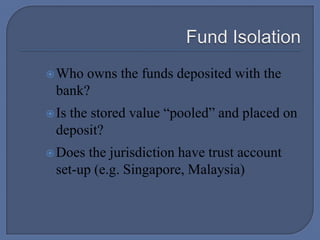

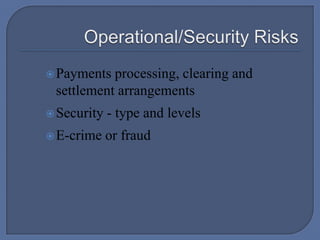

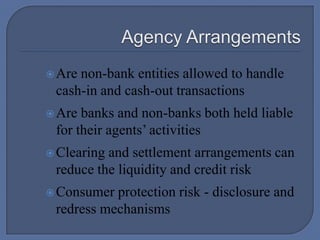

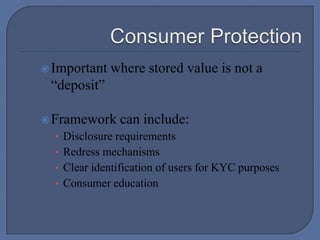

This document discusses financial regulatory issues related to mobile banking services. It covers regional and international efforts to promote mobile banking, regulators' viewpoints, and how business models and regulations influence areas like agent arrangements, consumer protection, and efficiency. Regulators aim to balance financial inclusion with safety by focusing on issues like float management, know-your-customer processes, and operational risks. Emerging themes suggest regulators will engage more with non-bank players and consider interoperability, while industries should involve regulators early in development.