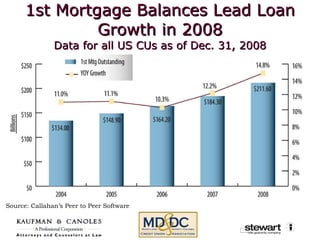

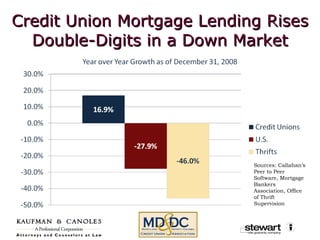

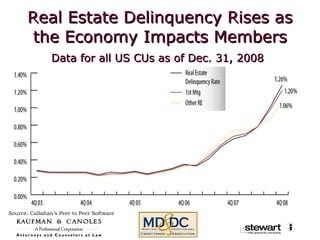

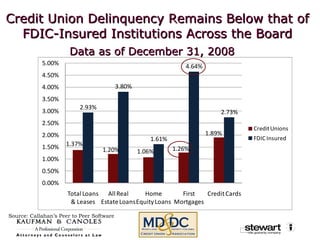

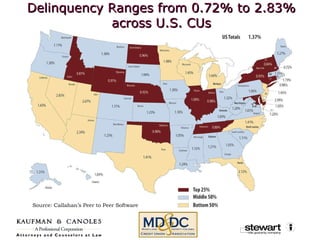

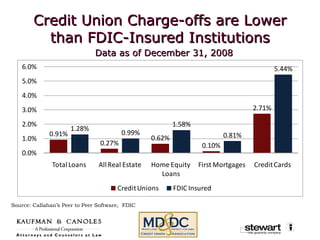

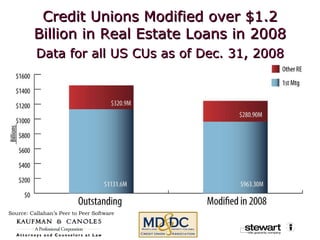

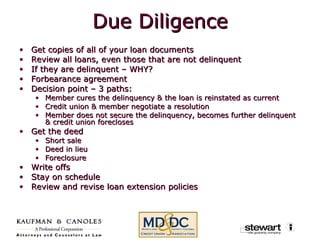

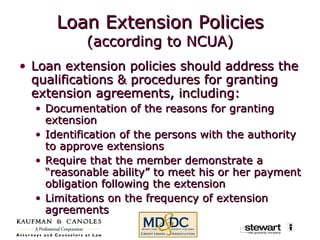

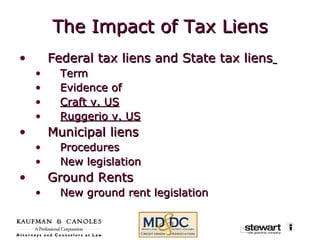

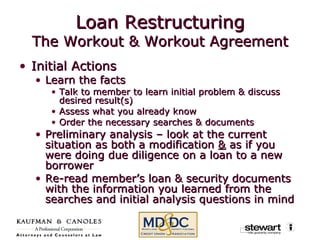

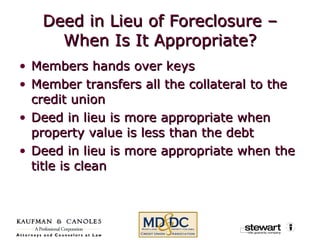

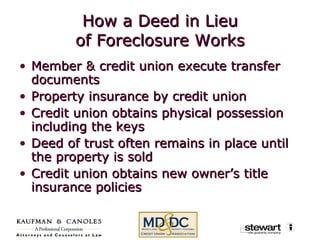

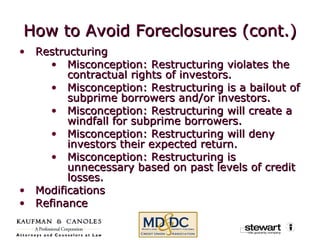

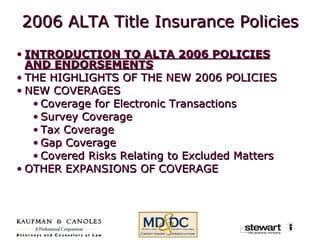

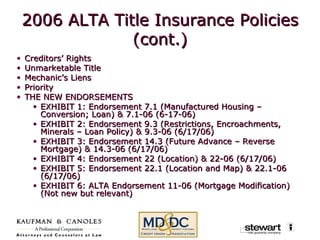

The document outlines strategies for managing a real estate portfolio, covering topics such as due diligence, tax liens, loan modifications, and various alternatives to foreclosure like short sales and deeds in lieu of foreclosure. It emphasizes the importance of comprehensive loan reviews, restructuring options, and the impact of economic conditions on real estate values. Additionally, it highlights the necessity for credit unions to maintain lower delinquency rates compared to traditional banks and the legal considerations involved in various real estate transactions.

![E. Andrew Keeney, Esq. Kaufman & Canoles, P.C. 150 West Main Street, Suite 2100 Norfolk, VA 23510 (757) 624-3153 [email_address] www.kaufmanandcanoles.com Shawn A. Goldfaden, Esq. Stewart Title Guaranty Company 609 Global Way, Suite 122 Linthicum Heights, MD 21090 (410) 789-8400 [email_address] www.stewart.com](https://image.slidesharecdn.com/cdocumentsandsettingsjldavismydocumentsmanagingrealestateportfolio-100426123019-phpapp01/85/Managing-Your-Real-Estate-Portfolio-2-320.jpg)

![1031 EXCHANGES ASSET PRESERVATION, INC. HEADQUARTERS 4160 Douglas Blvd Granite Bay, CA 95746 Toll Free: (800) 282-1031 Phone: (916) 791-5991 Fax: (916) 404-4598 Internet: www.apiexchange.com Email: [email_address] EASTERN REGIONAL OPERATIONS 4062 Grumman Blvd., Bldg. 81A Calverton, NY 11933 Toll Free: (866) 394-1031 Phone: (631) 369-3617 Fax: (631) 614-7954](https://image.slidesharecdn.com/cdocumentsandsettingsjldavismydocumentsmanagingrealestateportfolio-100426123019-phpapp01/85/Managing-Your-Real-Estate-Portfolio-66-320.jpg)

![E. Andrew Keeney, Esq. Kaufman & Canoles, P.C. 150 West Main Street, Suite 2100 Norfolk, VA 23510 (757) 624-3153 [email_address] www.kaufmanandcanoles.com Shawn A. Goldfaden, Esq. Stewart Title Guaranty Company 609 Global Way, Suite 122 Linthicum Heights, MD 21090 (410) 789-8400 [email_address] www.stewart.com](https://image.slidesharecdn.com/cdocumentsandsettingsjldavismydocumentsmanagingrealestateportfolio-100426123019-phpapp01/85/Managing-Your-Real-Estate-Portfolio-78-320.jpg)