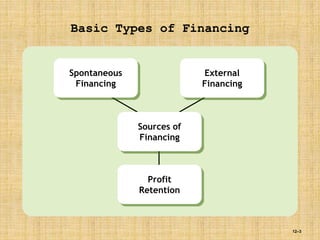

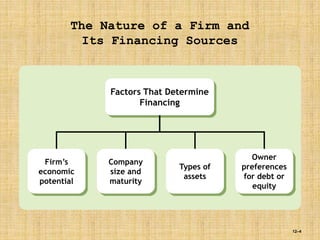

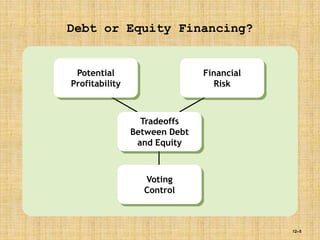

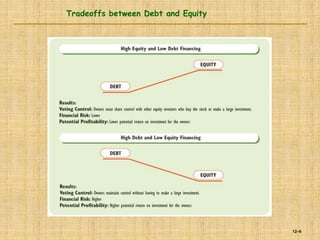

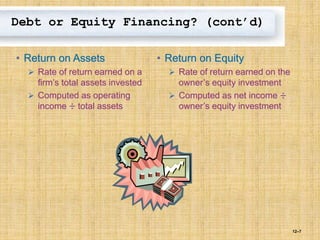

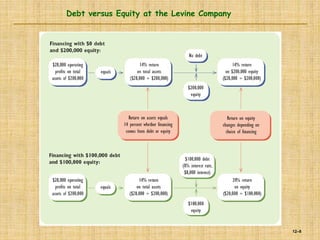

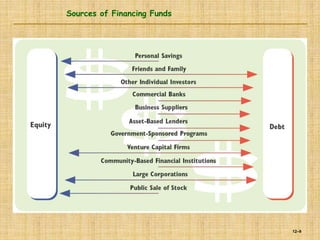

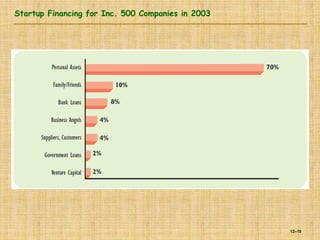

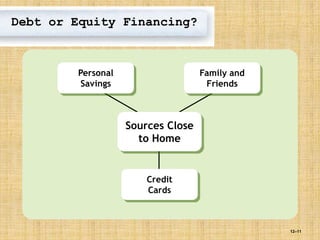

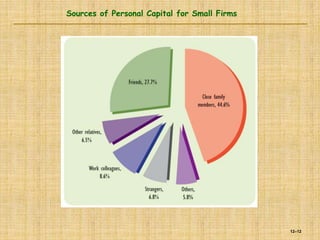

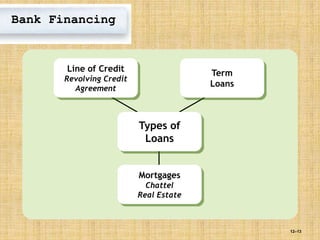

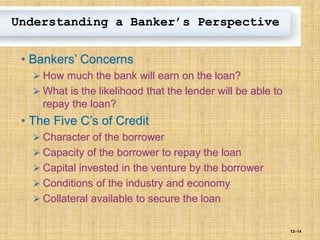

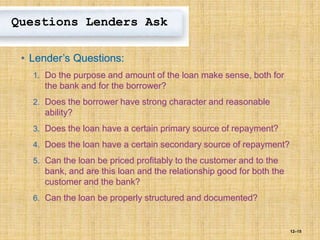

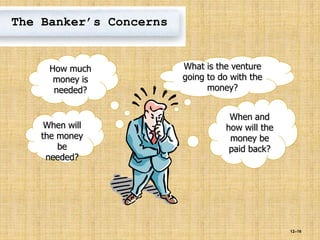

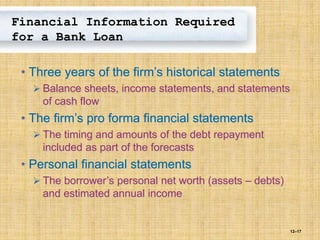

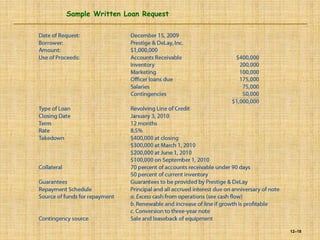

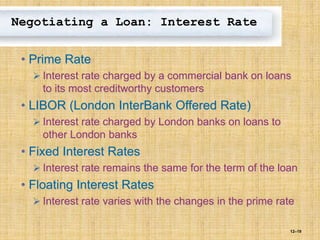

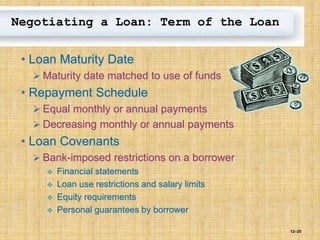

The document discusses various sources and types of financing for small businesses, including debt and equity financing, personal investments, and loans from banks or government programs. It evaluates the trade-offs and considerations for each financing option, emphasizing the importance of understanding a firm's economic potential, asset types, and relationships with lenders. Additionally, it outlines key elements in acquiring loans, such as the requirements for financial statements, negotiation of interest rates, and types of lenders available.