroy adds that “In fact, the first novela “Eva Luna” was made available after each broadcast Univision Studios produced hit novela “Eva Luna” was made on NovelasySeries.com and on mobile via the Univision available after each broadcast on NovelasySeries.com and on mobile via the Univision Video App.” Video App. “ “In addition, other popular programs are avail- able online, including Sunday talent competition “Pequeños Gigantes” and our novelas on TeleFutura “La Pola” and “Doña Bella.” Conroy adds that Univision recently provided a 360 CHRIS STANLEY experience of its “Premios Juventud” youth awards, which CEO, Alcance Media Group included four simultaneous live streams from never before seen angles of the stage and backstage areas on PremiosJuventud.com. Conroy also says that every game for the FIFA World Cup was streamed live as well as in the “There is not a lot of online video content inventory. recent Copa Oro and Copa America soccer matches.” We are seeing more of a drive to generate and conso- However, most observers say that Spanish-language lidate video content. Advertisers and agencies are audiovisual online content is still very scarce. “Advertisers try asking for it.” to reach US Hispanics via English sites, but feel that such environment is not contextually right,” says Jan-Luc (continued on page 22) www.portada-online.com | Q4 2011 | 3

- 5. CONTENTS Fourth Quarter 2011, Year 9, Number 44 FEATURES 1 EMERGING HISPANIC MARKETS. These markets 1 are on fire. So why are major advertisers not catering to them? Learn why marketing to Hispanics in states such as Arizona, North Carolina, Georgia, New Jersey, Nevada and Colorado can substantially contribute to Corporate America’s growth during the next decade. BEHIND THE STORY OF HISPANIC ONLINE VIDEO 1 ADVERTISING. It’s the most vibrant sector of the online ad market. Why is there so little Spanish —language video content online? Are there vested 1 interests interested in preserving the status quo? A report on what is being done and why. REBOUND: FINANCING LATIN VENTURES. 17 SUPPLEMENT: CENSUS DIGEST I FOR MARKETERS. WERE THE RESULTS EXPECTED? III WHAT THE CENSUS RESULTS MEAN IV TO MARKETERS. 17 SPECIAL PORTADA SEPTEMBER 21-22 A CONFERENCE PLANNER. All you need to know to prepare for our Fifth Annual Hispanic Digital and Print Media Conference (“Marketing to Hispanics: Taking the CMO’s Driver Seat”) and the Portada Emerging Hispanic Markets Forum on Sept. 21. (Page A-P) DATA, INSIGHTS AND ANALYSIS TO HELP YOU COMPETE IN THE LATIN MARKETPLACE YOUR VIEW-SOUNDING OFF. The gist of sounding off columns by Tony D’Andrea, Director of more with New Media than White Youth; Hispanics are Planning and Research at The San Jose Group; more likely to use video-sharing sites; Online Shopping vs. Dr. Felipe Korzenny, Director for the Center for Brick and Mortar Shopping Behavior. (Page 25) Hispanic Marketing Communication at FSU; Terry Soto, President & CEO About Marketing Solutions and Ivonne Kinser, American Airlines Marketing Solutions (Page 8) MARKETER INTERVIEW. Larry Upton, Founder and President of Edioma on using Mobile REGULAR SECTIONS Communications to reach Hispanic Customers 6 OUR VIEW (Page 20) 7 CALIENTE Y FRIO IN HISPANIC ANALYSIS. Do Preprints (FSI’s) work better in MARKETING Spanish or English? (Page 21) 7 EVENT CALENDAR STATISTICS IN CONTEXT 26 ADVERTISER INDEX Parents Beware! Minority Youth Spend 90 Minutes www.portada-online.com | Q4 2011 | 5

- 6. OUR VIEW WWW.PORTADA-ONLINE.COM THE LEADING SOURCE ON Beyond Measuring Performance: LATIN MARKETING AND MEDIA Print,Online, Newsletters, ARE WE MISSING SOMETHING IN THE Conferences, Research DIRECT RESPONSE DATA CRAZE? PORTADA EDITORIAL BOARD Dawn Marie Gray, Senior Manager Multicultural Marketing, CVS The digital revolution Gonzalo del Fa, Managing Director, MEC Bravo Kristyn Page, Director of Multicutlural over the last decade has Marketing, Macy's Inc. had a very strong impact on Rodolfo Rodriguez, Multicultural Marketing Director, General Mills the marketing and adverti- Teresa Wakeley, Marketing Media and Diversity sing industries. Thorough Manager, Volkswagen Group of America Inc data on performance and PUBLISHER Marcos Baer response to digital adverti- sing has become the norm. EDITORIAL - RESEARCH Carolina Re, Senior Researcher - Writer Due to the development of TRANSLATION sophisticated performan- Candice Carmel ce measurement tools, the CORRESPONDENTS famous phrase of Phila- Laura Martinez, Senior Correspondent delphia merchant John Mariana Carreño King, Feature Correspondent Jose Cervera, Global Correspondent Wannamaker that “half the money spent on advertising is wasted; the Levi Shapiro, Digital Media Correspondent Raul Riba, Mexico Correspondent trouble is to know which half it is” no longer holds. The advertising and media industries are becoming much more efficient. SALES AND MARKETING Nicolás Miranda, Online Sales Manager But, aren’t we losing something in the process? Isn’t the pendulum 1-800-397-53-22 moving too much towards mathematics and direct marketing myopia? Bob Oliva, Senior Sales and Business Development Representative Wanda Harris Millard, COO of media advisory firm Media Link, defini- Ruby Namoca, Sales and Marketing Intern tely thinks so. While Online Ad Networks, Ad Exchanges, DSPs Jimena Ovalle Marion Zipilivan, Intern (Demand Side Platforms), Agency Trading Desks, and SSP’s (Supply OFFICE MANAGER Side Platforms) have contributed to make the advertising and media Susan Cameron sectors more efficient, they also have commoditized the industry. INFORMATION TECHNOLOGY There is too much of a fixation with immediacy and sales results. Todd Sarouhan Harris Millard gave an interesting presentation during the recent DESIGN Interactive Advertising Bureau Mexico Annual Convention. In her view, Dafne Kleiman, www.dafnedesign.com.ar technological innovation has taken too much of a central space in AUDIT BY detriment of the creative and artistic part of the advertising and media planning/buying process. “Not everything that can be counted counts, and not everything that counts can be counted”. Advertising, Marketing and Media Executives Copyright: Portada®2011 No part of Portada® may be copied, reproduced or of the Digital Age should take into account this phrase from famous broadcast in any form without prior permission. American writer and humorist Mark Twain (1865-1910). It should par- Comments by sources cited in Portada® have been directly obtained from them, unless its is explicitly ticularly resonate with brand marketers. Currently, new metrics rele- noted otherwise. Portada® is not affiliated with vant to brand marketers are being developed. These metrics need to any other publication, media group, advertising agency or any other institution. go beyond direct response and performance oriented data. In addition, Portada® is published by Contenido LLC in measurements that are relevant and consistent across off- and “onli- New York City. Portada® is an integrated media company that informs and instructs its audience via ne” media have to be created. The development of these new metrics, audited print (4 x a year) and online vehicles (web- on which AAAA, IAB and ANA are currently working, should also help site, e-newsletters, webinars) and conferences. For reprints information and prices please contact to increase the amount of brand advertising dollars spent online. reprints@portada-online.com. While advertising must sell, it’s focus should be on the value exchan- Registered users can get any Portada e-newsletters, the quarterly magazine as well as participate in ge between brands and consumers. With the advent of social networks Portada awards nomination/voting and provide it is, to a large extent, in digital media were relationships are built, for- comments to articles. Premium content available for individual purchase or through an annual sub- med and shaped. This relationship can and should not only be measu- scription includes: Premium individual articles, Databases of Corporate Marketers/Media Buyers red with performance driven analysis. targeting U.S. Hispanic and/or Latin American As Harris Millard put it. Brand marketers should increasingly ask Consumers, Research Reports and Conference Tickets. To order premium comments, please call themselves questions like:” How does a logo sound?” or “how does a us at 1-800-397-5322. text move?” To notify about address changes, please write to Portada, 315 Fifth Avenue, Ste. 702, NY, NY 10024. Hispanic and Latin American marketing and advertising executives, with their well known creative skills, should substantially contribute to MISSION Portada®’s mandate is to help Executives in this necessary unlocking of creativity in the digital space. Business and Media understand and reach Hispanic and Latin American consumers. Portada strives to put its audience ahead of the curve so it can navi- gate change in the digital age. 6 | Q4 2011 | www.portada-online.com

- 7. OUR VIEW WHAT'S HOT AND COLD IN LATIN MARKETING, MEDIA AND BUSINESS CALIENTE FRÍO > Holistic Marketing Approach > Narrow Focused Marketing Approaches (can include Hispanic only without looking at the wider U.S. and > Hispanic Heritage Month multicultural landscape). > Pulitzer Winner Jose Antonio Vargas comes out as > PR professionals who ask media properties for an illegal alien media kits to measure the impact of their pitches and have no interest whatsoever in advertising. > Hispanics are Republicans’ big problem in 2012 EVENT CALENDAR INDUSTRY CONFERENCES OF INTEREST TO Portada READERS (check out http://www.portada-online.com/events.aspx for more events) USHCC 32ND ANNUAL NATIONAL CONVENTION & NAMIC 25TH ANNUAL CONFERENCE BUSINESS EXPO 1 October 4-5, 2011 4 Sept. 18-21, 2011 NAMIC, Hilton New York, New York, NY USHCC, Fontainebleau Miami Beach, FL 1ST ANNUAL HPNG ENTREPRENEUR CONFERENCE HPNG PORTADA'S EMERGING HISPANIC MARKETS October 3, 2011 5 FORUM, NYC 2 New York, NY Sept 21, 2011 Portada, Scholastic Auditorium, New York, NY THE FESTIVAL OF MEDIA LATAM 2011 October 12-14, 2011 6 FIFTH ANNUAL HISPANIC DIGITAL AND PRINT MEDIA C Squared Events Ltd., Loews Miami Beach Hotel, Miami, FL CONFERENCE, NYC 3 Sept. 22, 2011 ANA MULTICULTURAL MARKETING & DIVERSITY Portada, Scholastic Auditorium & Rooftop Terrace with CONFERENCE 2011 7 Greenhouse, New York, NY November 6-8, 2011 ANA, Fontainebleau Hotel, Miami Beach, FL MOST READ ARTICLES ON follow US PORTADA-ONLINE.COM (July 1 — August 14, 2011 period) 1. Research: The most engaging TV Ad Campaigns for Hispanic Audiences 2. Breaking: Media Division of Alloy bought by At Linked In Groups and Discussions Prospect Capital http://www.linkedin.com/ groups? 3. Breaking News: Diario de Mexico launches mostPopular=&gid= 2026937 Chicago daily edition 4. Best Practices: Using Mobile Communications to reach Hispanic Customers Share your Thoughts with US 5. Changing Places: Pamela Silva Conde, Mario through Twitter Diaz, Carlos Ruben Zapata, Peter Walker 6. Analysis: 1,000 New Web Domains https://twitter.com/Portada_online 7. Copa América: Media and Advertisers are get- ting ready 8. Latin Interactive World: The MediaMind-DG Befriend us on Facebook Strategy http://www.facebook.com/portada 9. Score Media Launches Spanish Edition of ScoreMobile for Copa America 10. Deal Digest: QuePasa-MyYearbook www.portada-online.com | Q4 2011 | 7

- 8. YOUR VIEW TERRY SOTO, SOUNDING OFF President & CEO About Marketing Solutions The Sounding Off column, published on www.portada- “The 4Cs That Lead to a Successful Hispanic Initiative” online.com provides a platform to experts to explain The Hispanic marketing community is abuzz about the 2010 ideas, trends and innovations and their value to the Census numbers and the double digit growth in the past 10 marketplace. Here is a summary of what some of our years. You’ve heard the rhetoric before: Corporate America recent columnists had to say. If you are interested in is missing the boat by not waking up to the Hispanic mar- submitting proposals for Sounding Off articles, please ket opportunity. email our Sounding Off column editor Carolina Re at Address the four most common culprits that lead to a suc- Carolina@portada-online.com. cessful Hispanic initiative: Commitment, Competency, Capability and Compensation. Commitment means that, upon a CEO’s communication to his organization, the Hispanic market is a critical business driver for the com- pany. Competency means that all areas of the organiza- tion responsible for delivering value to the company’s con- TONY D’ANDREA, sumer targets participate in the due diligence. Capability Director of Planning and means that each area leader understands the implications Research at The San Jose of existing area shortcomings, understands the necessary Group organizational and infrastructure interdependencies, and Compensation means that area leaders’ compensation and rewards systems are tied to KPIs for Hispanic stra- “Latina Business Owners: Women’s tegy success. Entrepreneurship on the Rise” 788,000 Latinas now run their own businesses in America, according to the most recent Survey of Business Owners. This represents a 46% increase over a five-year (2002- 2007) period against the 20% found across female busi- ness of all ethnic backgrounds. Their background is IVONNE KINSER, Mexican (44%), Cuban (9%), and Puerto Rican (8%), com- American Airlines Marketing plemented by a myriad of Central and South American Solutions. nationalities. Latinas now own 36% of all companies run by minority women in the country. “Five Good Reasons to Expand into Latin America” No one could deny at this point that we have arrived at an unprecedented stage where globalization is making the world “one large market”. Latin America is in the cross- DR. FELIPE KORZENNY, hairs of many global companies. Below are five reasons Director for the Center for that make the region a no-brainer for companies conside- Hispanic Marketing ring new markets to expand their businesses. Communication at FSU 1) An Economy Racing Ahead: It’s simple; Latin America is in a growth stage where many developed countries are still recovering from the economic impact. “The Multicultural Face of Smart Phones and Unlimited 2) An almost 600 Million People Market Organized in Four Data Plans” Trade Blocs: • Mercosur: Argentina, Brazil, Paraguay, Uruguay and Hispanics are digital pioneers in having blogs and personal Venezuela, (special member). websites. Much speculation and some research has clai- • Andean Community of Nations: Bolivia, Colombia, med that Hispanics are leading in the area of smart phone Ecuador, Peru and Chile, (associate). usage. Having a smart phone, to be truly useful requires of • Central American Integration System (SICA): Costa Rica, an unlimited data plan. Fifty six percent of online Latinos Guatemala, Honduras, Nicaragua, El Salvador, Panama, that prefer Spanish have an unlimited data plan. These fin- Belize and Dominican Republic. dings are not only surprising but outstanding in portraying • Mexico is part of NAFTA, which includes USA and Canada. Hispanics as the most aggressive users of mobile techno- 3) An enormous Import Potential: Between 1990 and 2000, logy for internet navigation and use. total U.S. merchandise trade with Latin America grew by Mobility and connectivity appear to be prime values for 219% compared to 118% for Asia. Hispanic consumers. What is the meaning of having Latinos 4) A millionaire e-commerce business that’s booming: E- be the leaders in this digital era? How can they influence commerce reaches critical mass in the region, especially others? What is their role in promoting the use of mobile digital in Brazil. communications? How do their tastes and preferences shape 5)Remittances: An additional $58.9 Billion Purchasing the future of technology use in the United States? These and Power: Money transfers made by Latin American and other questions are of great importance but the key ele- Caribbean migrants to their countries of origin reached ments here are the raw results. $58.9 billion in 2010. 8 | Q4 2011 | www.portada-online.com

- 10. EMERGING HISPANIC MARKETS (continued from page 1) opportunity. This means that tradi- (+302,285) and Maryland (+242,716). tional focal points are no longer the (See table on page 14). In 2000, 61 percent of the only high growth areas. There are As Phillip Woodie, president of Hispanic population residing in the 50 many secondary markets that are seeing LER says, “the growth which is taking states and District of Columbia resided an influx of Hispanic migration. If place in many of these emerging mar- in just four states: California, Texas, those emerging markets overlay well kets is staggering and simply too com- Arizona and Florida. By 2010, that with our footprint, we do market to pelling for agencies and advertisers to proportion had declined to 58 percent that demographic. We are a national overlook. The list of emerging markets while nine states (Alabama, Arkansas, carrier and definitely cater outside the continues to evolve in concert with the Kentucky, Maryland, Mississippi, top 10 Hispanic market. Our media migration patterns of Hispanics across DOES A MARKET NEED TO HAVE AT LEAST A 12% TO 15% HISPANIC SHARE OF ITS TOTAL POPULATION TO JUSTIFY EXPENDITURES IN HISPANIC SPECIFIC MEDIA? North Carolina, South Carolina, South and retail merchandising efforts are the US. Markets like Denver, Salt Lake Dakota and Tennessee) saw their national.” Other advertisers that have City, Milwaukee, Seattle, Atlanta and Hispanic populations more than dou- “ventured” outside the top 10 Hispanic DC have gained some good traction. ble. The change in the ratio is particu- markets include Maseca, Cricket And as these markets progress through larly noteworthy because the overall Wireless, WalMart, Verizon Wireless their growth curve, other markets like Hispanic population grew by a breath- and H&R Block. Boise and Minneapolis emerge as viable taking 43% during the 2000-2010 Zulema Tijero, Advertising Sales Hispanic markets of consequence. If time period. Director of Washington Post Co owned advertisers are truly interested in grow- Are advertisers and major brands El Tiempo Latino in Washington DC, ing their business, they will insist on following the expansion of the tells Portada that business has increased including Emerging Hispanic markets Hispanic population?”. in the last few months due to the fact as part of their overall media plans.” According to Mark Stockdale, that advertisers have taken notice of the LER represents over 100 Spanish lan- Director, Hispanic Marketing at T- strong increase of Hispanic population guage radio stations serving close to 80- Mobile USA, “T-Mobile recognizes the between 2000 and 2010 in Virginia percent of the U.S. Hispanic market. 10 | Q4 2011 | www.portada-online.com

- 11. EMERGING HISPANIC MARKETS NOT ON THE RADAR SCREEN Bakersdale in CA, which has a 45% Emerging Hispanic Markets can be an Yet, to market outside the top 5 or Hispanic share. Areas of high growth advantage for marketers. Last year top 10 Hispanic markets often falls in both population and purchasing Maseca organized a tour of large U.S. outside the radar screen of major power of the Hispanic demographic are cities, spearheaded by advertising national advertisers. “The problem is also overshadowed by major neighbor- agency Lopez Negrete. It included that Emerging Hispanic markets are ing metropolis like Orange County and Charlotte, NC, in the effort. Perla often outside of the comfort zone of Riverside (Los Angeles) or Hoboken Wasserman, Account Service Director clients”, says Global Works Vélez-Silva. (New York). These markets often fall at Houston based Lopez Negrete According to Ronnie Coates, out of the radar screen of major Communications, tells Portada that Director of Sales of Charlotte, NC, national advertisers. For example, Charlotte was the only specific effort based Norsan Multimedia, advertisers Inland Empire, comprised of the outside the top 10 Hispanic markets. often argue that a market needs to Riverside and San Bernardino The campaign supported the Maseca have at least a 12% to 15% Hispanic Counties, is the fastest growing area in brand around the 2010 Soccer World AREAS OF HIGH GROWTH ARE OFTEN OVERSHADOWED BY MAJOR NEIGHBOURING METROPOLIS LIKE ORANGE COUNTY AND RIVERSIDE (LOS ANGELES) OR HOBOKEN (NEW YORK). share of its total population to justify the U.S. for the Hispanic population. Cup theme “Maseca tu Amuleto de expenditures in Hispanic specific In 2010 almost 50% of Riverside Sabor” talking to females and moms. media. According to this view, markets County’s population was Latin com- The idea was to help moms to cele- with a Hispanic population of well pared to 29.2% in 2000. brate and enjoy the World Cup with over 700,000 like North Carolina, Often local media in emerging, their families. The campaign included Georgia and Pennsylvania do not merit smaller, Hispanic markets has a higher radio, POS at key retailers, events at Hispanic specific advertising. Norsan penetration than Hispanic media in stores, and national online advertising. Multimedia is a Hispanic Media con- bigger markets. This is not surprising The campaign registered a much high- glomerate in the Southeast, offering as smaller markets tend to be less er engagement in Charlotte, where a coverage in North Carolina, South competed than the large metropolitan very high number of consumers visited Carolina, Florida, and Tennessee. Its markets. Hernan Guaracao, publisher Maseca storefronts. media assets include AM, FM radio of Al Día in Philadelphia, tells The number of visitors was much stations, Hola Noticias Newspaper, Portada that his newspaper's penetra- higher than the one registered in similar DescubreCharlotte.com as well as tion rate in Philadelphia Hispanic events in Dallas, Houston, Chicago and events, mobile text and out of home households is higher than 80%.This Los Angeles. It has to be taken into advertising properties. extremely high penetration can not be account that on a proportional basis the Monica Messina, VP Northeast matched by Hispanic newspapers in Charlotte engagement is even higher Regional at LER thinks that there are large metropolis such as Los Angeles, because there are more Hispanics living two valid approaches for marketers: New York and Miami. in Dallas, Houston, Chicago and Los “To go into big markets who have a Angeles than in Charlotte. 10%+ Hispanic share or into small LOW SATURATION... Another advantage for major markets with a very high Hispanic The low saturation of advertising share. Among the latter she counts messages targeting Hispanics in www.portada-online.com | Q4 2011 | 11

- 12. EMERGING HISPANIC MARKETS brands to invest in Emerging Hispanic HOT NEW MARKETS: markets is that they provide a more Why Brand Marketers should try them efficient way of learning about the Hispanic market than the bigger mar- > Low level of saturation of Hispanic marketing messages kets. The marketing/advertising expen- ditures tend to be lower and so are > Very high growth of the Hispanic consumer base overhead costs. > Local Hispanic media in Emerging Hispanic markets tend to have very high penetration rates WHEN TO ENTER: THE FIRST SIGNS Martha Kruse, Senior Director > Emerging Hispanic Markets can be “cheap” test markets for major brands who want to enter the Hispanic market Multicultural Marketing at Rooms To Go, says that usually a market is ready > First mover’s advantage for advertising messages targeting Hispanics when Rooms To Go retail stores have a bilingual sales force. of enough critical mass for an adver- ing clout of Hispanics outside the tra- Kruse calls store managers to discuss tiser to enter an Emerging Hispanic ditional top 5 markets. Televisa’s how Hispanic clients are catered to. market. According to LER’s Phillip Publishing and Digital’s Vanidades Kruse expects to start marketing in Woodie, “Usually, a Spanish-language increased it’s rate base by 74% in 2011 North and South Carolina next year. radio station is the first sign that a sig- to 270,000. An important reason for Rooms To Go has stores in Florida, nificant Hispanic population exists in the population increase is the distribu- Georgina, Mississippi, the Carolinas, a city. Radio continues to be the pri- tion in Emerging Hispanic markets. “WE HAVE STARTED TO INCREASE OUR DISTRIBUTION IN NEW HISPANIC MARKETS WHICH ARE 'HOT'” Tennessee, and Texas. mary medium to reach the US “We have started to increase our distri- She cites as an impediment that Hispanic consumer - radio stations bution in new Hispanic markets which sometimes the tools for effective function as a trusted friend who are “hot” as a result of the census advertising placement are not ready brings news, sounds of home and which include the Carolinas, Virginia yet. For example she says that Atlanta information to their everyday life in and Maryland, etc.”, says Mariana does not have Hispanic TV ratings the US - including ads about where to Toledo, Marketing Manager at yet. In Atlanta Rooms To Go uses shop and which brands/retailers/ser- Televisa Publishing and Digital. Hispanic radio and Hispanic newspa- vices want their business.” In April Univision in Atlanta pers such as Cox communications El launched full fledged newscasts after Mundo Hispanico. MEDIA PROPERTIES years of producing local news briefs, The existence of community TAKE NOTE Univision 34 in Atlanta finally media such as a local newspaper and a Many media properties are adapt- launched 2 half-hour newscasts. They Hispanic radio station is another sign ing their offerings to reflect the increas- are airing at 6 and 11 pm Mon-Fri. 12 | Q4 2011 | www.portada-online.com

- 13. EMERGING HISPANIC MARKETS Gianncarlo Cifuentes, who had been manning the news briefs, is the news director and anchor of the newscasts. Amanda Ramírez, Mariela Romero and Omar García round up the news team. Atlanta’s Hispanic buying power is expected to increase from US $4.3 bil- lion in 2000 to US $16.6 billion in 2012. Cox Media owned Mundo Hispanico is the largest Hispanic news- paper in Atlanta, Georgia. It has an audited weekly reach of 193,500 read- ers. Another major Atlanta Hispanic newspaper is the weekly Atlanta Latino. Local media properties are also emerging. Viva Now Magazine recently launched in Atlanta as a bilingual pub- lication that covers the Southeastern U.S. (in print, on-line and multiple social media forums with a focus on special events) and is specifically designed to appeal to Hispanic profes- sionals and entrepreneurs “Living the American Dream”. Viva Now is pub- lished in glossy magazine format; it has a circulation of 25,000, and is pub- lished twice a year. www.portada-online.com | Q4 2011 | 13

- 14. EMERGING HISPANIC MARKETS TOP 20 EMERGING HISPANIC MARKETS RANKED BY POPULATION GROWTH BETWEEN 2000 AND 2010 STATES 2000 2010 Growth Increase Hisp. Share Hisp. Share 2000-2010 in Hispanic of State of State Census (in %) Population Pop. 2000 Pop. 2010 1. Arizona 1,295,617 1,895,149 46.3% 599,532 25% 29.6% 2. New Jersey 1,117,191 1,555,144 39.2% 437,953 13.3% 17.7% 3. North Carolina 378,963 800,120 116% 421,157 5% 8.4% 4. Georgia 435,227 853,689 96.1% 418,462 5% 8.8% 5. Pennsylvania 394,088 719,660 82.6% 325,572 3.2% 5.7% 6. Nevada 393,970 716,501 81.9% 322,531 19.7% 26.5% 7. Washington 441,509 755,790 71.2% 314,281 7.5% 11.2% 8. Colorado 735,601 1,038,687 41.2% 303,086 17.1% 20.7% 9. Virginia 329,540 564,239 91.7% 302,285 4.7% 7.9% 10. Maryland 227,916 470,632 106.5% 242,716 4.3% 8.2% 11. Massachusetts 428,729 627,654 46.6% 198,925 6.8% 9.6% 12. New Mexico 765,386 953,403 13% 188,017 42% 46.3% 13. Indiana 214,536 389,707 81.7% 175,171 3.5% 6.0% 14. Oregon 275,314 450,062 63.5% 174,748 8% 11.7% 15. Tennessee 123,838 290,059 134.2% 166,221 2.2% 4.6% 16. Oklahoma 179,304 332,007 85.2% 152,703 5.2% 8.9% 17. Connecticut 320,323 479,087 49.6% 158,764 9.4% 13.4% 18. Utah 201,559 358,340 77.8% 156,781 9% 13% 19. Wisconsin 192,921 336,056 74.2% 143,134 3.6% 5.9% 20. South Carolina 95,076 235,682 147.9% 140,606 2.4% 5.1% SOURCE U.S. Census COMMENT Portada took Census 2010 data and ranked the top 20 Hispanic markets, outside of the top 5 CA, NY, TX, FL and IL, by Hispanic population growth. According to the table, Arizona, despite its immigration laws, is the clear leader with almost 600,000 more Hispanics counted between 2000 and 2010. It is followed by New Jersey, North Carolina and Georgia. These 3 states registered a growth of more than 400,000 Hispanics.They are fol- lowed by Pennsylvania, Nevada, Washington State and Colorado. 14 | Q4 2011 | www.portada-online.com

- 15. EMERGING HISPANIC MARKETS EDUCATION PROCESS Going forward, a substantial part of the growth of the Hispanic advertising and media market is going to be in Emerging Hispanic Markets. As LER’s Phillip Woodie says, “it’s a continuing education process and a story which has to be told at the client level as well as through the agency planning, account and buying teams. The challenge is keeping the emerging markets front and center in the client’s and agency’s mind and to continue to emphasize the amaz- ing transformation and growth these emerging markets are experiencing.” Woodie adds that “for the longest time, the emphasis has been on the top 15 Hispanic markets. Now, with clients wanting and needing to grow their business and their market share, they are realizing the huge potential emerging markets offer. “ Woodie con- cludes with an example: “If an adver- tiser is doing business in Salt Lake City and they haven’t allocated a portion of their budget to reach out to the Salt Lake City Hispanic community, then their competition will. Their competi- tion will cultivate the Hispanic con- sumer for long into the future. And as we all know, first one in wins.”. www.portada-online.com | Q4 2011 | 15

- 16. YOUR WEEK AT PORTADA-ONLINE.COM site to provide You the best conten t available about the Latin We recently introduced a new web kets. These are its main features: Advertising, Media and Content Mar IMPROVED NAVIGATION > WEDNESDAY You will be able to find Portada Regular Features by clicking on each feature on the left navigation bar (below of Special Interest button). In addition, the expandable Channels button, also on the left navigation bar, displays thousands of articles categorized in Hispanic centric con- ANALYSIS tent, Finance current and past issues as well as channels covering An important topic facing the Hispanic advertising and media in- different media types. dustry and what it means for marketers targeting Hispanics. MORE INTERACTIVE TOOLS Interact with your peers and give Portada's editorial team feedback through the following interactive tools: Comment on Article, Share PODCASTS Articles through e-mail, Linkedin, Twitter and Facebook and RSS Feed. (Alternating with Analysis) Portada's Interview with a leading player who sets and/or spots trends in our dynamic industry. (Coming soon). > THURSDAY IN-DEPTH SECTION Six feature articles in this section, provide an in-depth look at spe- cific aspects of the Latin Marketing, Advertising, Content and Media industries. NEW RESEARCH New research and statistics on how to reach Hispanic consumers, THE WEEK AT PORTADA-ONLINE.COM market intelligence, advertiser rankings, media rankings and more. On a daily basis, You will get breaking news and commentary. In THE LATIN INTERACTIVE addition, the following regular features will be offered each week: WORLD > MONDAY Digital technologies are making the Spanish-speaking world (U.S. Hispanic, Latin America, and Spain) smaller. An in-depth look at how marketers are using the digital medium nationally and inter- SALES LEADS nationally to attract Spanish-speakers worldwide. New leads and intelligence about activity of Ad Agencies and > FRIDAY National Advertisers. Market intelligence to help agencies and media executives to reach clients. SOUNDING OFF CHANGING PLACES Thought leadership. A platform for industry experts to explain cer- tain trends and innovations and their value to the marketplace. Personnel changes. What positions are changing, which new ones are being created? WEEKLY POLL THREE TYPES OF ACCESS Portada provides three types of online access (Coming soon). 1. Free content available on portada-online.com > TUESDAY 2. Content that requires registration BEST PRACTICES Registered users can get any Portada's e-newsletters, the quar- terly magazine, and/or participate in polls and provide com- MARKETING TO HISPANICS ments to articles. Registering on Portada-online.com does not grant free access to premium content. Read how and why top marketers reach the Hispanic consumer. The latest trends and qualitative and quantitative insights in tradi- 3. Premium (paid) content tional and below the line marketing. Case studies. Includes: > Premium individual articles (available for individual purchase BUYER/INTERVIEW (alternating with Best Practices). or through a subscription) An interview with an important Marketer or Buyer at an Agency/ > Databases of Corporate Marketers/Media Buyers targeting U.S. Hispanic and/or Latin American Consumers Media Placement firm. > Reports > Conference tickets. PORTADA QUICK HITS A review of interesting and/or important articles/content from around If you have questions and/or to order premium content, the web and what we have to say about them. please call 1-800-397-5322.

- 17. FINANCING LATIN VENTURES A NEW INVESTMENT BONANZA? ATTRACTIVE SECTORS INCLUDE MOBILE TECHNOLOGIES, LOCAL SEARCH AND ONLINE AD NETWORKS… Good news for entrepreneurs and startups in the Hispanic and Latin American media, advertising and marke- ting services sectors. In the last few months there have been several deals involving small and medium sized companies. Mobile Technologies, Local Search, Digital Advertising Services and Online Ad Networks are getting most of investors' interest. Other sectors with potential for funding include Web-TV, Online and Social Games, and Vertical Social Networking Sites. Below some recent transactions: > BRIABE MEDIA (MOBILE MARKETING) Series A investment of US $2.8million. The series was fund- Venice, California-based Briabe Media, a mobile marketing ed by Seavest Inc, ff Venture and Contour Ventures. Voxy firm targeting Hispanic, African, and Asian American con- belongs to a group of companies, which includes Edioma, sumers, last spring raised more than US $2 million in fund- who provide different offerings to the Hispanic demographic, ing from Stochasto Holdings AS of Norway. According to mostly through the mobile phone. Voxy just launched an Briabe, the funding also includes a joint venture between the iPhone app which teaches English to Portuguese users (thus company and Stochasto Holdings AS. far all its offerings have been English to Spanish users).”We believe that in many developing markets people will be > HIPCRICKET (MOBILE ADVERTISING) leapfrogging browser-based applications in favor of mobile In August mobile ad network Hipcricket, which also has a devices,” said Voxy founder Paul Gollash. Hispanic mobile ad network, was acquired for US $44.5 million by New York City based mobile marketing company > BATANGA ACQUIRES I-NETWORK AND AD-FUNKY Augme Technologies. (ONLINE AD NETWORK) In early June online ad network Batanga bought Latin > VOXY (MOBILE LANGUAGE LEARNING SERVICE) American online media companies Adfunky and I-Network Voxy, a language-learning service that turns real-world con- in two distinct and separate transactions. With the acquisi- tent into personalized language lessons, announced a new www.portada-online.com | Q4 2011 | 17

- 18. FINANCING LATIN VENTURES tions of Bogota, Colombia, based I-Network and Buenos WHY INVESTMENT DOLLARS Aires, Argentina, headquartered Adfunky, Batanga Network MAY CONTINUE POURING IN significantly increases its audience, publishing partners and sales organization. GroupArgent represented Adfunky and I- > GLOBAL LATIN AUDIENCES Network in this transaction and acted as their exclusive finan- Due to the expansion of interactive-digital-technologies, media companies and content producers worldwide can reach Latin cial advisor. The details of the transactions were not disclosed. audiences regardless of where these audiences are based. The I-Network business led by Juan Carlos Samper, will con- This facilitates media and marketing companies to realize eco- tinue as is in the region with operations in 14 countries. I- nomies of scale. Network will also continue to represent Microsoft Network properties in Latin America. Juan Carlos Samper who will > THE MOBILE/SMARTPHONE REVOLUTION The smartphone is a new and essential instrument in the day of continue to act as I-Network’s CEO, says that I-Network, the average consumer. The case is even stronger in the together with Batanga’s team, will continue to develop its Hispanic market, because Hispanics over index in mobile Adstars performance advertising unit, which will also enter usage. In addition, Hispanic mobile phone users also over index the Brazilian market soon. Based in Argentina, Adfunky is a in smartphone usage. growing ad network and digital media company. > STRATEGIC BUYERS Industry giants like Mexico’s Televisa and Spain’s Grupo Prisa > DEMAND MEDIA BUYS EMERGING CAST are always on the lookout for ventures that are leaders in spe- (Content Farm) cific niches and/or have know-how of technologies with strong In August Demand Media acquired Emerging Cast, a growth potential. Buenos Aires, Argentina, based company led by Argentinean > INCREASINGLY HOLISTIC MARKET APPROACH entrepreneurs Max Goldenberg and Damián Voltes. With IN THE U.S. the acquisition Demand Media expands into the U.S. Two independent Hispanic research firms (Encuesta Inc and Hispanic and Latin American markets with Spanish-language Garcia Research) recently integrated, in one form or another, content. In fact, it is launched the beta version of eHow with general market firms. clients are looking at the market in Español in August. Demand Media, a public company, is a a more integrated way and are looking for research and adver- tising agencies that provide excellent Hispanic capabilities so-called content farm, a firm that produces content (texts, together with other multicultural and general market skills. images, videos etc.) according to the requirements of users This is driving M&A and financing. searching at search engines. > PROSPECT CAPITAL BUYS MEDIA DIVISION OF ALLOY (Multicultural Print and Out of Home (LeadtoLead) and an online ad network with behavioural Placement Firm) targeting technology (Efficienttarget). MediaResponse is In July the Media Buying Business under Alloy Media + headquartered in Madrid and has additional offices in Marketing was acquired by Prospect Capital Corporation, a Portugal, Brazil, Mexico and Argentina. publicly traded investment company that specializes in mez- zanine finance and private equity investments. Effective > MATOMY-ADPERIO (Online Ad Marketing) immediately, the company will operate under the new name Online ad company Matomy Media Group Inc, previously re:fuel (www.refuelnow.com), with continued focus on print named Adsmarket, acquired US digital advertising compa- media buying, out-of-home and sampling services centered ny Adperio Inc. for US$ 30 million in July. The acquisi- on targeted consumer segments including youth, military, tion will enable Matomy to expand its advertising and mar- multicultural and local audiences, according to President and keting foothold in the US, while giving Adperio’s clients Chief Executive Officer, Andrew T. Sawyer, who previously greater access to European and Latin American markets led the division under Alloy. “Prospect invested $32 million where Matomy operates. This is the second acquisition by in the media buying units of Alloy Media + Marketing,” Matomy, after acquiring Mexican advertising firm Ergos Greg Anthony, SVP Sales of re:fuel told Portada. Media in 2010. > VSS FUNDS MEDIARESPONSE (Direct > KNOWLEDGE NETWORKS-GARCIA RESEARCH Response Media) (Research) In 2008, New York and London based media investment In July research firm Knowledge Networks acquired Garcia firm VSS (Veronis, Suhler & Stevensohn) invested US $15 Research Associates (GRA). According to Knowledge million in a group of direct response online marketing firms Networks, with the acquisition of GRA Cada CabezaSM active in Spain and Latin America. The companies included online panel and team of expert researchers, Knowledge e-mail marketer Canalmail and in text contextual advertising Networks has elevated its long-standing commitment to firm HOTWords. The companies have been regrouped under Hispanic consumer research, becoming the leading force for the MediaResponse umbrella. Other firms are SEO/SEM understanding how to capture US $1 trillion in U.S. buying campaign management (Newbriefing); email list brokering power among Spanish-speaking Americans.” . 18 | Q4 2011 | www.portada-online.com

- 20. BEST PRACTICES USING MOBILE COMMUNICATIONS TO REACH HISPANIC CUSTOMERS We conducted an interview with Larry Upton, Founder and President of Edioma, a provider of mobile phone and Internet-based language instruction products designed to help companies communicate more effectively with cus- tomers, employees and partners. Edioma’s clients include 7-Eleven. Portada: How does Edioma teach major brands to learn the Hindi, Urdu, or Arabic as their native language. 7-Eleven chose to Spanish-language and cater to Hispanic customers? work with edioma, as our mobile phone based language instruction Larry Upton: “As you may already know, US Hispanics are the platform represents a cost-effective, scalable, easily-deployed means fastest growing retail customer segment for many large CPG's by which they might educate their counter staff in Spanish language (Consumer Packaged Goods Companies). However, traditional out- greetings, courtesy phrases, and up-sell terminology. We've been of-home marketing programs (e.g., print, broadcast, online) don't working with a number of Chicago-based 7-Eleven locations over effectively target Spanish-dominant consumers. The resulting “lan- the past 14 months and have achieved notable results including: guage differences” often lead to a cross-cultural communications gap: > Over 80% proficiency gains in spoken Spanish > Most 1st generation, Spanish-speaking customers don't read US > Over 23% increase in Hispanic customer satisfaction publications (e.g., USA Today, WSJ, NYT) and often prefer > Over 50% close rates on Spanish language up-sell programs.” Spanish-language programming (e.g., Univision, Telemundo) to traditional broadcast TV. Portada: How do you measure these results? > English speaking service staffs often encounter problems commu- Larry Upton: “As a means to demonstrate ROI for 7-Eleven's nicating and doing business with Spanish speaking customers, not investment, edioma contracted a 3rd party consumer polling group only from a language perspective, but likewise from a lack of “cul- (PMG, San Antonio, previous work with P&G, J&J, etc.) to con- tural understanding,” i.e., the highly familiar, word-of-mouth based duct “customer intercepts” among Spanish-dominant 7-Eleven cus- reference shared among Hispanics. Typically, the Hispanic con- tomers as they entered/exited 7-Eleven retail locations. This con- sumer enters the US retailer hoping to be greeted, informed, and sumer research group polled nearly 800 customers over a one-year sold to based on a recommendation from a trusted friend/family period, compiled their feedback, and extrapolated the results as member... not simply from an ad touting the virtues of one prod- detailed above.” uct/service over another. > Traditional language training programs (e.g., Rosetta Stone, Portada: You say that English-speaking retail staff has difficul- Berlitz) are often costly and don’t scale well for multi-location, geo- ties in engaging and up-selling in Spanish. Do you mean that graphically disparate retail operations.” the retail staff targeting Hispanic customers should be Spanish- dominant (at least)? If so, why? Cant they bilingual? Portada: How do you try to remedy this? Larry Upton: “No, we do not necessarily believe that US retail staff Larry Upton: “First, targeting US Hispanics with culturally rele- should be “Spanish dominant” before they can adequately service vant, compelling offers over an easily accessible, ever-present plat- Hispanic customers; simply that they should be able to meet, greet, form, their mobile phone. Second, the platform trains US retail thank, and sell products in Spanish.” staffs in how to better engage, service, and sell to Spanish-speaking clients via contextual language instruction (e.g., greetings, courtesy Portada: Can you provide data about the way advertising/partic- phrases, problem-solving). We utilize the “lowest common denomi- ularly direct response advertising should relate to a Spanish-lan- nator” of SMS (text messaging), coupled with embedded IVR (inter- guage sales force? active voice response) and microsite links to deliver mobile market- Larry Upton: “Typical direct response advertising campaigns strive to ing promotions and language instruction content directly to the cus- achieve a 2-3% response rate from target customers. We believe this tomer/ associate's mobile phone. Thus we “connect” the Hispanic should be much higher, particularly for the highly mobile-centric consumer to the retailer by providing a compelling promotion which Hispanic population. We therefore strive to achieve a minimum 6% drives foot traffic to the retailer, then prepares the retailer to actively response rate on our programs, coupled with a 40%-plus “click-thru” engage/up-sell the consumer in Spanish once in-the-door.” rate on retail promotions. However, high direct response rates are only the first half of the equation: if Hispanic customers come into a retail Portada: You work with 7-Eleven can you share and explain the location to take advantage of a compelling offer only to find them- data you got from your work with them? selves unable to communicate with retail staff, the promotion will fall Larry Upton: “7-Eleven recognizes that Hispanics are their fastest on deaf ears (no pun intended). Thus the out-of-home mobile cam- growing consumer segment, representing over 23% of their gross paign needs to be closely tied to an in-house Spanish language training business. However, many of their franchisees are of non-US origins, hence not typically educated in the Spanish language, most speak . program designed to improve the retailers' ability to engage and then actively up-sell the promotion to Hispanic consumers.” 20 | Q4 2011 | www.portada-online.com

- 21. ANALYSIS DO PREPRINTS (FSI’S) WORK BETTER IN SPANISH OR ENGLISH? “EN INGLES O ESPAÑOL?” What major Advertisers do dominant Hispanics. (A Spanish-language newspaper already qualifies its audience as SPANISH LANGUAGE ENGLISH LANGUAGE BILINGUAL mostly Spanish-dominant.) Oscar Castro, Director International E- Lowe's, Home Depot, Target, Sears, OfficeMax, CVS P&G/News America, Best Best Buy, Radio Shack, Commerce at Sears, and responsible for the Buy, Staples, Dish Latino Valassis and News America recently launched Sears.com/espanol site, coupon books, Petco, Smart says that “the target audience for Source magazine, local auto Sears.com/español is Spanish-preferring US dealers, CVS, Toys R’us customers. As a result, we use Spanish lan- guage advertising to let our customers know that they have an online option available to SOURCE Portada Survey NOTE The fact that an advertiser is listed in one of the categories (English,Spanish or bilingual) them. We also work with relevant publica- does not mean they do not advertise in another language. tions, in relevant markets, to ensure that the message is reaching the right people.” It’s an important question for advertisers that she tries to convince advertisers to While direct mailed coupon books target- who reach Hispanics through magazines and insert in Spanish.” It is usually the ideal ing Hispanics tend to be in English, newspapers. Other relevant questions and way because it relays the feeling that the Marketing Services firm Valassis, mails out its answers: What brands advertise in Spanish, advertisers is talking to its audience.” Redplum direct mailed preprint with a bilin- which ones in English? Should FSI’s exclu- However, sometimes for logistic and gual masthead in heavily Hispanic populated sively be in Spanish? If so, does it even make cost reasons FSI’s placed in Spanish-lan- markets such as Southern California, Miami sense to buy English FSI’s? How does this guage newspapers are in English. Is it better and Texas. The company also has the ability relate to in-store signage and customer serv- to insert no FSI’s whatsoever into Hispanic to target sub zip codes that are heavily popu- ice? Portada’s editorial team asked advertisers newspapers or insert English-language lated by Hispanics. Hispanics have moved and media about their experience. ones? “I would recommend to place in towards suburbia over the last ten years. This “Generally we prefer to place FSI’s in Hispanic newspapers even if they are in trend has also favored FSI insertion, as news- Spanish”, says Martha Kruse, Senior English. This is because Hispanic newspa- papers have tended to substantially increase Director of Multicultural Marketing at pers often distribute in areas reaching their distribution through home – delivery Rooms To Go. “While response can’t be Hispanics that are not reached by other (for instance Al Día in Dallas). FSI advertis- measured accurately, common sense says media, Kruse notes. Rooms To Go is ers, generally retailers, prefer to insert in that placing in Spanish-language is a service present in Florida, Georgia, Mississippi, home delivered newspapers for several rea- to our audience”. Anita Grace, president of Tennessee, Texas and the Carolinas. sons: FSI’s can easily fall out of rack distrib- Anita Grace Ad Execs, a firm that sells However, Rooms To Go does use bilingual uted newspapers and will not reach the read- adverti-sing into Hispanic newspapers messaging in preprints that are direct ers homes. Second, the main household deci- including Phoenix La Voz, La Prensa Riverside and Orange County’s Excelsior says mailed, because these mailings are more prone to reach bilingual or even English sion maker, often the housewife, is better reached with a home-delivered newspaper. . www.portada-online.com | Q4 2011 | 21

- 22. ONLINE VIDEO WHAT YOU NEED TO KNOW ABOUT HISPANIC ONLINE VIDEO USAGE Google, Microsoft, Vevo dominate ...and the Spanish dominant segment (Hispanic — All/June 2011)... watches many more minutes (Hispanic - Spanish Primary / June 2011)... TOP CONTENT Total Visits Minutes Unique (Sessions) per TOP CONTENT Total Visits Minutes PROPERTIES Viewers (000) Viewer Unique (Sessions) per (000) PROPERTIES Viewers (000) Viewer (000) Total Internet Hispanic All 26,341 823,150 911.2 Total Internet Hispanic - 5,151 198,188 1,238.1 Google Sites 22,223 340,258 341.9 Spanish Primary VEVO 10,998 68,344 119.2 Google Sites 4,676 81,720 410.4 Microsoft Sites 7,694 35,098 32.8 VEVO 2,486 16,096 136.6 Viacom Digital 7,268 40,878 82.2 Microsoft Sites 1,913 8,140 40.7 FACEBOOK.COM 6,741 21,291 17.6 FACEBOOK.COM 1,677 5,847 22.3 Yahoo! Sites 6,101 23,108 38.9 Viacom Digital 1,355 6,707 76.1 AOL, Inc. 4,955 25,775 47.3 Yahoo! Sites 894 3,284 35.7 Turner Digital 3,563 11,910 26.7 USTREAM.TV 778 6,261 153.3 Hulu 2,743 12,227 152.8 AOL, Inc. 714 3,251 67.3 NBC Universal 2,172 4,419 13.6 Univision Communications Inc 708 2,122 22.2 Justin.tv Sites 685 13,905 466.9 ...Univision.com also makes top ten list among bilinguals (Hispanic - Bilingual / June 2011)... ...but falls out of the top 10 for English- preferred (Hispanic - English Primary / TOP CONTENT Total Unique Visits (Sessions) Minutes per June 2011) PROPERTIES Viewers (000) Viewer (000) TOP CONTENT Total Visits Minutes Unique (Sessions) per PROPERTIES Viewers (000) Viewer Total Internet Hispanic - 7,480 237,197 869.4 (000) Bilingual Total Internet Hispanic - 13,711 387,766 811.2 Google Sites 6,576 110,730 378.6 English Primary VEVO 3,446 21,866 124.2 Google Sites 10,971 147,809 290.7 Viacom Digital 2,233 12,032 79.5 VEVO 5,066 30,383 107.3 Microsoft Sites 2,221 8,949 28.1 Viacom Digital 3,680 22,139 86.2 FACEBOOK.COM 2,051 6,410 16.7 Yahoo! Sites 3,571 14,486 48.5 Yahoo! Sites 1,636 5,338 19.5 Microsoft Sites 3,560 18,009 31.5 AOL, Inc. 1,478 7,045 45.7 FACEBOOK.COM 3,013 9,034 15.7 Turner Digital 927 3,000 28.8 AOL, Inc. 2,763 15,479 42.9 Hulu 775 4,308 195.1 Turner Digital 2,080 7,729 29.8 Univision Communications Inc 740 1,870 23.9 Hulu 1,660 6,859 136.5 SOURCE ComScore NBC Universal 1,433 3,065 16.6 COMMENT > Out of a total universe of 26.4 million unique visitors a relatively small proportion of Spanish primary speakers (5.1 million) watch online video. > Interestingly, if they watch videos online, Spanish-dominant Hispanics spent substantially more time (50% more!) than English — dominant Hispanics watching them.: 1238 minutes per viewer/month, versus 811 minutes per viewer. > While Google and to a lesser extent Vevo dominate both the English dominant and Spanish-dominant spectrums, Microsoft sites are higher ranked in the Spanish primary ranking than n the Bilingual and English Dominant rankings. Univision makes the 9th position among Spanish-dominant Hispanics ranking, 10th for Bilinguals and falls out of the top 10 ranking for English primary and the overall ranking. 22 | Q4 2011 | www.portada-online.com

- 23. ONLINE VIDEO (continued from page 3) What it costs Advertisers TYPE OF CONTENT CPM’s (Cost per thousand impressions) Blakborn, president of Maximum Original Content $25-30 TV. Start up companies like Syndicated Content $16 MaximumTV and ButacaTV are trying User Generated Content (e.g. most of YouTube con- $6 to fill this gap as they are 100% focused on Spanish-speaking U.S. Hispanics. NOTE CPMs Online Video publishers can charge for different types of content on pre-roll online Google’s YouTube, which mostly video advertising provides user generated video content, has been and still is the driver of over- the growing consumption of online the Démoda site, a site promoting style all online video viewership. Digital video has done more to attract brands and fashion for Hispanic women. media veteran Juan José Duran was than any other online ad format.” Currently the partnership is entering its recently hired by YouTube as Strategic The volume of the U.S. Hispanic fourth year. The site is sponsored by Development Partnership Manager for online video advertising market is P&G’s brand Olay during the first six YouTube in the U.S. Hispanic market. much lower, in a big part due to the weeks and then will rotate every six Duran tells Portada that his main aim scarcity of offerings. According to weeks to other P&G beauty brands is to bring Hispanic content into Maximum TV’s Blakburn, “As brand such as Covergirl and Pantene. YouTube through partnerships with all marketers / advertisers start to shift DeModa has a strong brand integration premium content players in the U.S. more and more to true US Hispanic worked through online videos, premi- “While the US Hispanic audience contextual (Spanish language) advertis- um product placement and theme spe- over-indexes on use of internet and ing, two categories will grow signifi- cific blogs. Tapestry Multicultural in mobile, the advertising offering is trail- cantly: online video (professional con- Chicago and MG’s Connected Tissue ing behind. Ad agencies and their tent sites) and mobile advertising unit in NYC worked together with brand customers are constantly looking (including mobile video).” Yahoo!’s team on the project. for online video opportunities to adver- tise to US Hispanics in the right con- CURRENT HISPANIC ONLINE ...PROVIDING MORE text, not just another US commercial VIDEO CAMPAIGNS... TARGETED AND ENGAGED somewhere on a Hispanic site,” Many advertisers targeting AUDIENCES Blakborn says. Maximum TV provides Hispanics are already using online According to Casanova Pendrill’s a Hispanic online TV destination. It video. Right now telecommunication Karen Treydte, “online video gives claims to have the largest TV and video companies (e.g. Verizon, Sprint), car advertisers the ability to target lighter content library, mostly in Spanish companies (e.g.Toyota), insurances TV viewers with video content. The focused on the U.S. Hispanic audi- (Allstate and Farmers) and some con- online space in general provides access ence/population. Its content partners sumer goods companies (P&G) are to video outside of typical television day include Venevision, SUR, Azteca, taking a very active role in creating parts and programming and can engage Caracol, Multimedios, RCN, etc. “ this category. users in a more active fashion (viewers Differently than regular TV adver- may tend to multi-task when viewing GROWTH IN THE GENERAL tising, online video advertising can be television, not the case with online MARKET targeted and measured, much more so viewership). In addition, the combina- In the general market, video adver- than TV advertising, says Karen tion of online video in addition to tele- tising is growing faster than all other Treydte, VP, Director of Media vision can elevate the overall effective- online ad formats, and this year Services, at Casanova Pendrill where ness of both platforms. Hispanics are eMarketer estimates online video will she buys and plans media for brands embracing online video more than their surpass rich media in terms of ad including General Mills and U.S. non-Hispanic counterparts, in part due spending. US online video advertising Army. “We incorporated online video to the fact that content relevant to spending will grow 52.1% to $2.16 both in-banner and pre-roll for Tr3s. them is not prevalent in mainstream billion, up from $1.42 billion last year, They were revamping their program- broadcasting. This behavior provides when the video ad market grew ming line-up and our primary strategy advertisers with an opportunity to 39.6%. By 2015, eMarketer expects was to get examples of the new pro- engage users when and where they the online video advertising market to gramming in front of as many poten- chose to consume video content.” grow to $7.11 billion. According to tial viewers as possible. So, in addition Kevin Conroy from Univision says David Hallerman, an expert of to television/cable, online video was a that Univision sells video advertising research firm eMarketer, “Marketers primary component of the media primarily on a premium CPM basis increasingly see the internet as a place plan,” Treydte notes. both online and on mobile. “We sell where brand advertising, especially in Yahoo-and Procter & Gamble live streaming, pre-roll with tandem ad the form of video advertising, is effec- renewed their agreement for the De units, and clickable video pre-rolls. tive,” said Hallerman. “Combined Moda site (http://espanol.blogs.mujer. Video is by far the most sought after with greater targeting and measure- yahoo.com/de-moda/) in July. In 2009 and most premium of the ‘display’ ad ment than marketers get with TV ads, Yahoo partnered with P&G to launch types in the market today.” . www.portada-online.com | Q4 2011 | 23

- 25. STATISTICS IN CONTEXT Hispanic Parents Beware! Minority Youth Spend 90 Minutes more with New Media than White Youth Minority youth aged 8 to 18 consume an average of 13 hours of media content a day- about 4-1/2 hours more than their white counterparts, according to a Northwestern University report, the first national study to focus exclusively on children’s media use by race and ethnicity. Interestingly, minority youth are especially avid adopters of new media, spending about an hour and a half more each day than White youth using their cell phones, iPods and other mobile devices to watch TV and videos, play games, and listen to music (a total of 3 hours and 7 minutes, or 3:07 in mobile media use among Asians, 2:53 among Hispanics, 2:52 among blacks, and 1:20 among whites). “In the past decade, the gap between minority and white youth’s daily media use has doubled for blacks and quadru- pled for Hispanics,” says Northwestern Professor Ellen Wartella, who directed the study and heads the Center on African-Americans and Hispanics Media and Human Development in the School of Communication. are more likely than Whites to visit “Our study is not meant to blame parents,” says video-sharing sites. Wartella, a longtime Sesame Workshop trustee and Hamad Bin Khalifa Al-Thani Professor in Communication. “We 100% hope to help parents, educators and policymakers better 90% understand how children’s media use may influence health 80% and educational disparities.” 70% 60% 79% 50% 69% OTHER REPORT FINDINGS 40% 30% > Traditional TV viewing remains the most popular 20% 34% of all media -- with black and Hispanic youth con- 10% 25% suming an average of more than three hours of live 0% TV daily (3:23 for blacks, 3:08 for Hispanics, 2:28 White, Non-White for Asians and 2:14 for whites). Non-Hispanic > TV viewing rates are even higher when data on Typical Day Total time-shifting technologies such as TiVo, DVDs, and mobile and online viewing are included. Total daily SOURCE The Pew Research Center’s Internet & American Life television consumption then rises to 5:54 for black Project, April 26 - May 22, 2011 Spring Tracking Survey. n=2,277 adult youth, 5:21 for Hispanics, 4:41 for Asians, and 3:36 internet users ages 18 and older, including 755 cell phone interviews. Interviews were conducted in English and Spanish. for whites. COMMENT A notable and persistent trend is that non-white adult > Black and Hispanic youth are more likely to have internet users have higher rates of video-sharing sites, such as YouTube, Flickr and Vmeo, than their White counterparts, a consis- TV sets in their bedrooms (84% of blacks, 77% of tent finding since 2006, according to a recent report by Pew Hispanics compared to 64% of whites and Asians), Research Center's Internet & American Life Project. Overall, 69% and to have cable and premium channels available in of white internet users said they had visited video-sharing sites, 13 points higher than in April 2009, and more than double the 31% their bedrooms (42% of blacks and 28% of Hispanics reported when the question was first asked in December 2006.2 At compared to 17% of whites and 14% of Asians). the same time, 79% of online non-whites –African-Americans, Hispanics and others– reported using video-sharing sites. That figure is 12 points higher than April 2009, and 41 points higher than > Minority youth eat more meals in front of the TV in 2006. set -- with 78% of black, 67% of Hispanic, 58% of Overall, more online Americans are using video-sharing sites—and white and 55% of Asian 8- to 18-year-olds reporting they are doing so more frequently. As of May 2011, 71% of online that the TV is “usually” on during meals at home. adults reported watching videos on a video-sharing site such as YouTube or Vimeo. A demographic portrait of these site users is in the table below. www.portada-online.com | Q4 2011 | 25