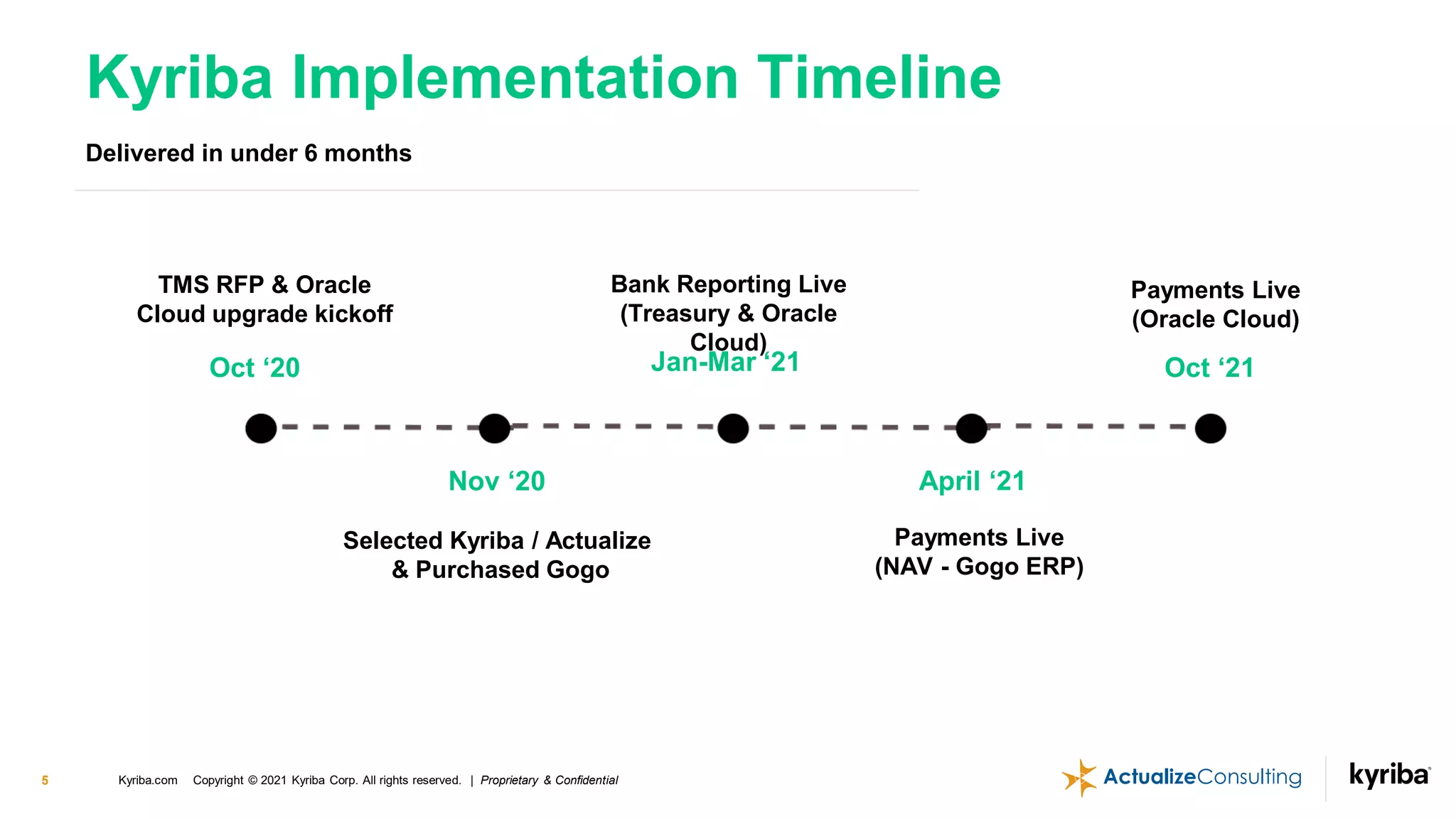

The document discusses the benefits that Intelsat has realized from implementing Kyriba's treasury management system (TMS). It provides an overview of Intelsat, including its size and operations. It then summarizes Intelsat's treasury operations and cash management challenges. The TMS implementation was completed in under 6 months and provided several key benefits: (1) centralized processes and standard reporting across business units; (2) rationalization of workflows for improved controls; and (3) rapid scalability to integrate new acquisitions. Additional benefits included improved cash visibility, payments automation, and fraud prevention controls.