This document discusses factors that banks should consider when evaluating mobile payment systems to integrate into their business. It notes that nearly half of checks and bill payments in the US now involve mobile devices. The summary is:

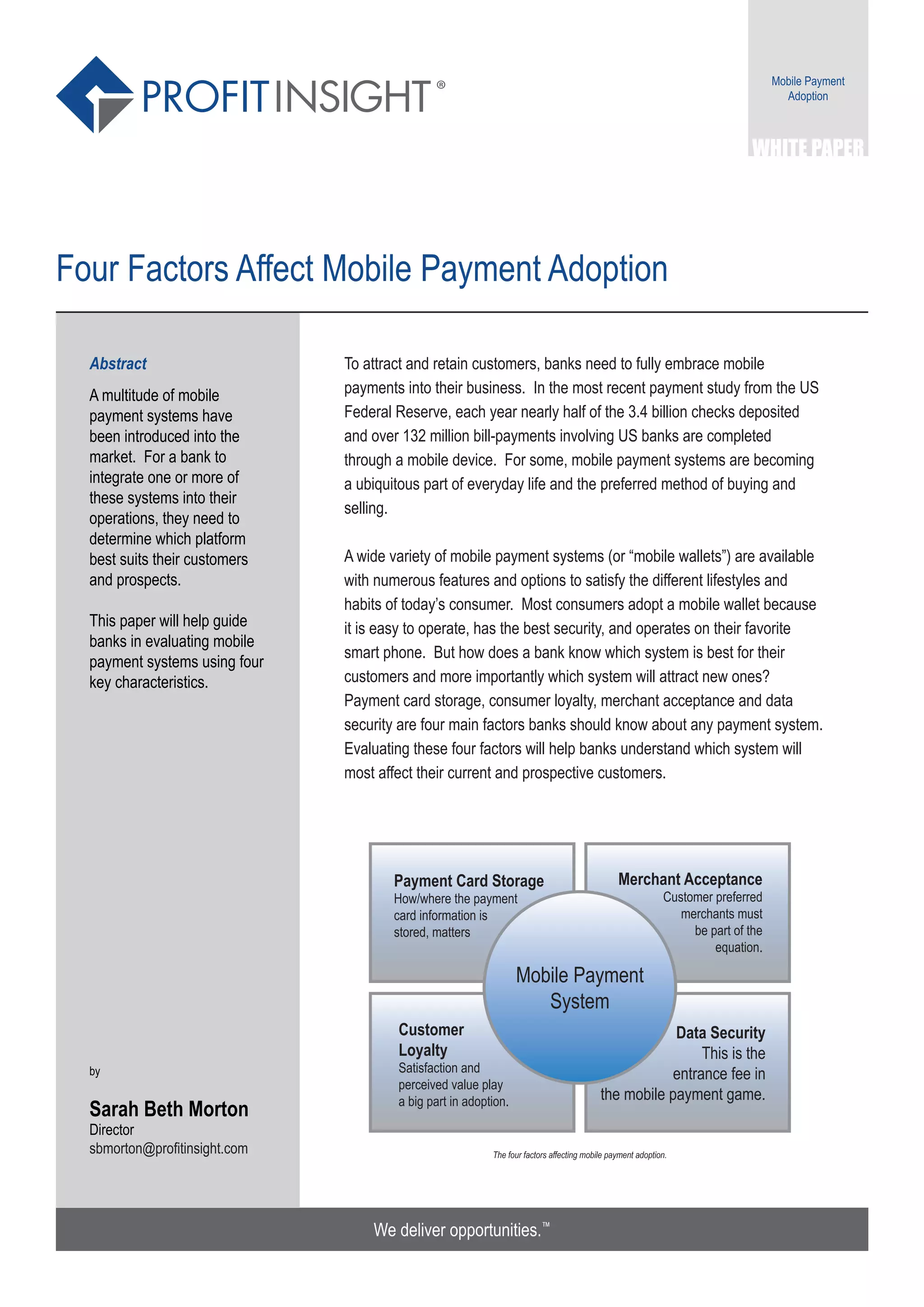

The document examines four key factors for banks to consider when evaluating mobile payment systems: how payment card information is stored, levels of customer loyalty and satisfaction, merchant acceptance, and data security. It argues that evaluating these factors will help banks understand which systems will be most appealing to current and potential customers.