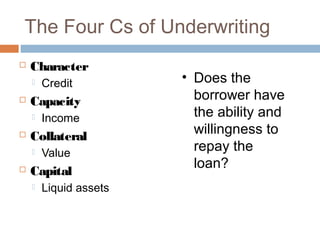

The four Cs of underwriting are:

1. Character - The borrower's credit history

2. Capacity - The borrower's ability to repay based on income

3. Collateral - The value of the property securing the loan

4. Capital - The borrower's available funds, typically a down payment