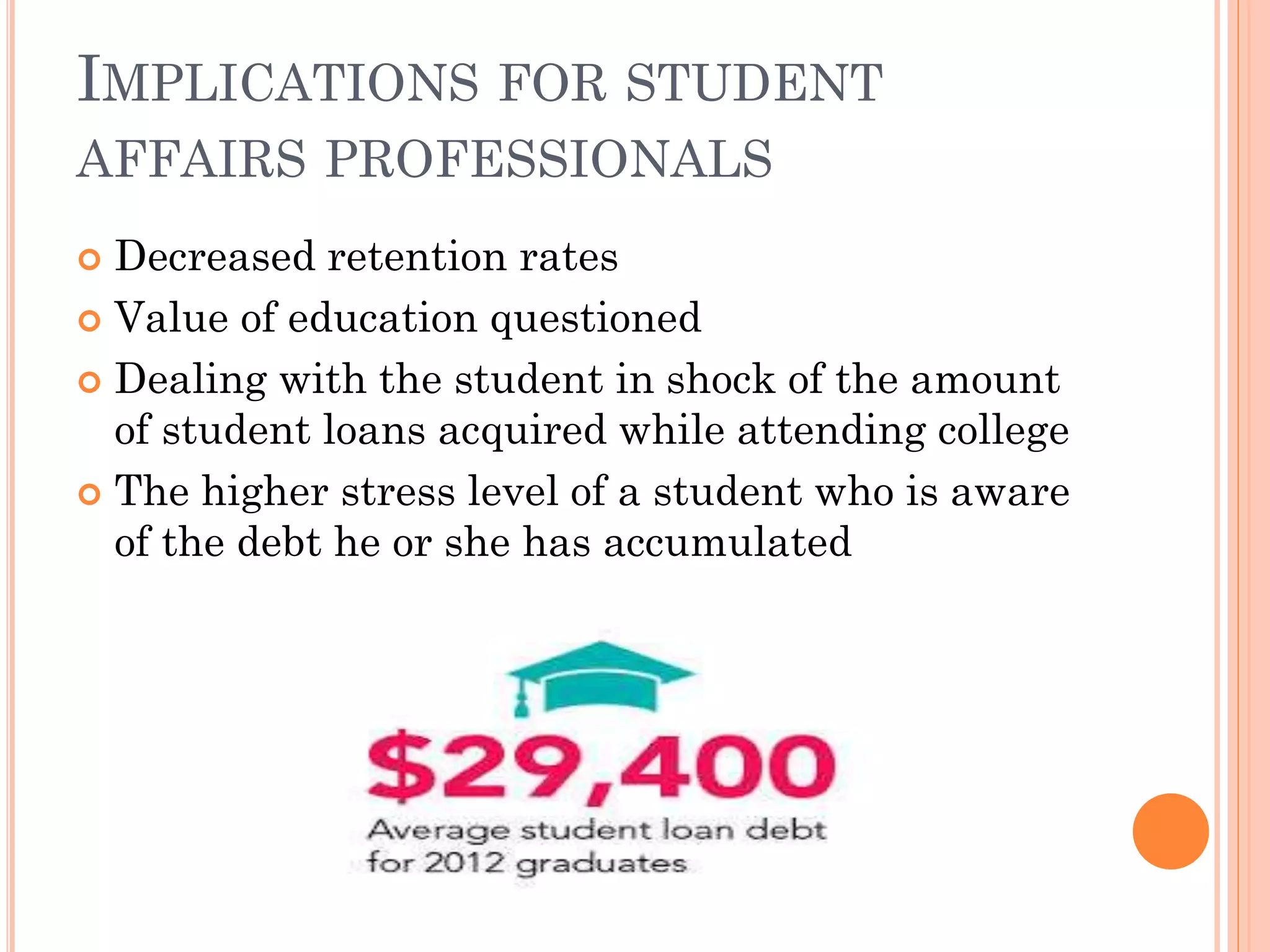

This document discusses student loan debt accumulated by college students. It finds that total student loan debt outstanding is over $800 billion, with average debt between $20,000-$150,000. Interest rates range from 4.5-6.8% and the national default rate is over 8%. The rising cost of tuition is increasing the amount students borrow. This debt burden impacts students' ability to find jobs and make payments after graduation. The document recommends colleges provide specialized student loan offices and mandatory financial literacy education to help students better understand and manage their debt.