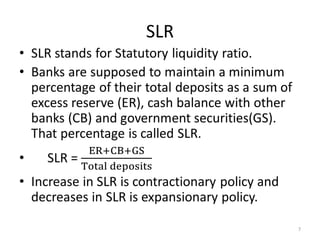

This document discusses monetary policy in India. It defines monetary policy as the set of policies by the Reserve Bank of India to regulate money supply and credit in order to achieve goals like economic growth and price stability. The objectives and instruments of monetary policy are described. Key instruments include repo rate, reverse repo rate, cash reserve ratio, and open market operations, which can expand or contract the money supply. Qualitative measures like credit rationing and moral suasion are also discussed.