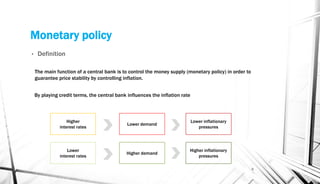

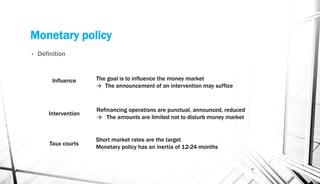

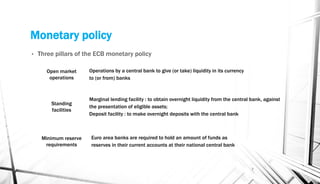

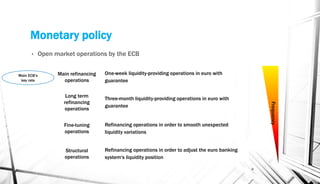

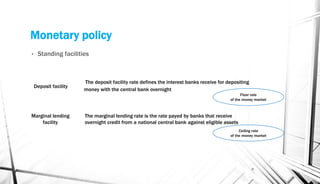

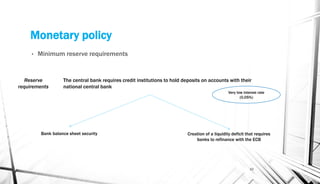

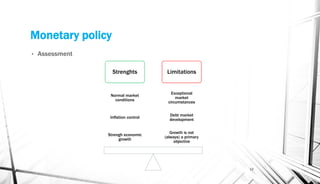

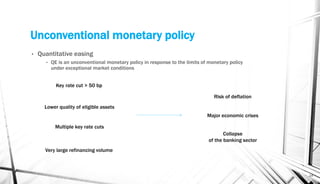

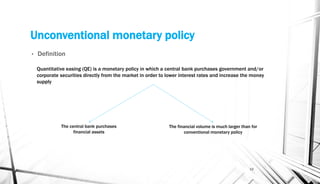

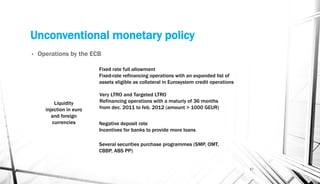

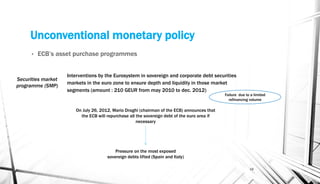

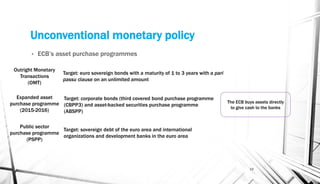

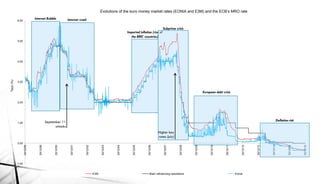

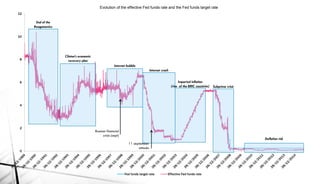

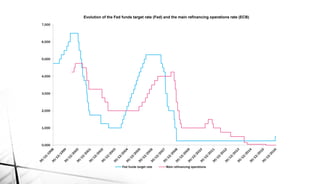

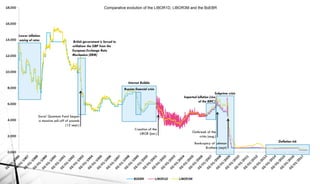

The document provides an overview of monetary policy, detailing the roles and operations of central banks, particularly the European Central Bank (ECB). It explains conventional and unconventional monetary policies, including quantitative easing (QE), and their impact on interest rates, inflation, and economic growth. Strategies for managing liquidity, reserve requirements, and various money market rates across major economies are also discussed.