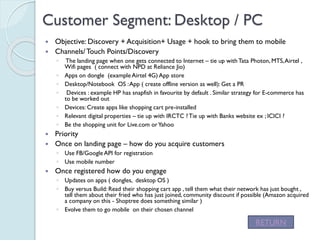

This document outlines a growth plan for mobile users for an e-commerce company in India. The plan maps out seven key strategies: 1) discovery, 2) onboarding, 3) usage and transactions, 4) referrals, 5) alliances with telecom operators, 6) alliances with original equipment manufacturers, and 7) promotions on other channels. It then provides details on implementing each strategy, such as partnering with telecom operators and mobile payment providers, bundling the e-commerce app with devices, and leveraging social media and influencer marketing.

![Mapping the strategies for user

growth..

S5

S6

Existing E-

com

user

( Desktop)

S

1

DISCOVER

Y

ONBOARDING

USAGE &

TRANSACTION

S

7 REFERRA

L

S[x] refers to strategy for that segment- which is explained later

MOBILE USER

Ecom next set of

Customers](https://image.slidesharecdn.com/mobileusergrowthplanfore-commerceplayerinindia-140311024959-phpapp01/85/Mobile-user-growth-plan-for-e-commerce-player-in-india-3-320.jpg)

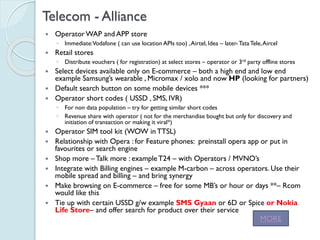

![Translating the desktop impact to mobile

Customer Segment on Desktop E-commerce

Alliance / Channel

Intel App Store

Browser OS

Laptop/Netbook/Desktop

Targeted promotion on Facebook and relevant digital properties

Tie up with landing page for dongles **included in Telecom operator alliance

Web Registration

◦ What?

Create Tools to onboard customers who are on Desktop to mobile platform for E-com.

Import their registration and user details to mobile platform.

◦ Why?:

Evolve existing customer to mobile

Maximise the impact of any future web spending

◦ How?

Tie up with web development agencies [S1]

Do Trial launches – calibrate results – do more refinements

LINK up and Ride on Social media audience

◦ Use FB registration details for on boarding [S5]

Let people know when customer has bought with permissions [S7]

◦ Pull in customers and drive engagement

Reverse bidding or generate some content ( example price in context of reverse bidding)

Click for

MORE](https://image.slidesharecdn.com/mobileusergrowthplanfore-commerceplayerinindia-140311024959-phpapp01/85/Mobile-user-growth-plan-for-e-commerce-player-in-india-4-320.jpg)

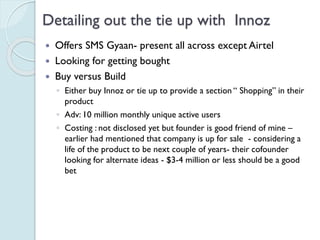

![Alliance with Enablers

What ?

◦ Enablers

Payment Gateways or mobile payments: Example Oxicash or

banking payment gateways to Maximise the conversion from

Sales from system POV to cash collection

Rating agencies : To profile customer based on their credit ratings

Predictive engines: To identify the probable customer or next

purchase- deployed on mobile and desktop internet

Link up with Device Address Book(for mobile app) : [S7]

Product videos , image recognitions ( Snaptell, Slyce, Amazon’s

Flow) , mobipocket (Amazon acqd)

Why?

◦ These assist in Sales

How ?

◦ Using their public or private API’s – Vendor selection

Click for

MORE](https://image.slidesharecdn.com/mobileusergrowthplanfore-commerceplayerinindia-140311024959-phpapp01/85/Mobile-user-growth-plan-for-e-commerce-player-in-india-8-320.jpg)