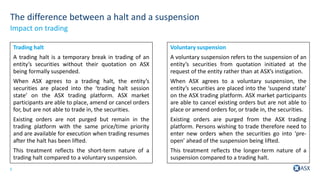

This document provides an overview of trading halts and suspensions under the ASX Listing Rules. It discusses the difference between trading halts and voluntary suspensions, how to request each from ASX, the circumstances under which ASX will agree to a halt or suspension, how halts and suspensions can be used to manage disclosure issues, and when ASX may impose a suspension. Key points covered include that halts are temporary while suspensions are longer-term, halts can last up to 2 days while suspensions have no time limit, and entities should use suspensions over halts if they cannot make the required announcement within 2 days.