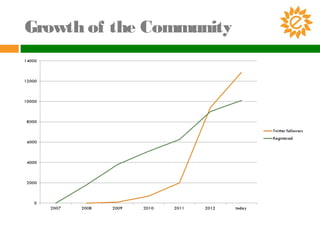

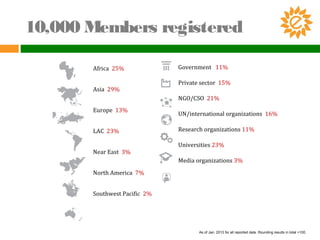

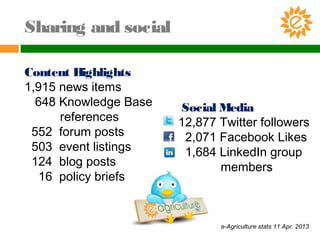

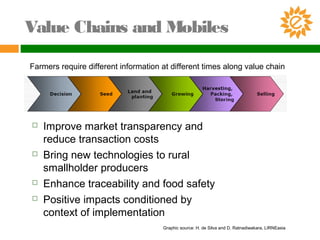

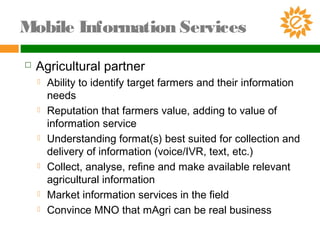

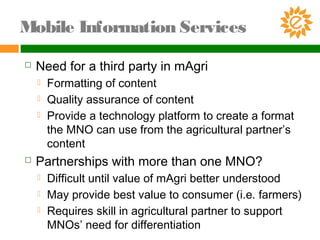

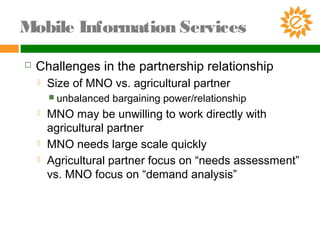

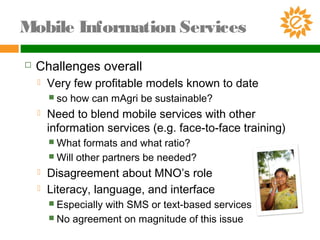

This document discusses a global community of practice focused on using information and communication technologies (ICT) for sustainable agriculture and food security called e-Agriculture. It provides statistics on the community's growth and composition. A key topic is how value chains and mobile technologies can benefit smallholder farmers. It also summarizes an online discussion about forming partnerships between mobile network operators and agricultural organizations to provide sustainable and scalable mobile information services for farmers. Challenges in creating such partnerships and mobile agriculture services are also outlined.