The document presents information about Bitcoin, including:

- An introduction to cryptocurrency and Bitcoin's origins.

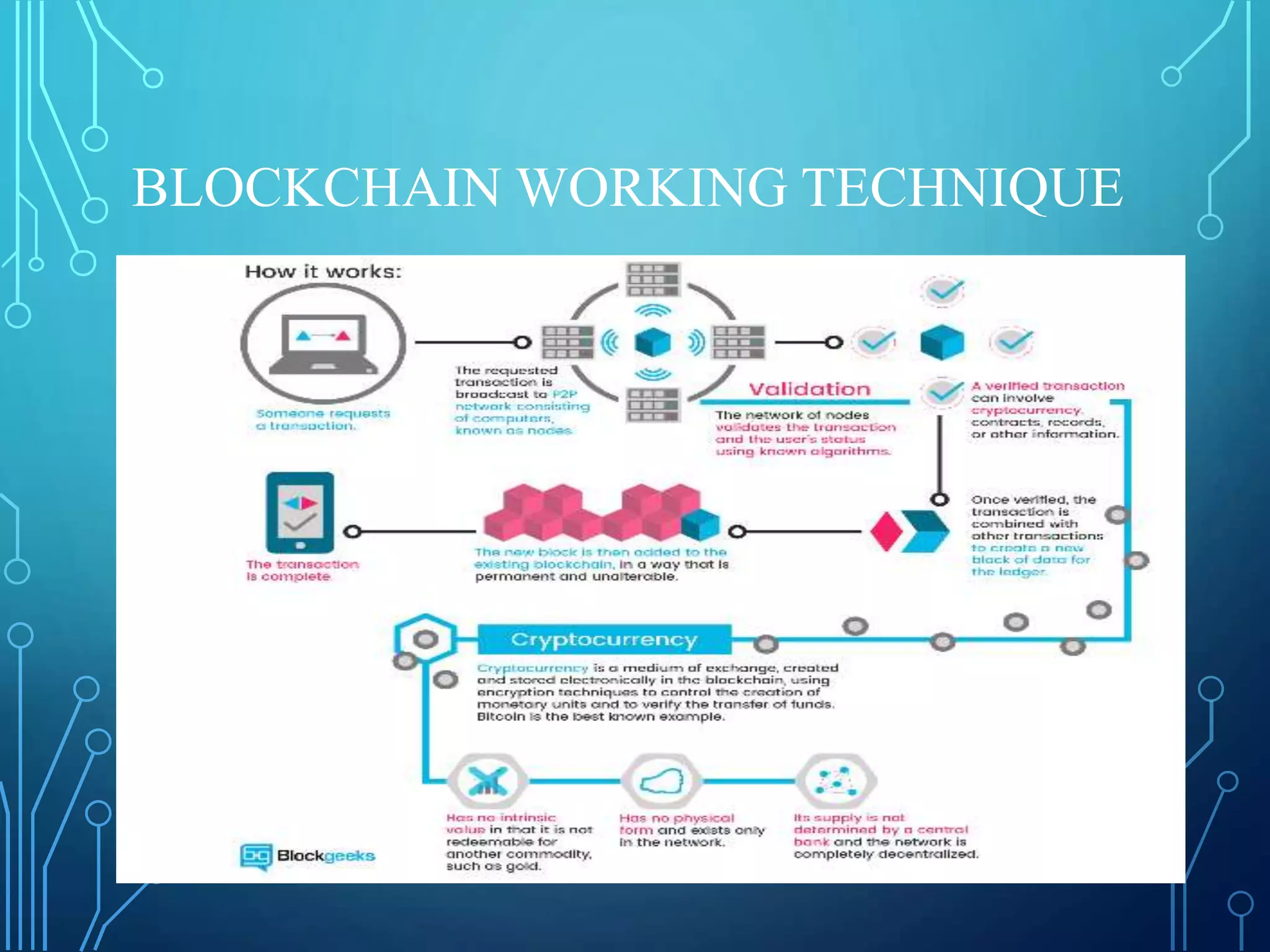

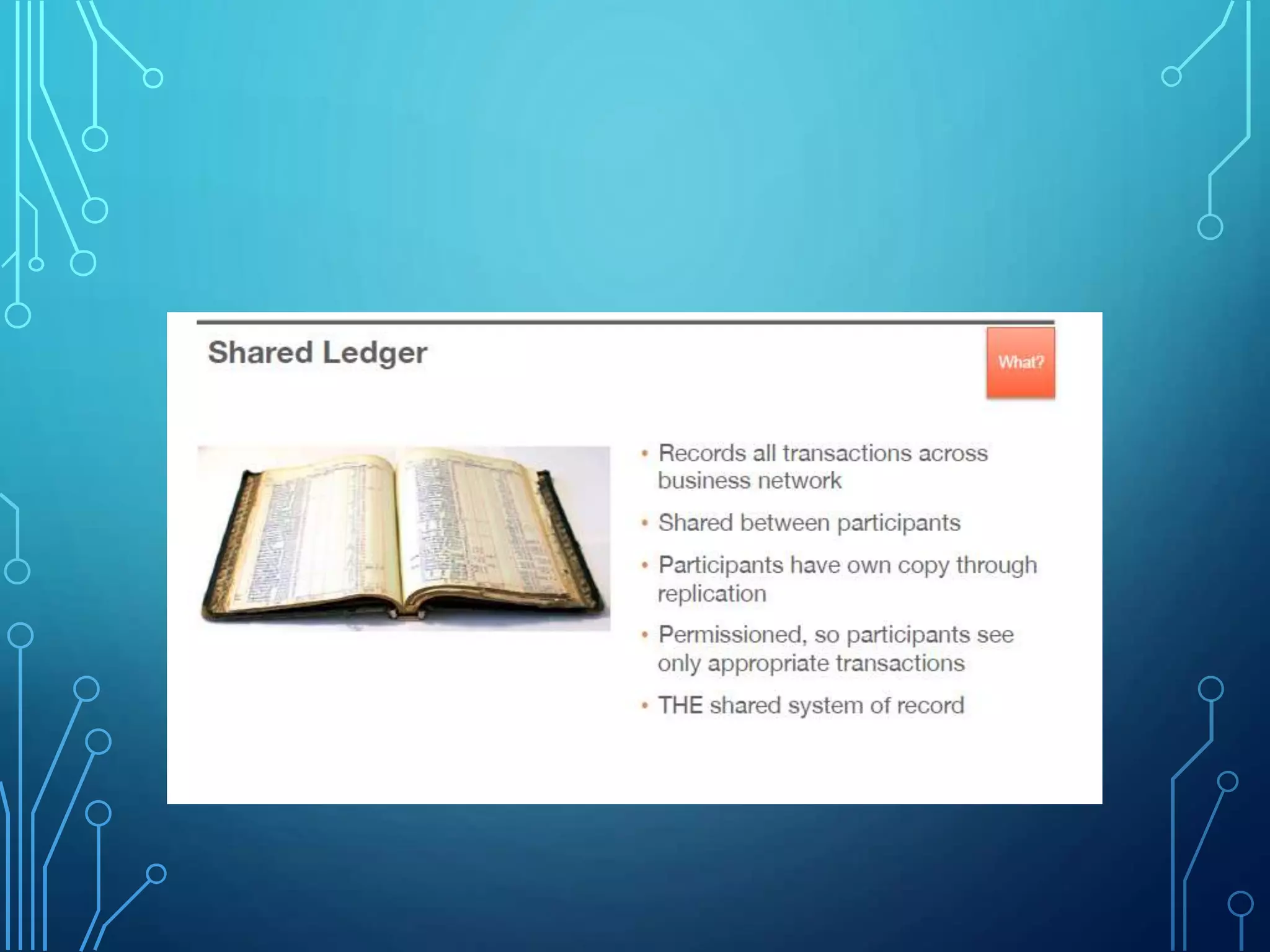

- How the blockchain works and how Bitcoin is mined.

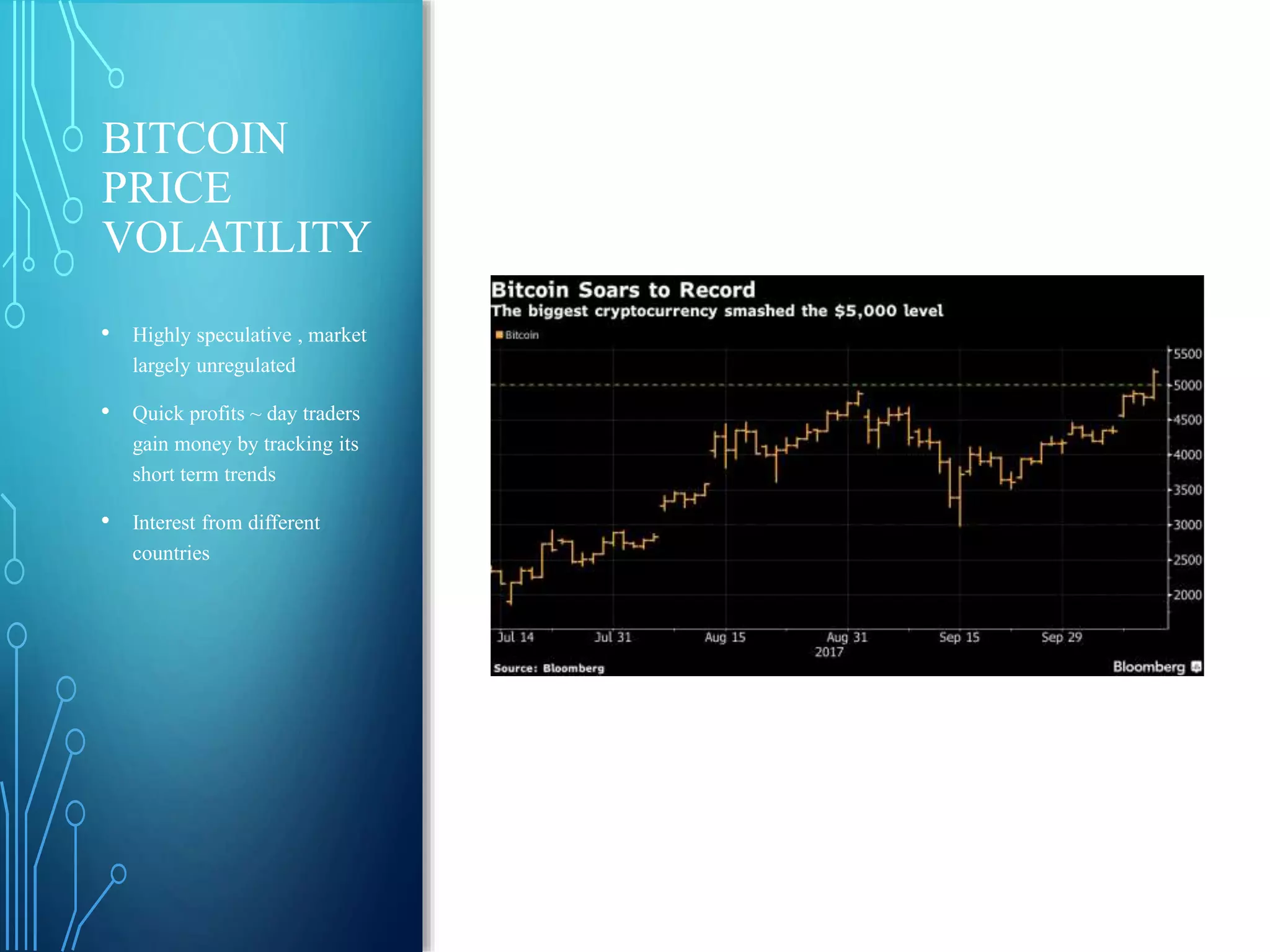

- The high volatility of Bitcoin's price due to speculation and lack of regulation.

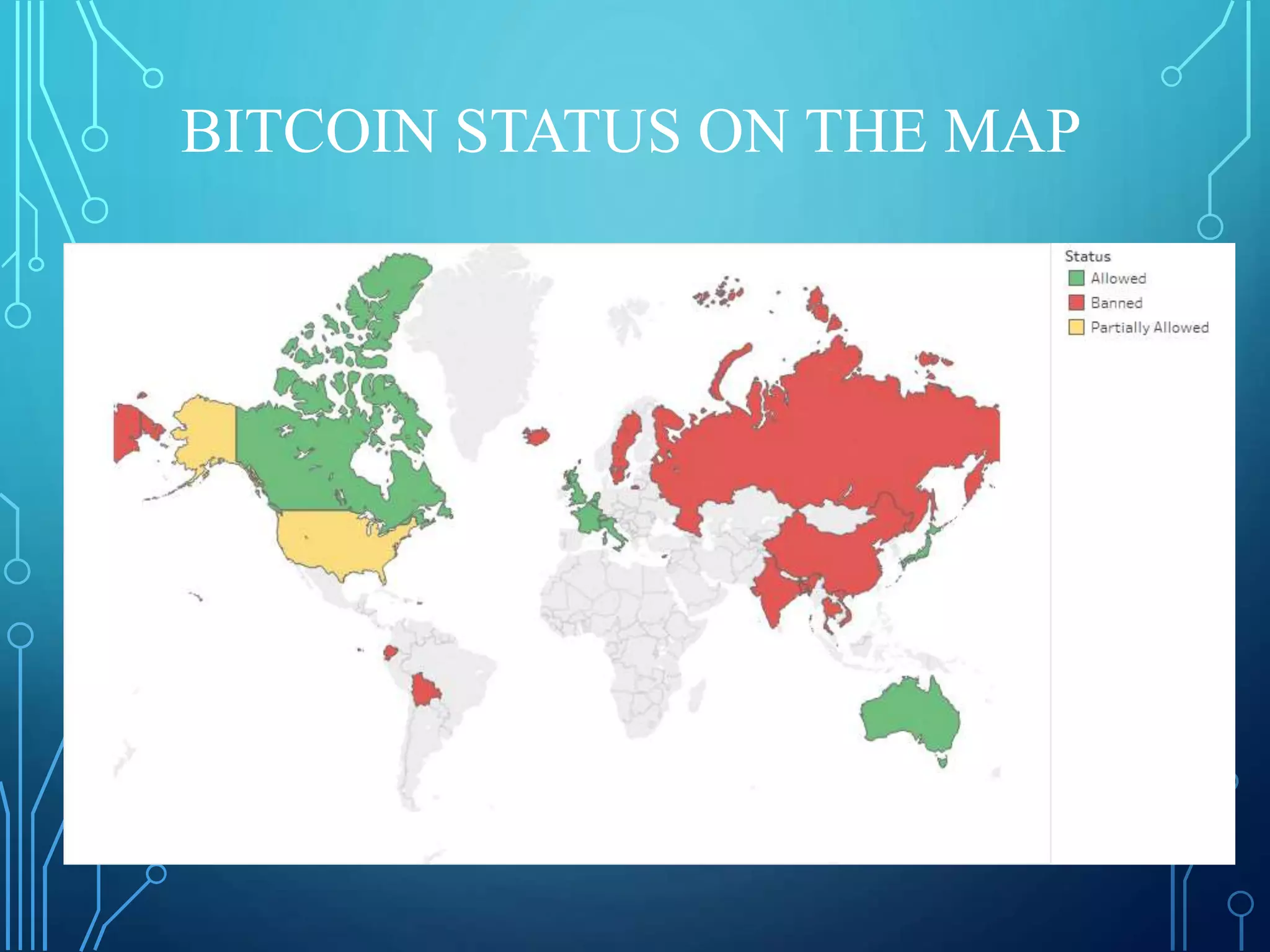

- Different countries' views on Bitcoin, from bans to allowing its use.

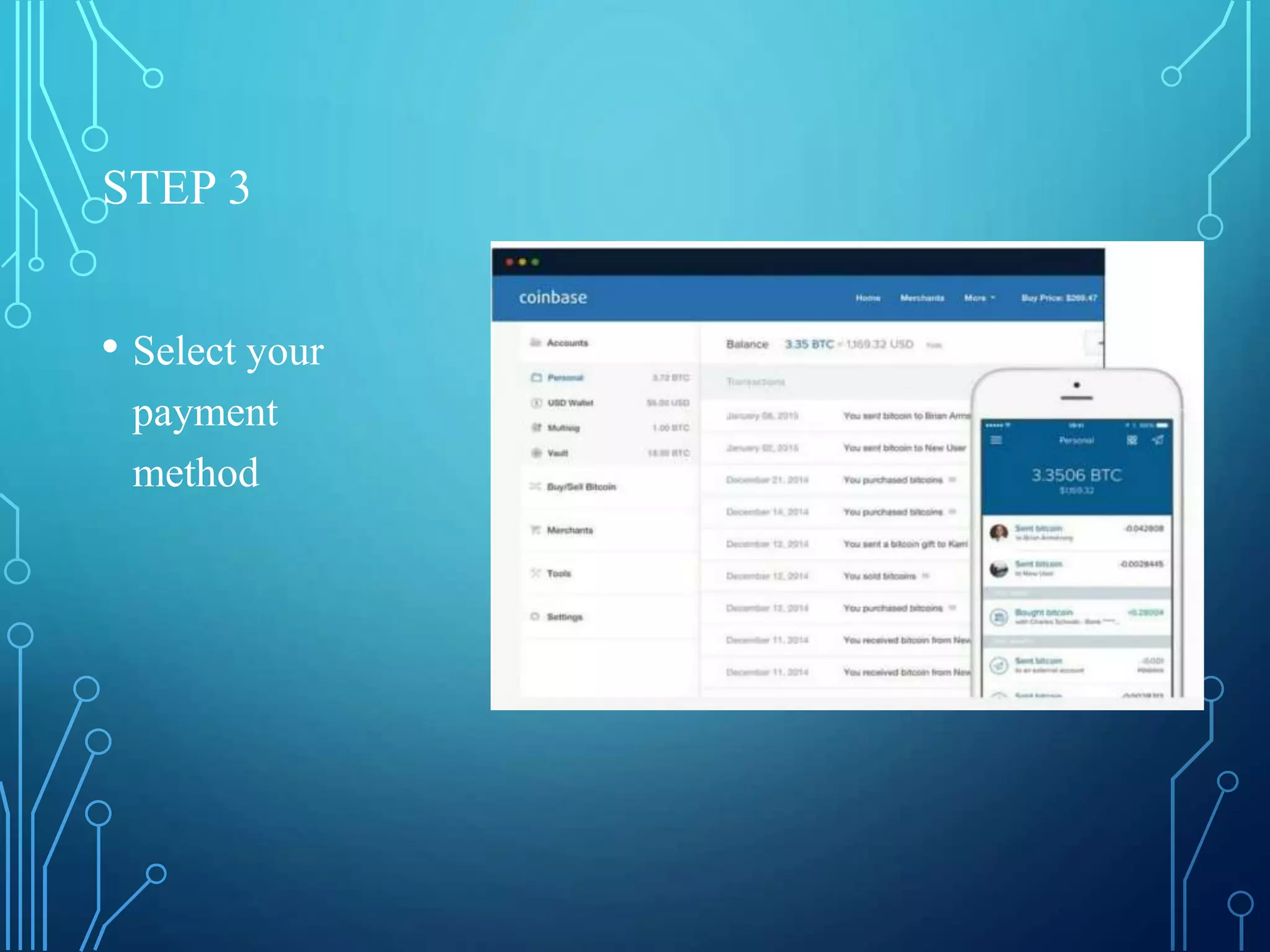

- How to buy and store Bitcoin, and endorsements of it from wealthy individuals.

- Risks like its use in illegal activities and ransomware attacks.

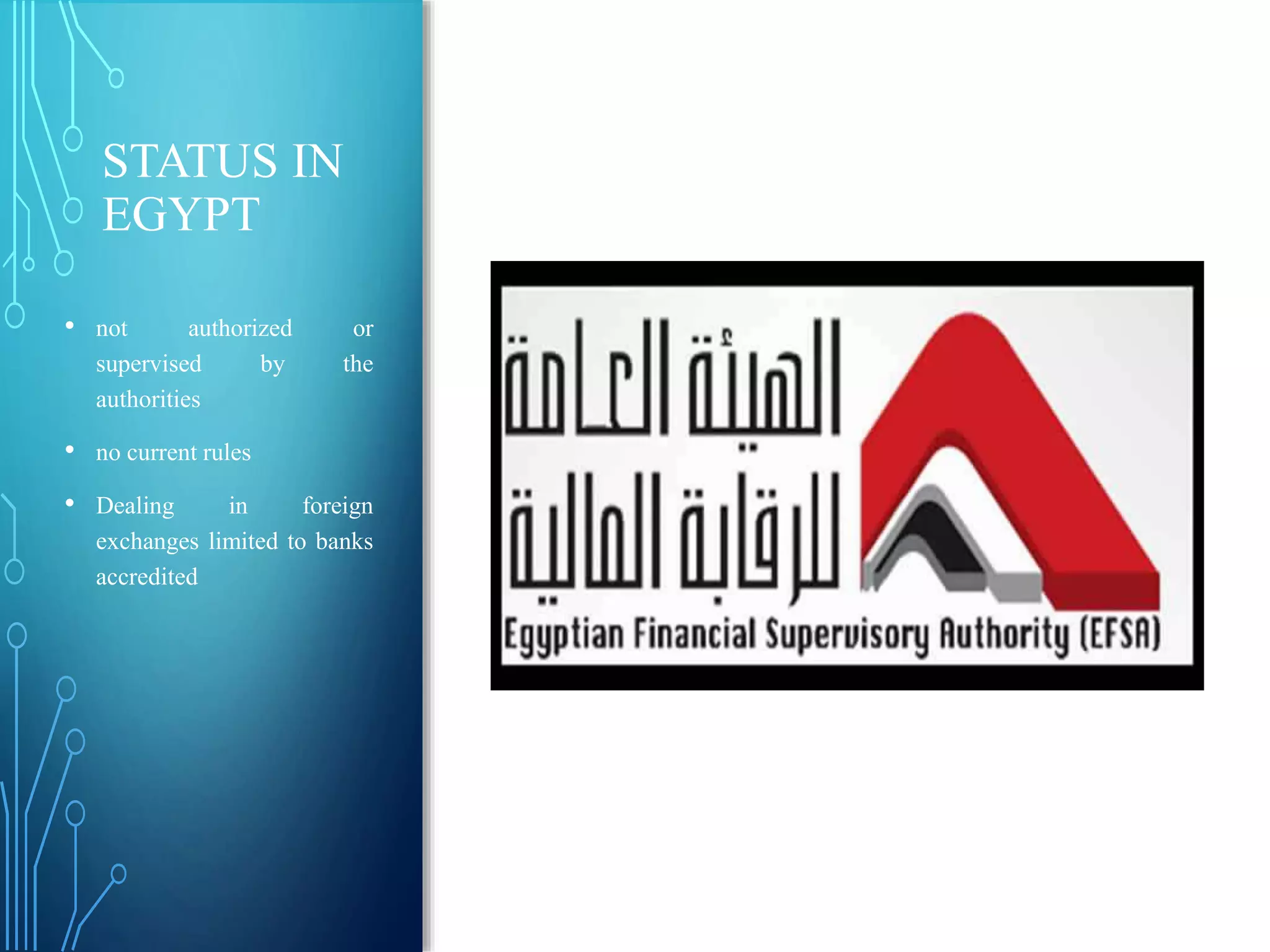

- Existing regulations and agencies that oversee Bitcoin in various countries.

- Suggestions for the future, like treating Bitcoin only as a currency for tax purposes.