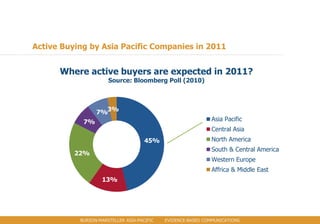

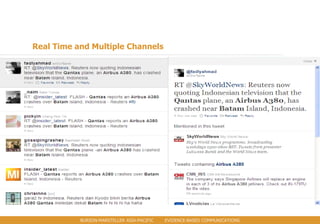

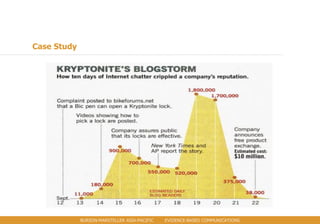

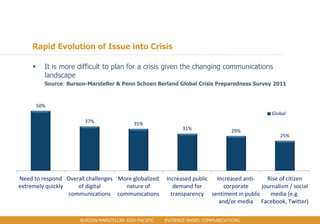

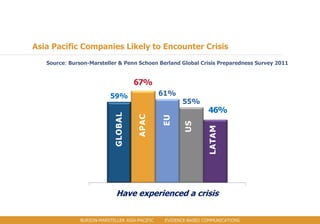

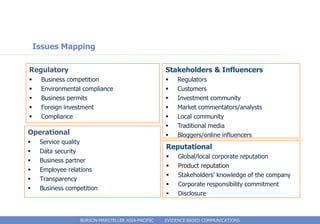

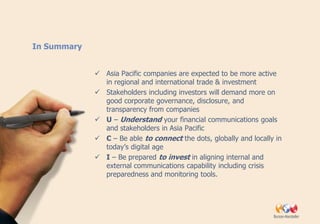

The document discusses trends in financial communications for companies in Asia Pacific. It notes the rise of Asia Pacific as a center for capital raising and mergers and acquisitions. Transparency and real-time communication across multiple channels are increasingly important. The document then provides guidance on developing a financial communications plan, including defining objectives, identifying stakeholders, crafting messages, and planning communications channels and issue monitoring. It also offers two case studies showing how companies effectively responded to crises through coordinated communications with investors and other stakeholders.