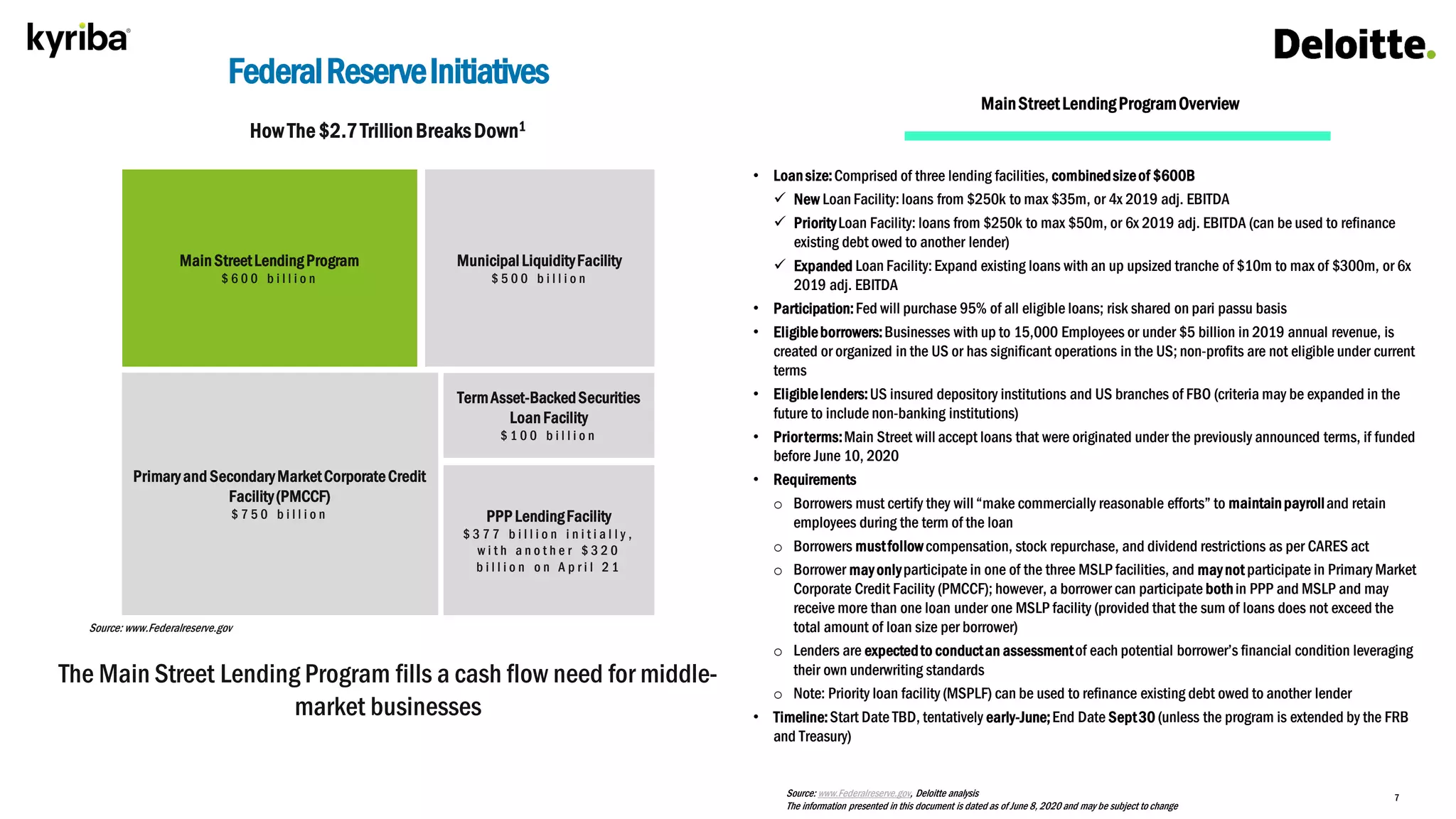

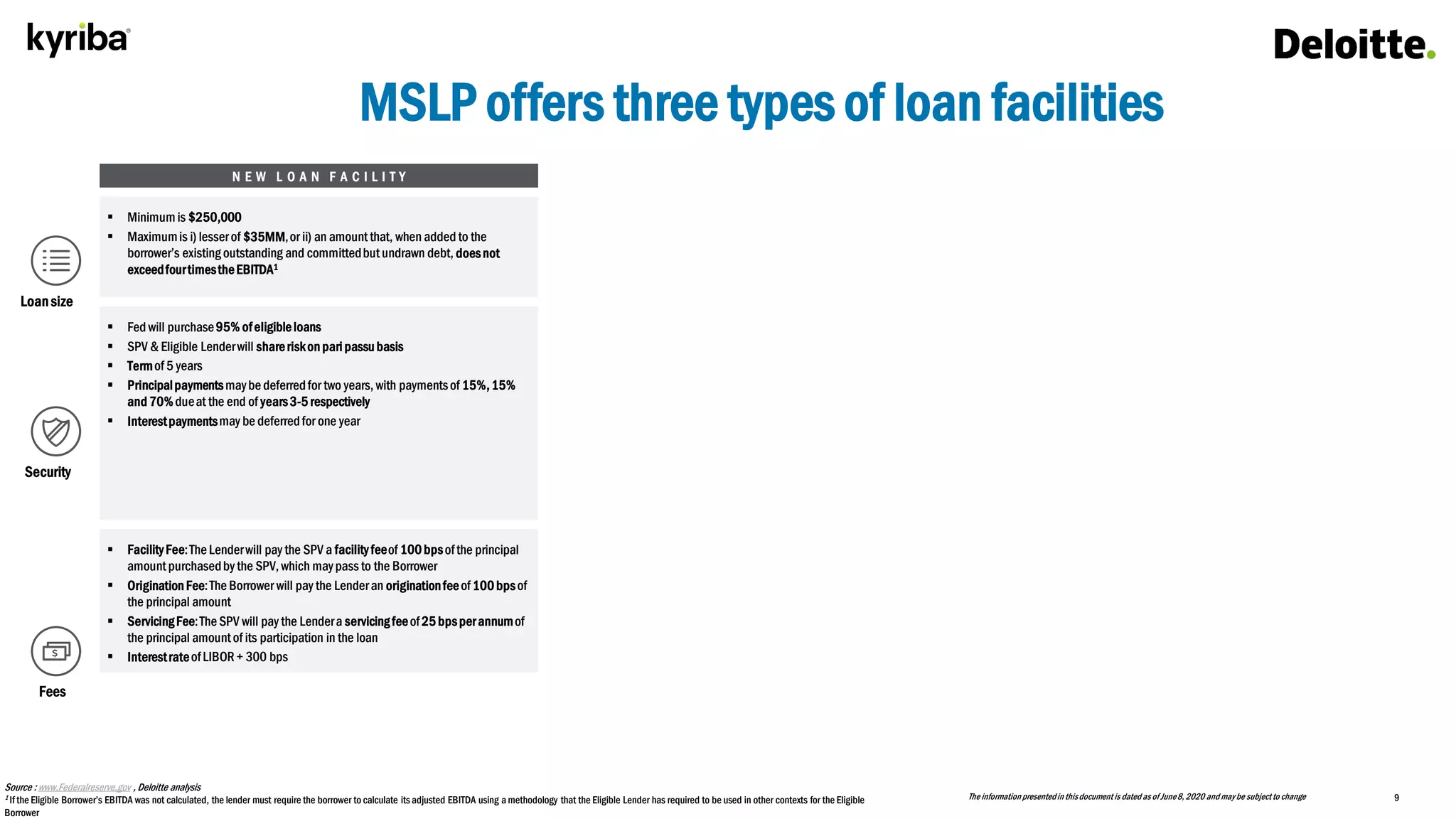

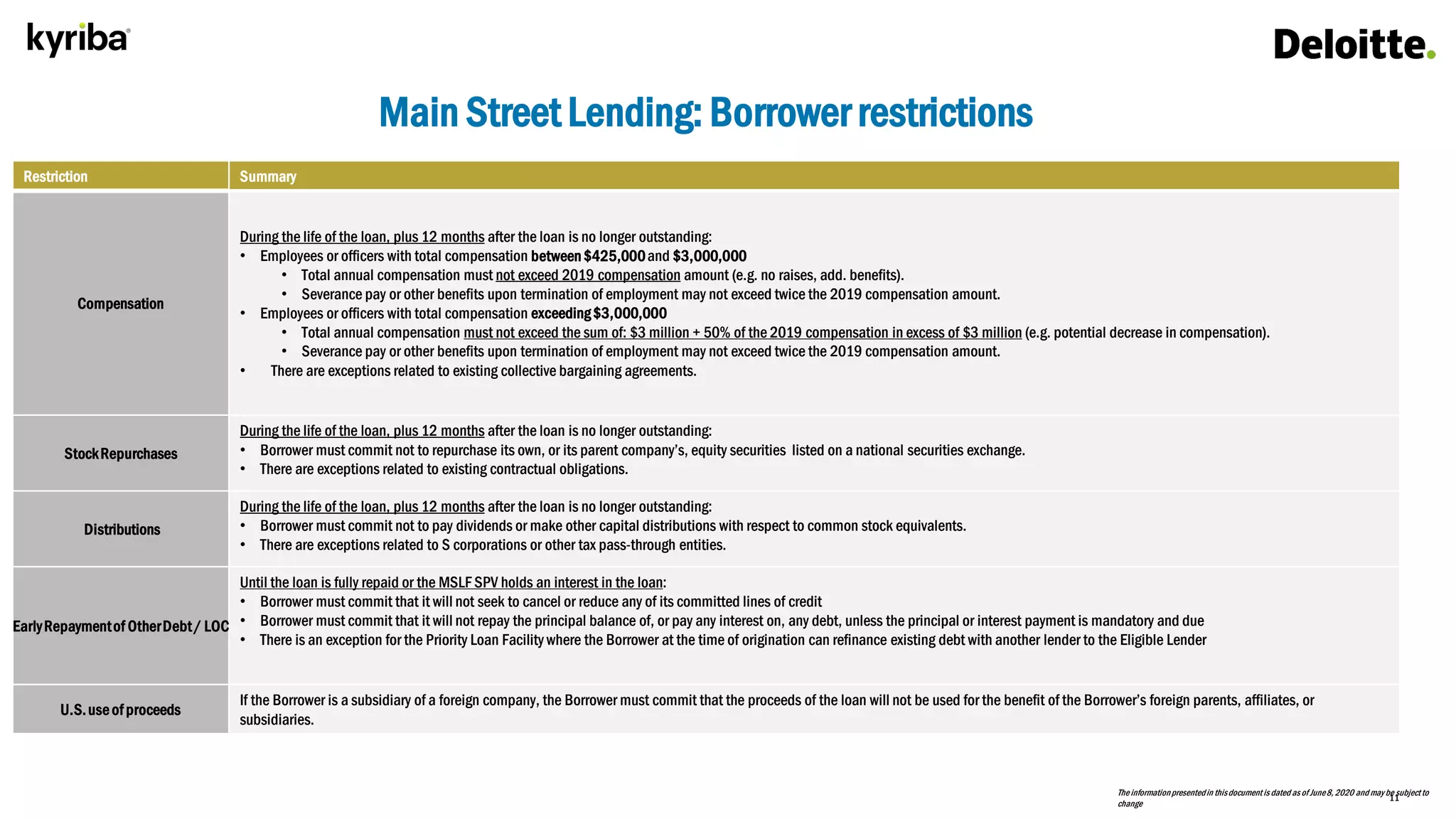

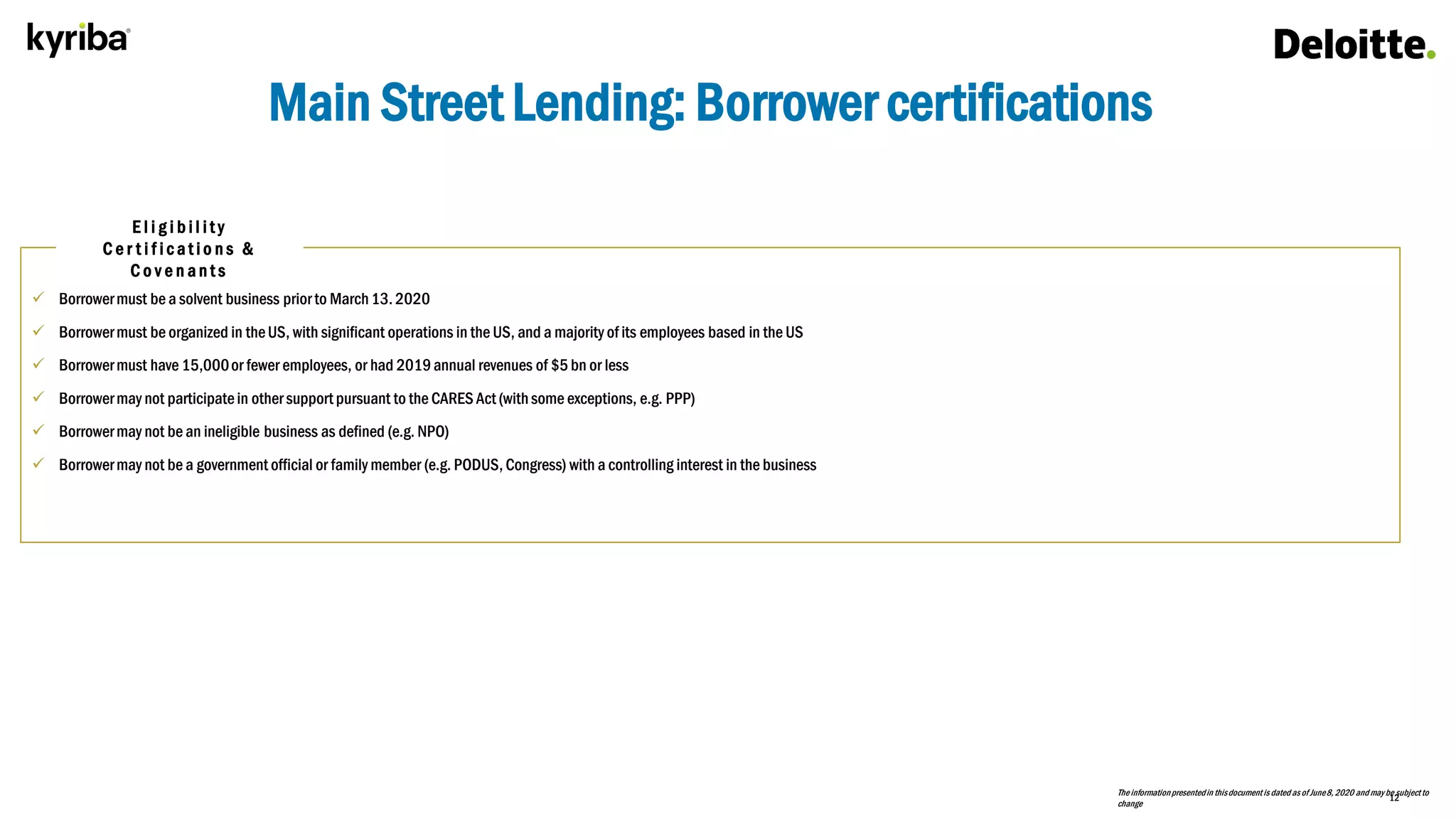

The document summarizes the Main Street Lending Program (MSLP) established by the Federal Reserve to provide support to small and medium-sized businesses during the COVID-19 pandemic. It describes the three types of loans offered through the program - the New Loan Facility, Priority Loan Facility, and Expanded Loan Facility. It provides details on loan sizes, terms, fees, and the role of the Federal Reserve and eligible lenders. It also outlines restrictions on borrower compensation, stock repurchases, dividends, debt repayment, and use of funds to qualify for the program.