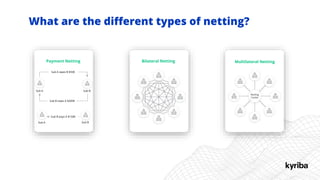

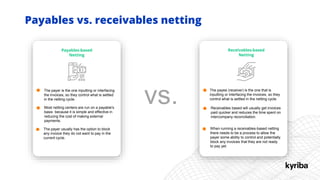

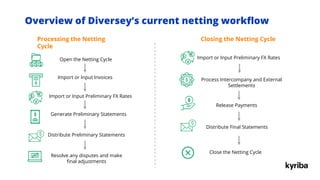

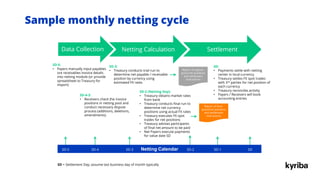

This document provides an overview and discussion of implementing multilateral netting. It begins with an introduction to the different types of netting and the types of organizations that would benefit from multilateral netting. It then discusses the key benefits of multilateral netting such as reduced costs and operational efficiencies. The rest of the document discusses considerations for implementing a netting program such as technology, structure, operations, and key decisions. It provides examples from Diversey's netting process and implementation tips.