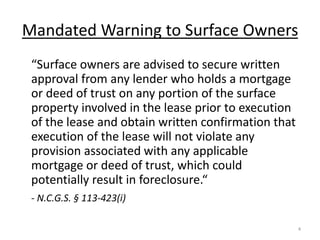

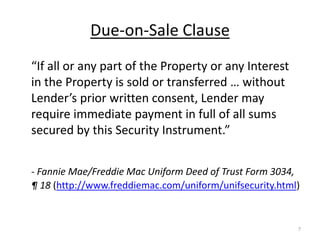

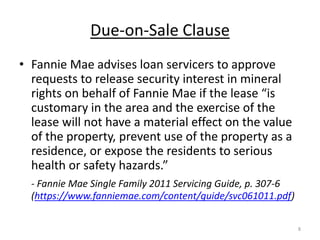

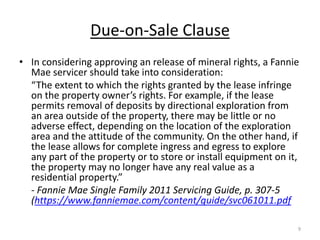

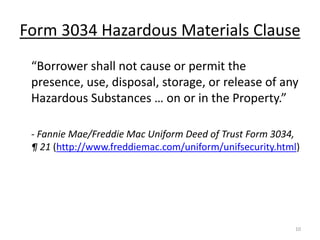

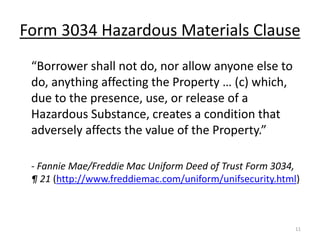

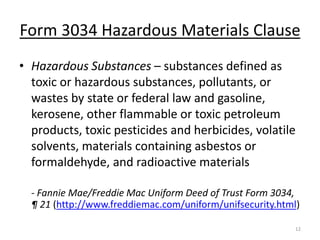

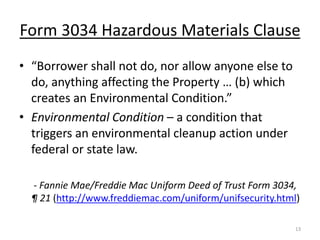

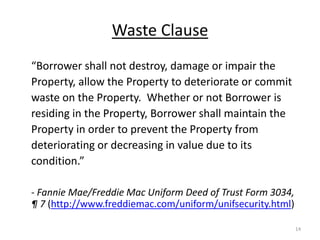

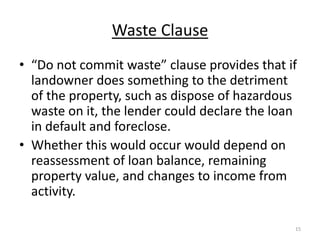

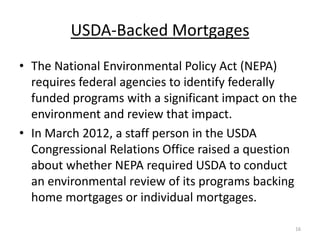

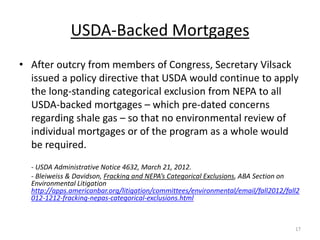

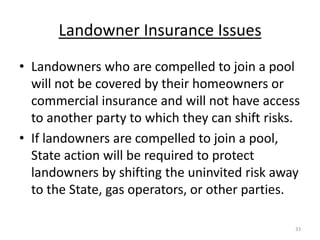

The presentation addresses concerns regarding the impact of compulsory pooling laws on mortgages and insurance for property owners in North Carolina, highlighting potential risks to existing and new mortgages, as well as insurance coverage issues. Key points include the need for mortgage lenders to assess the implications of gas leases on property values and the regulatory uncertainty surrounding environmental liabilities. It also documents how mortgage defaults and asset value decline may affect landowners, particularly those compelled to join pooling agreements.