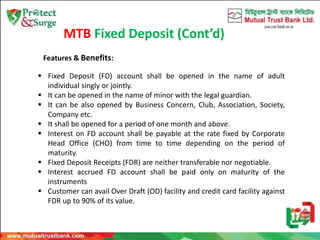

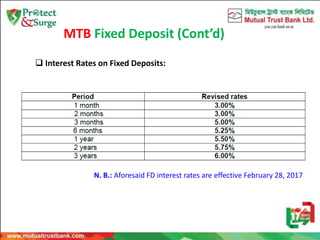

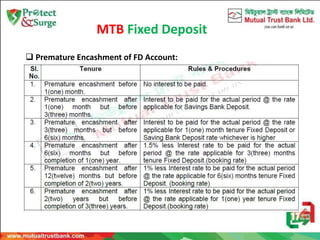

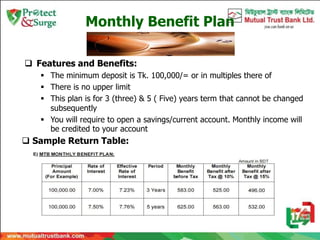

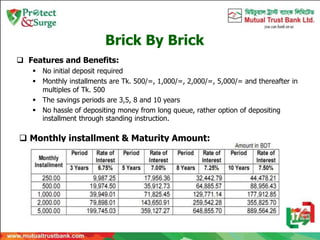

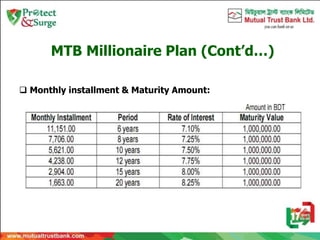

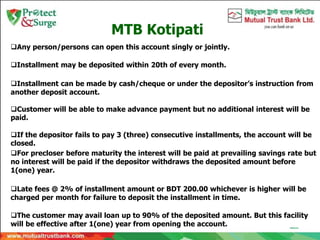

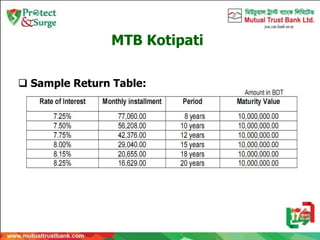

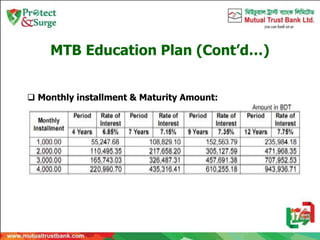

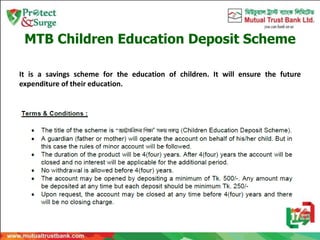

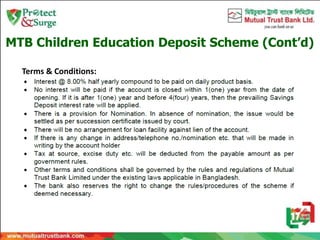

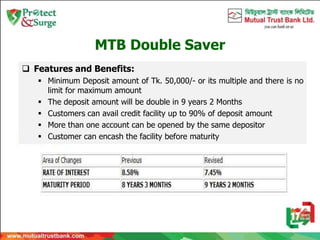

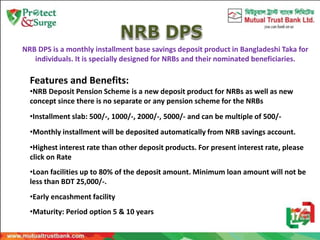

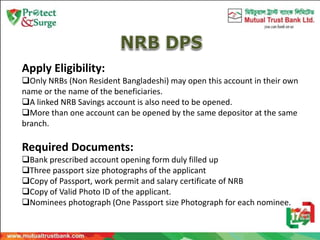

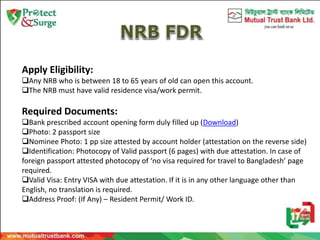

The document outlines various fixed deposit and savings account products offered by MTB, including terms for opening accounts for individuals, minors, businesses, and NGOs. Key features include interest rates, loan facilities, premature encashment options, and minimum deposit requirements, with specific plans targeting education savings and expatriates. Each product is designed with unique benefits such as monthly income plans, double saving opportunities, and linked overdraft facilities.