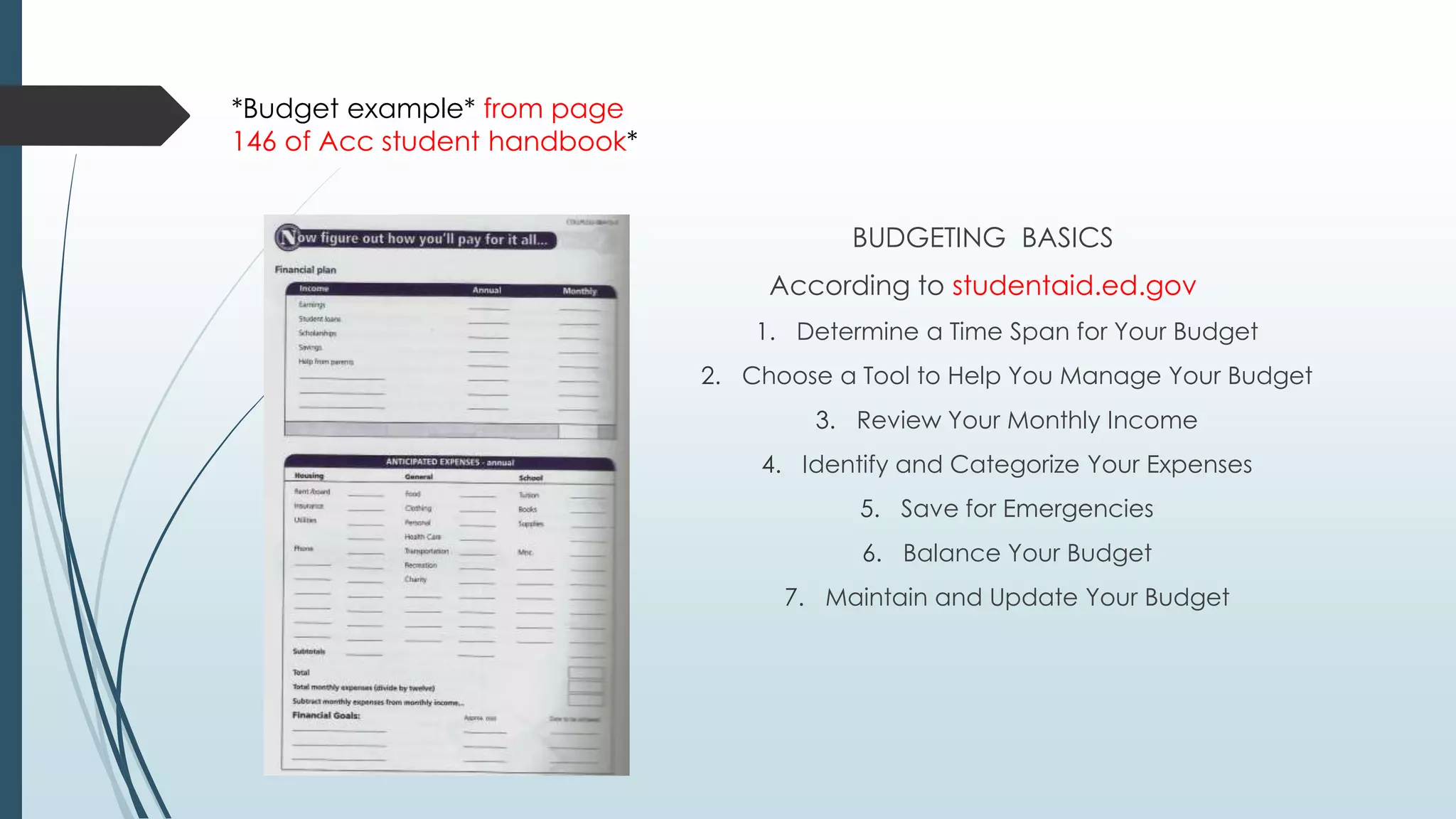

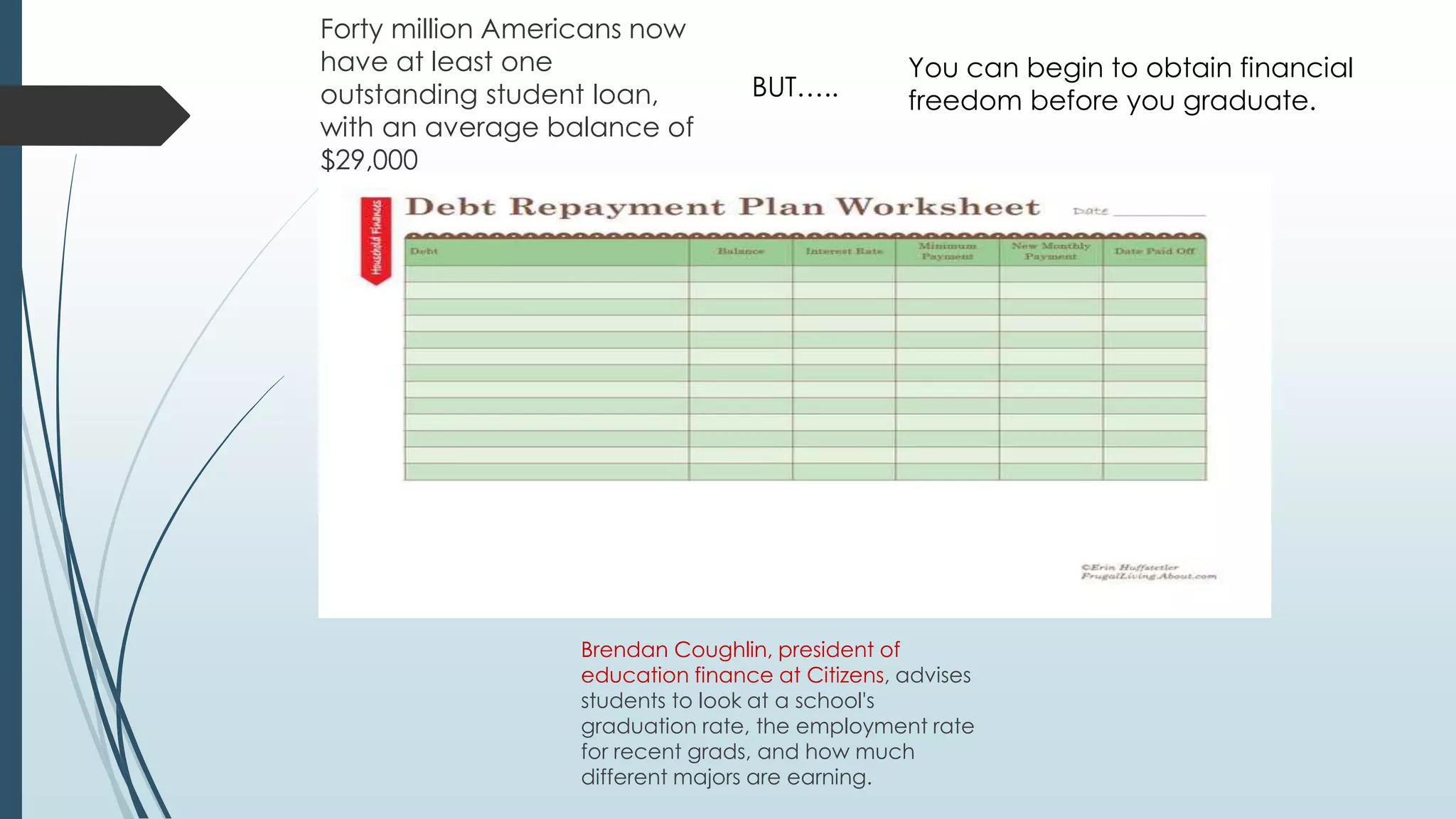

Student loan debt in the US has surpassed $1 trillion and exceeds the total amount of credit card debt. College graduates on average owe $30,000 in student loans upon graduating. The document discusses the importance of budgeting and financial planning in college to avoid debt problems after graduation. It provides tips on budgeting, finding scholarships, and the consequences of defaulting on student loans.