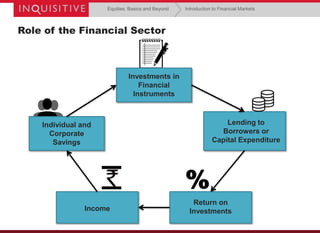

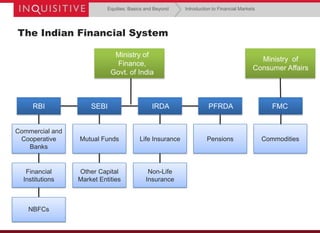

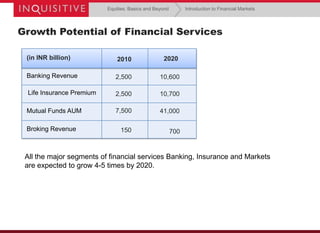

The document discusses the growth of financial services in India. It notes that India has a growing economy and high household savings rate, fueling growth in the banking, insurance, and financial markets sectors. It predicts these sectors will grow 4-5 times by 2020, creating over 9 million financial services jobs by 2022. The exponential growth of the financial sector presents many opportunities for professional and business growth, but taking advantage of them requires developing expertise in financial markets and continuous learning.