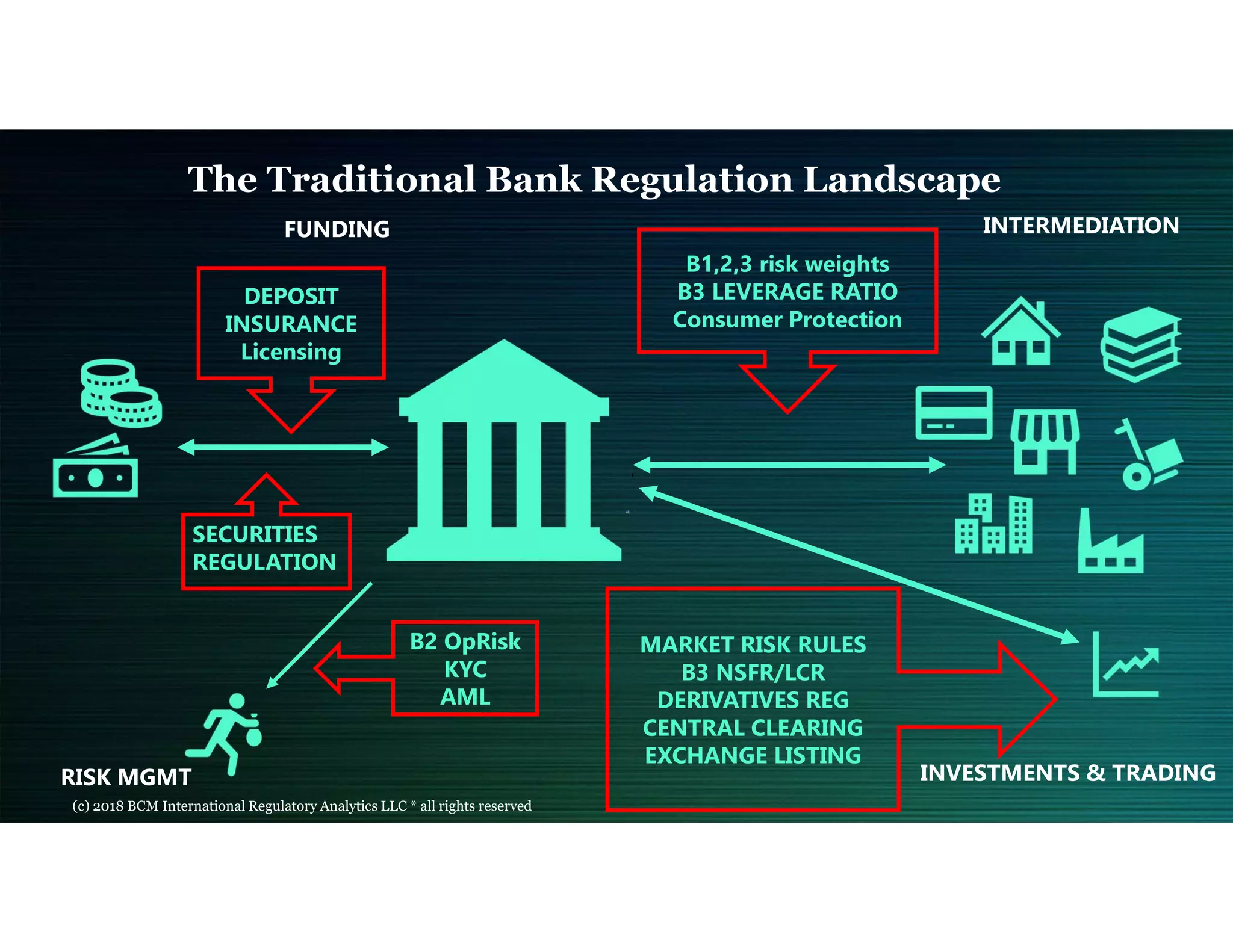

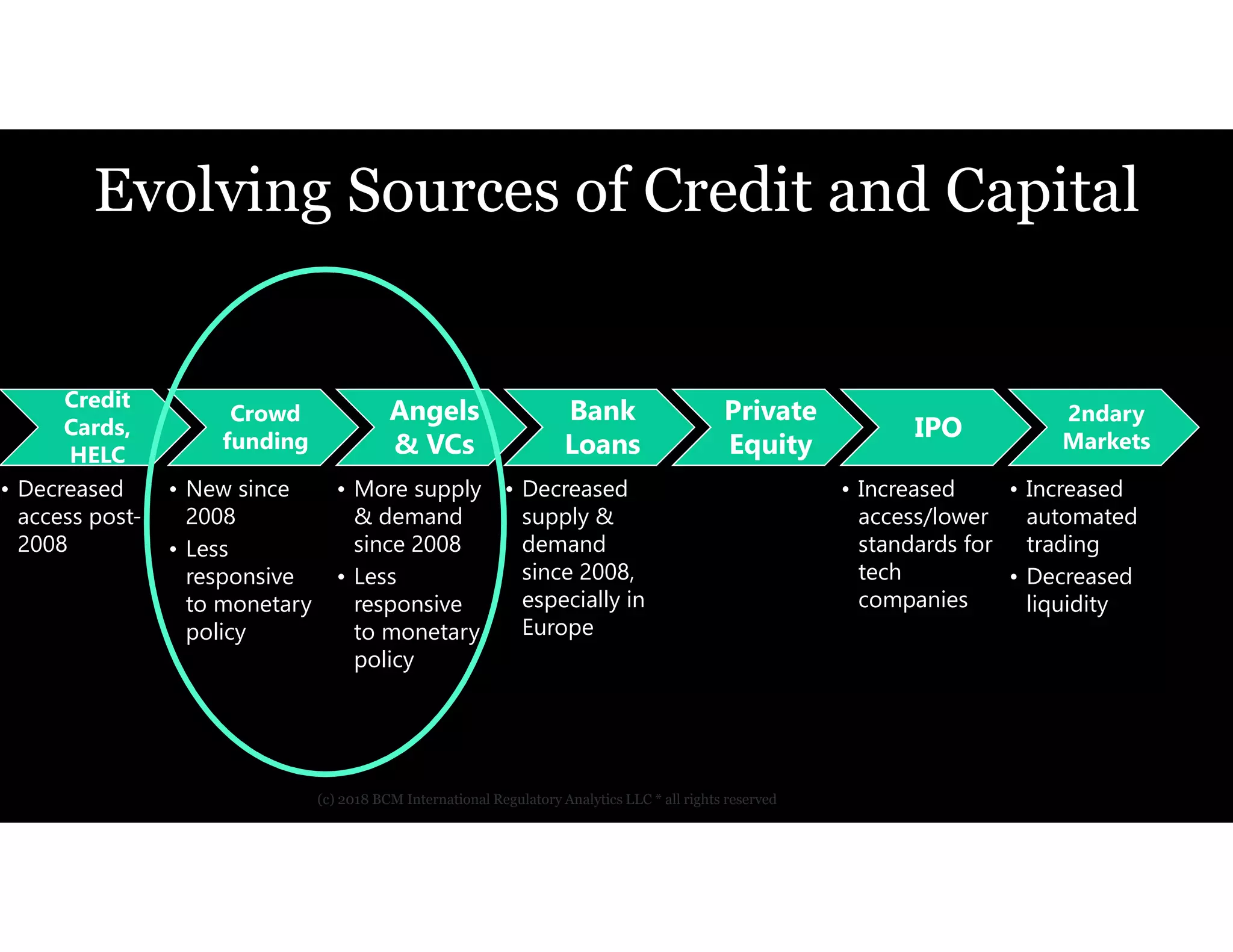

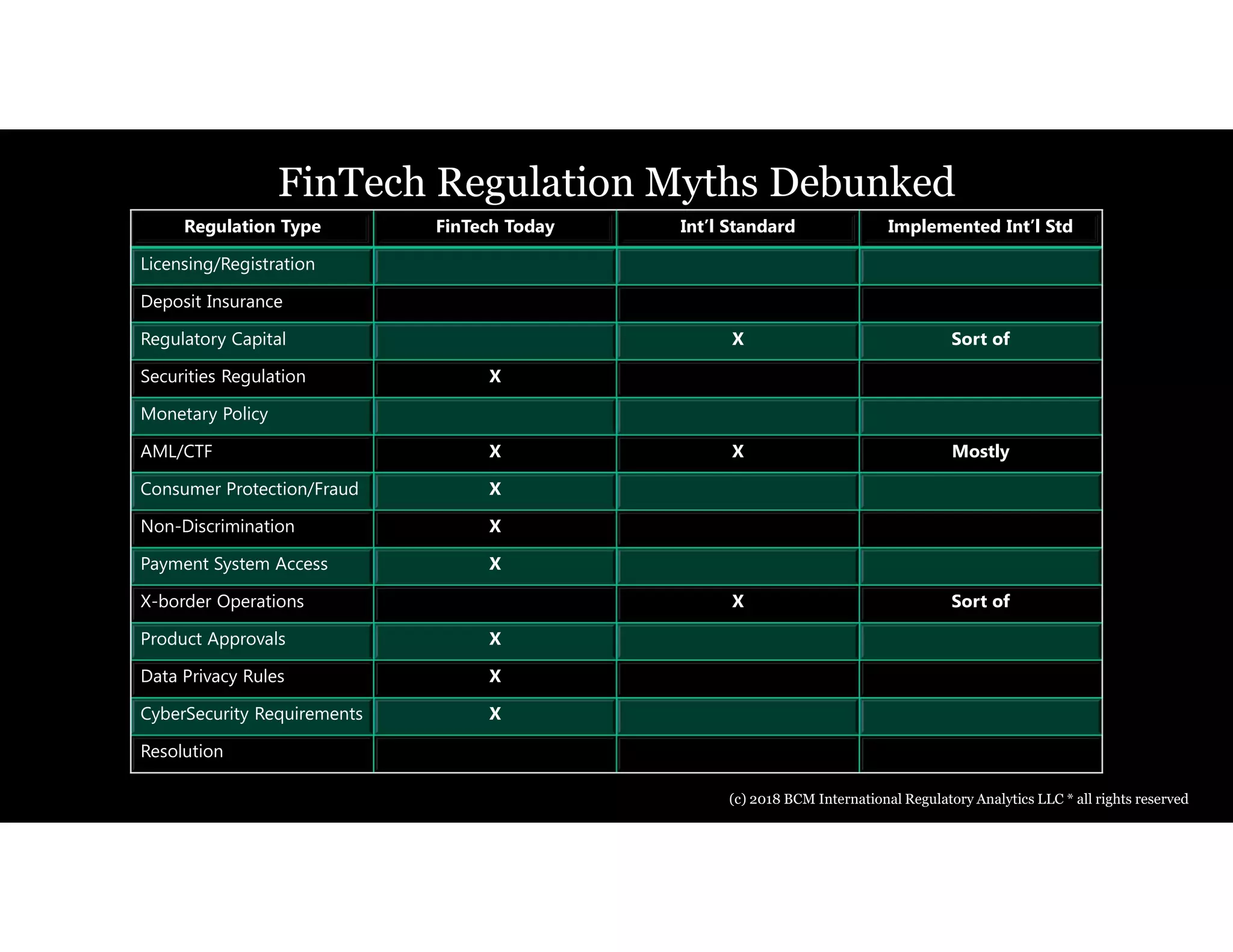

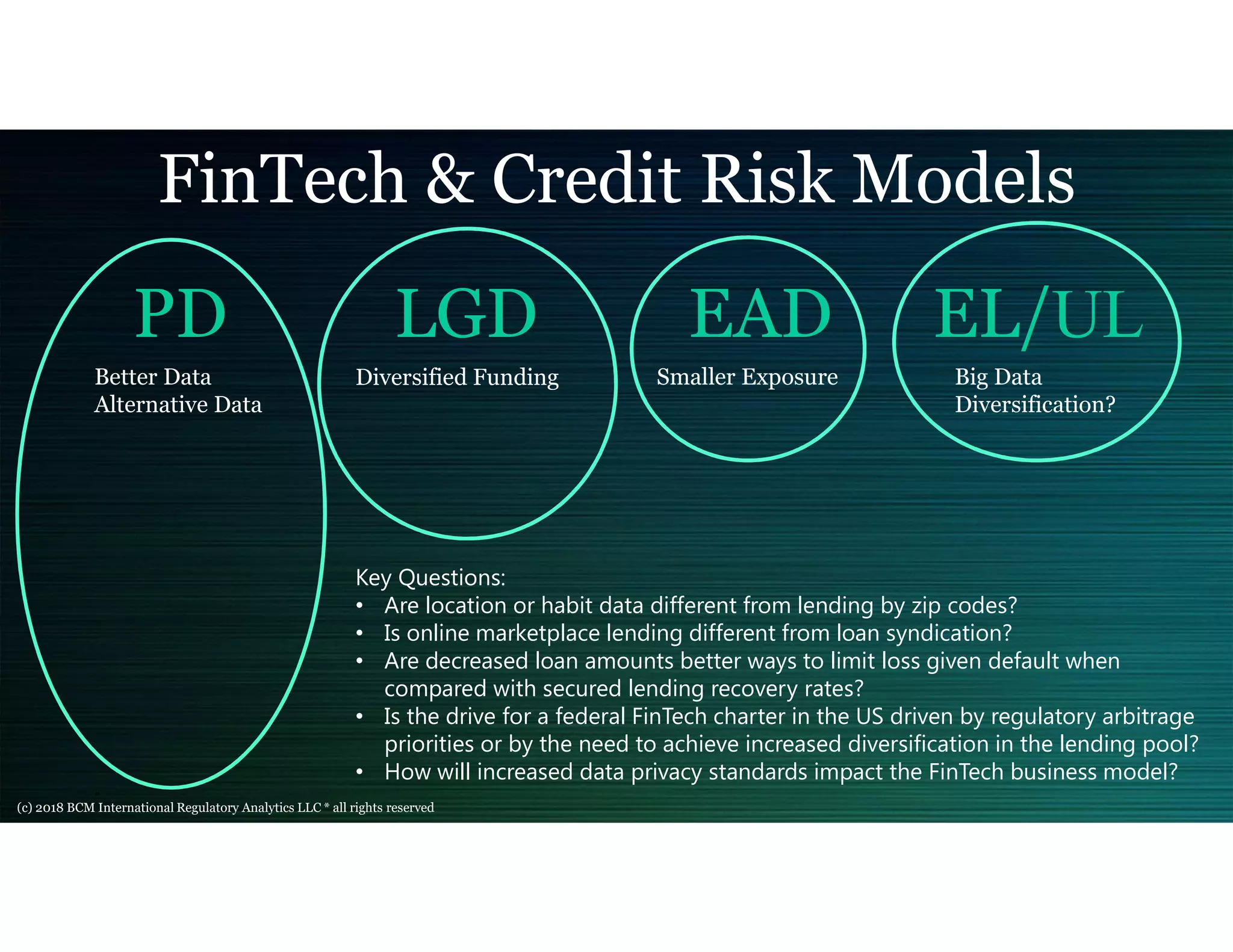

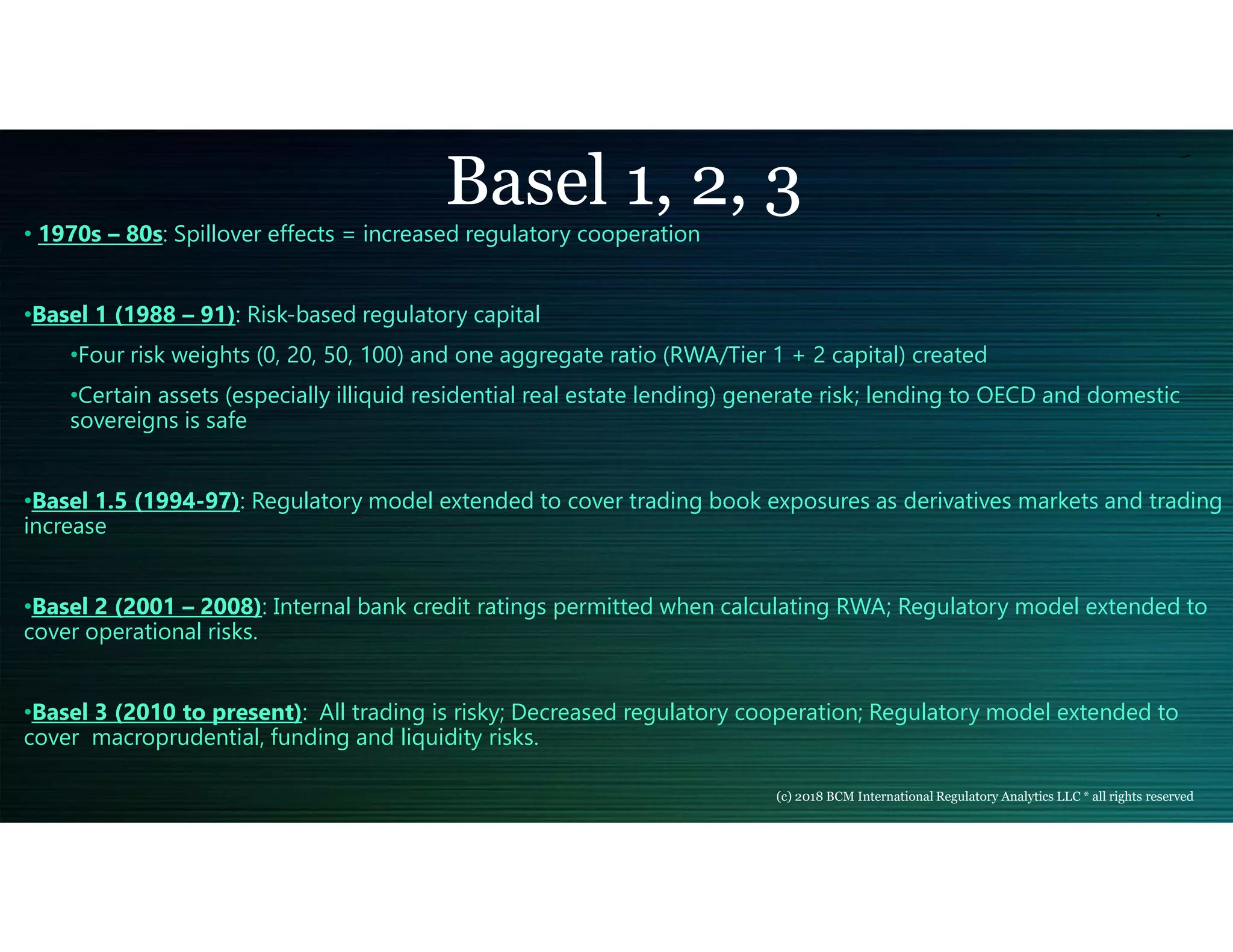

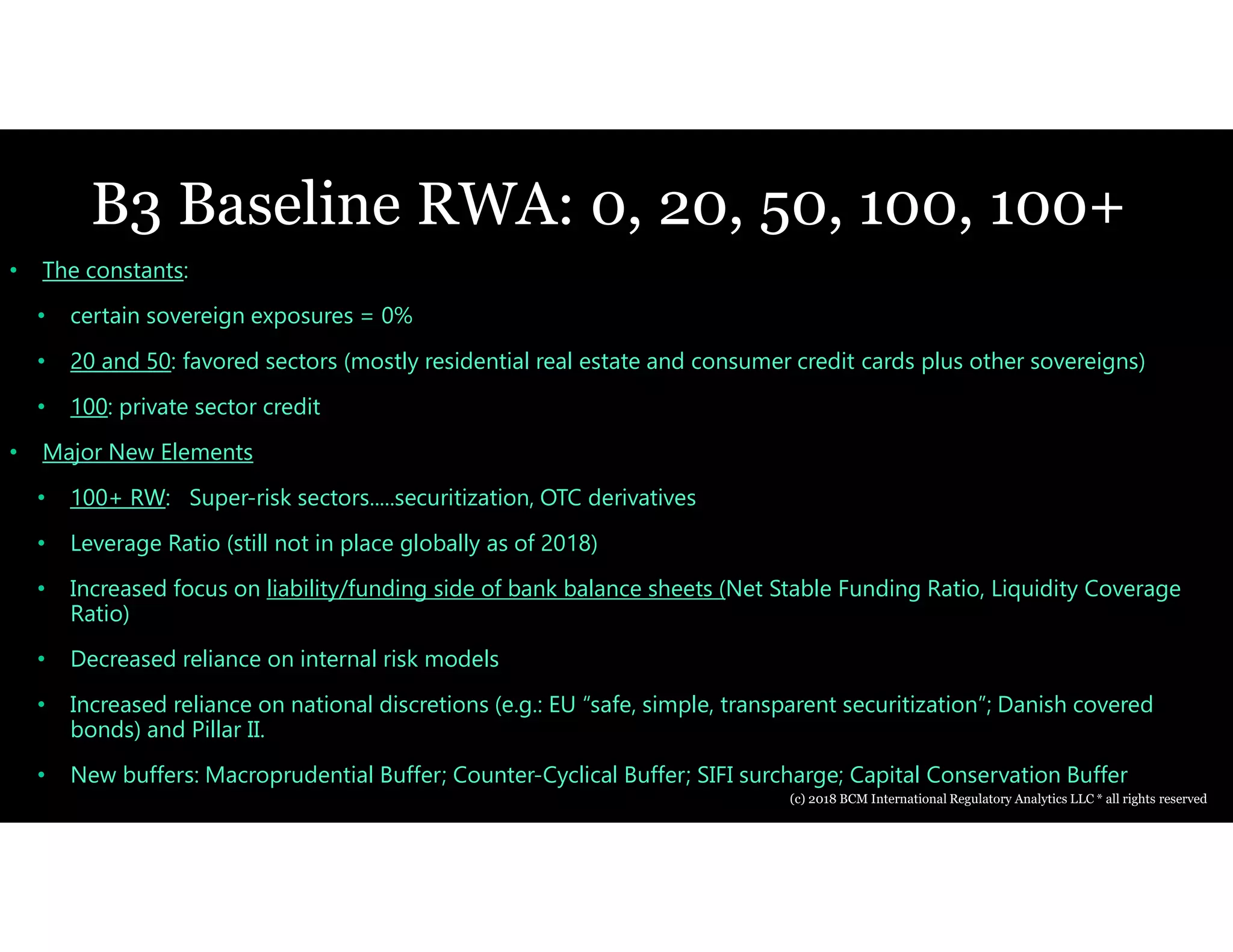

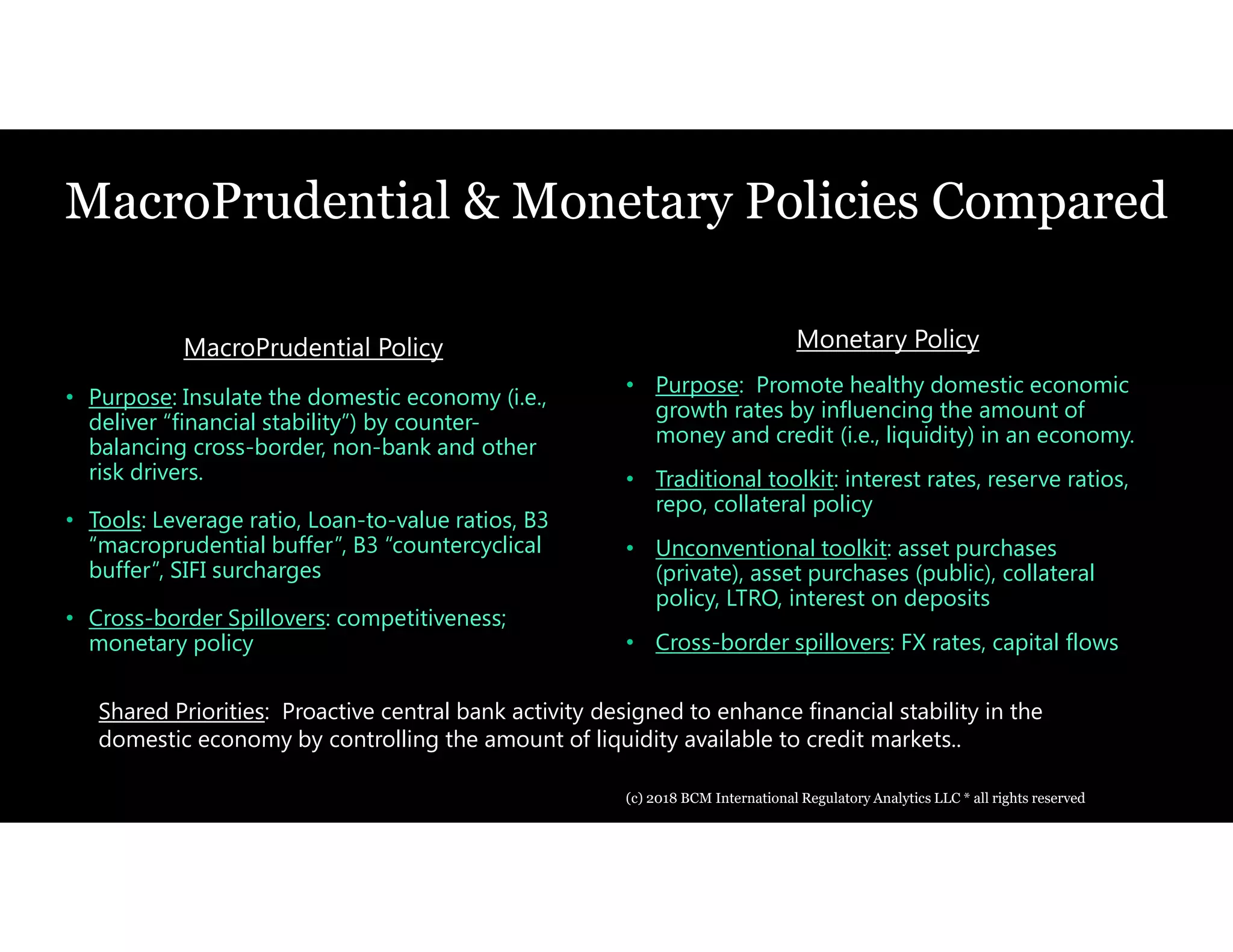

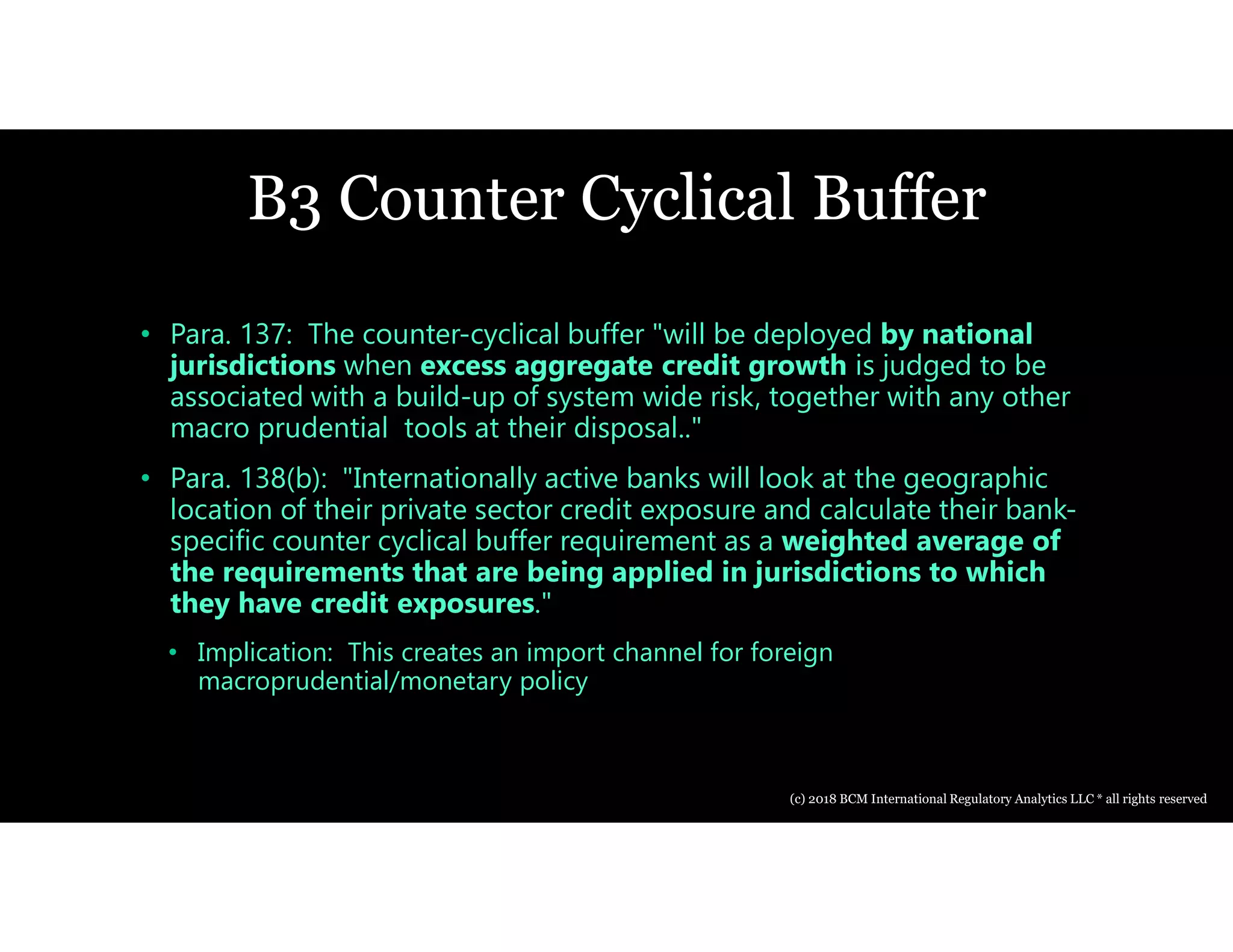

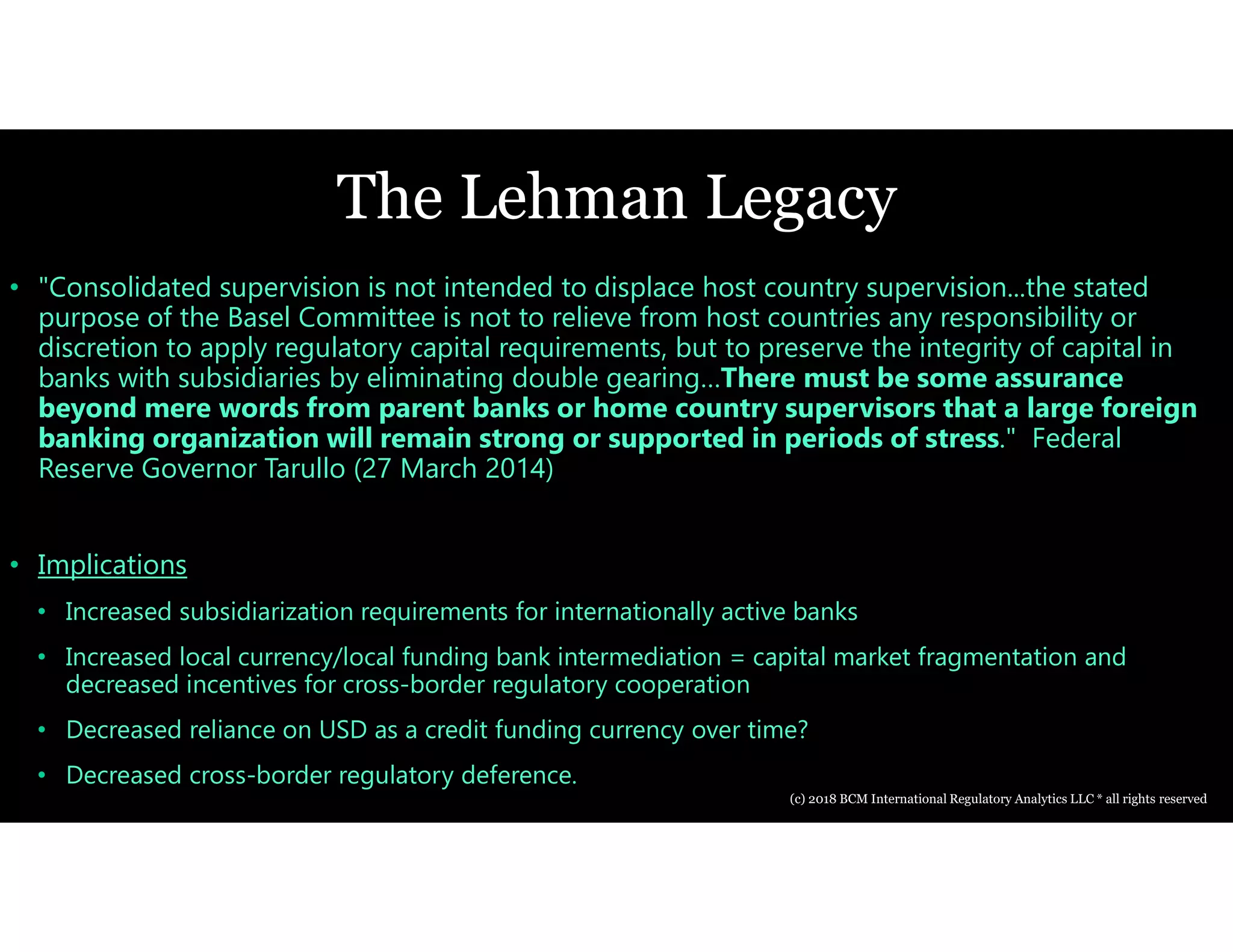

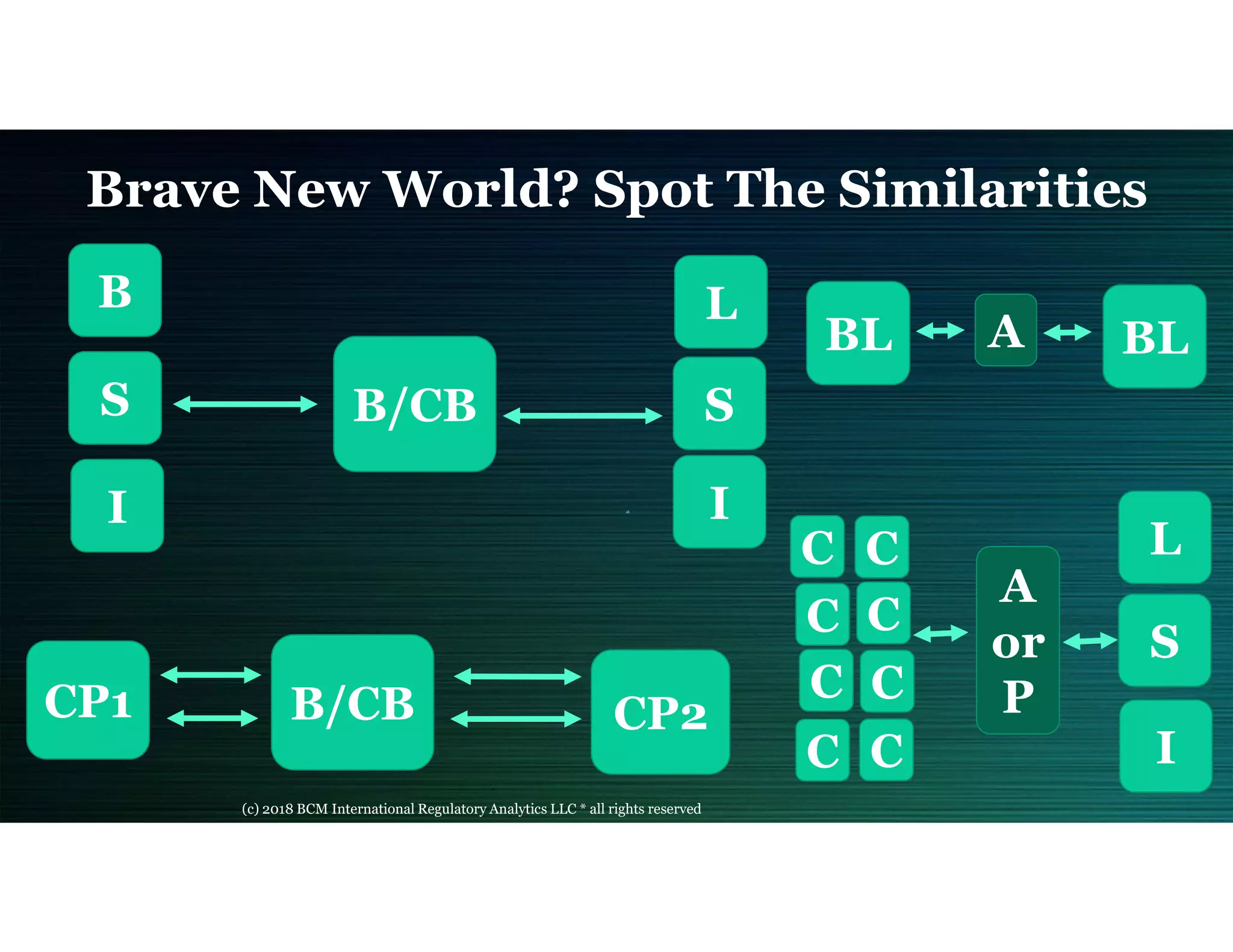

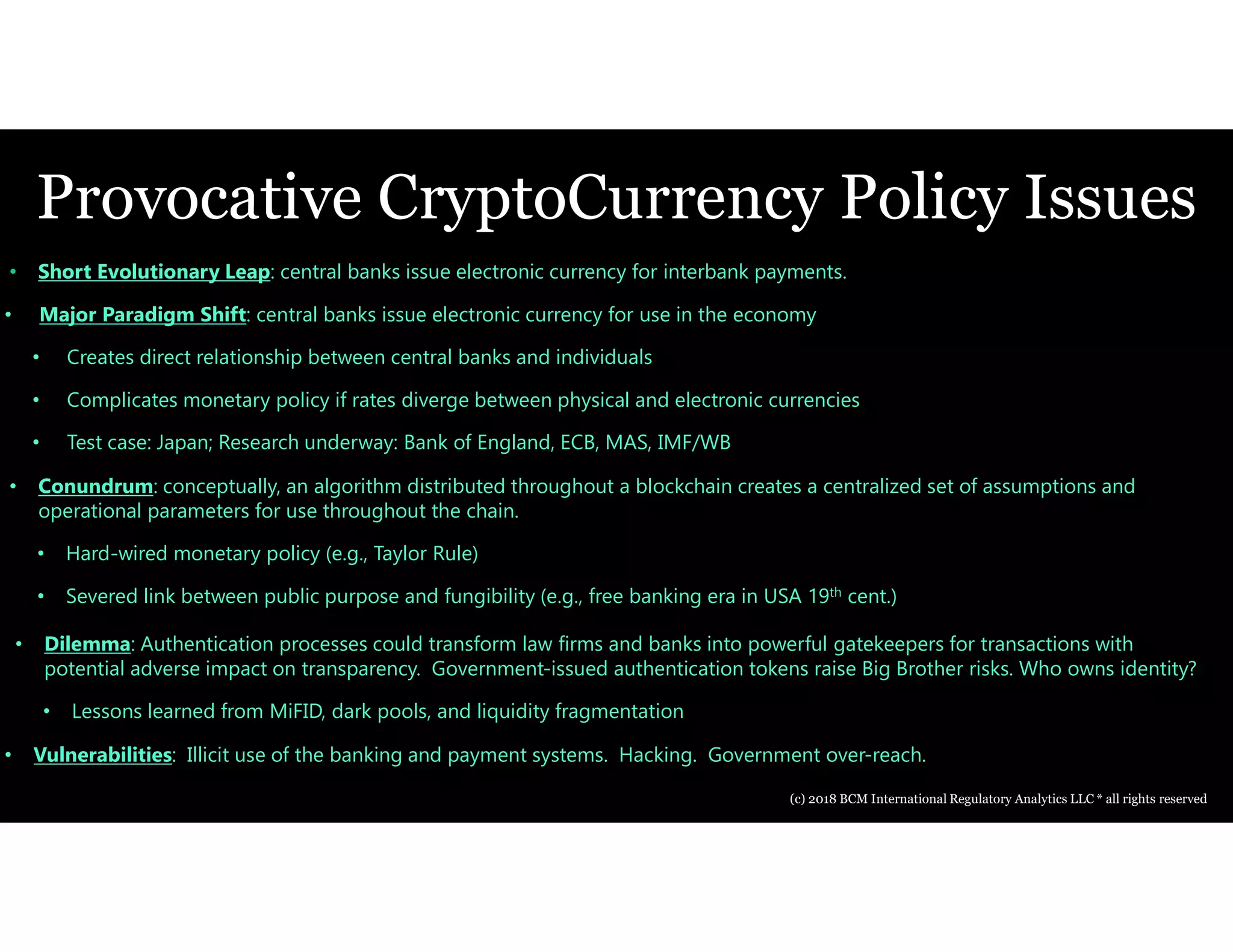

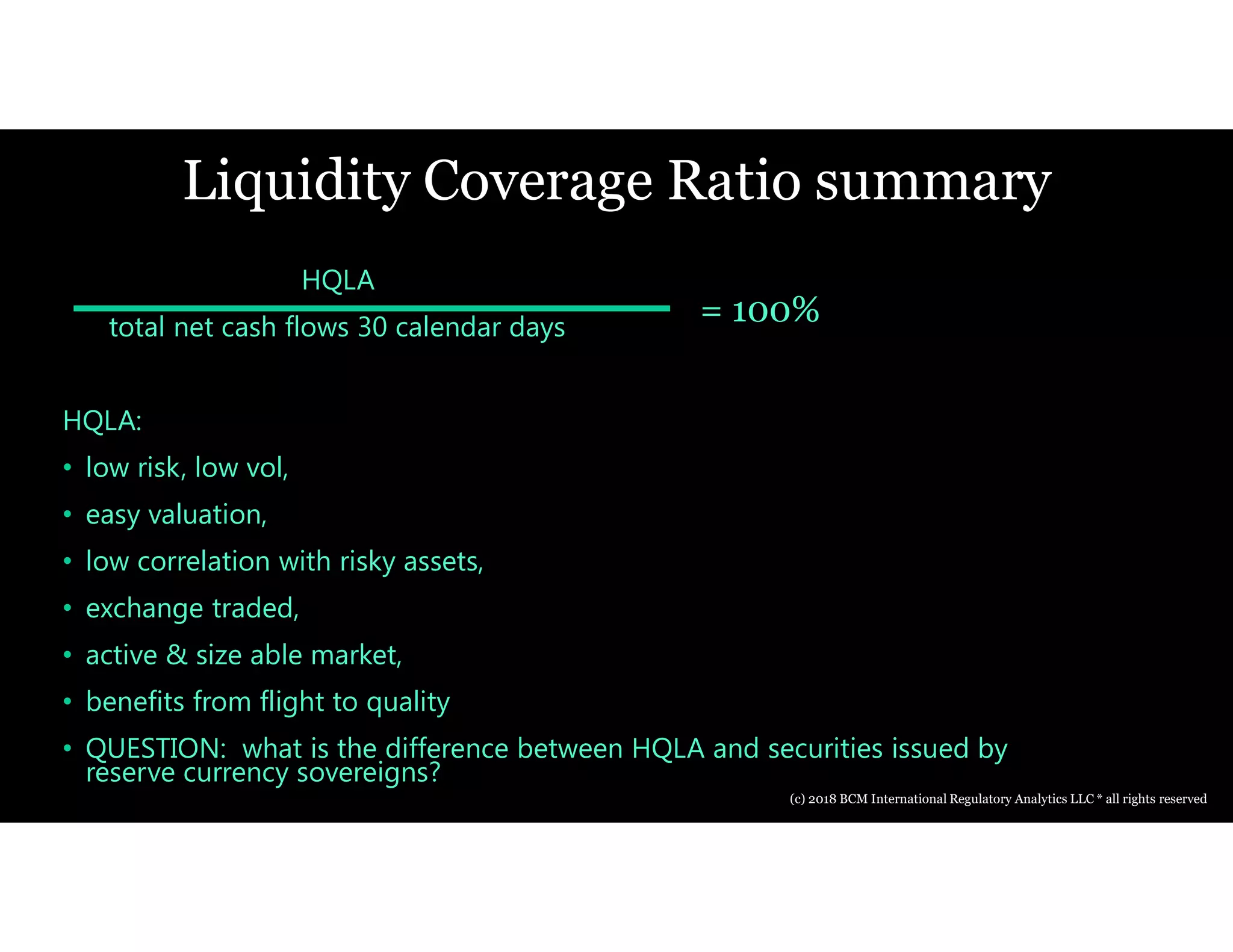

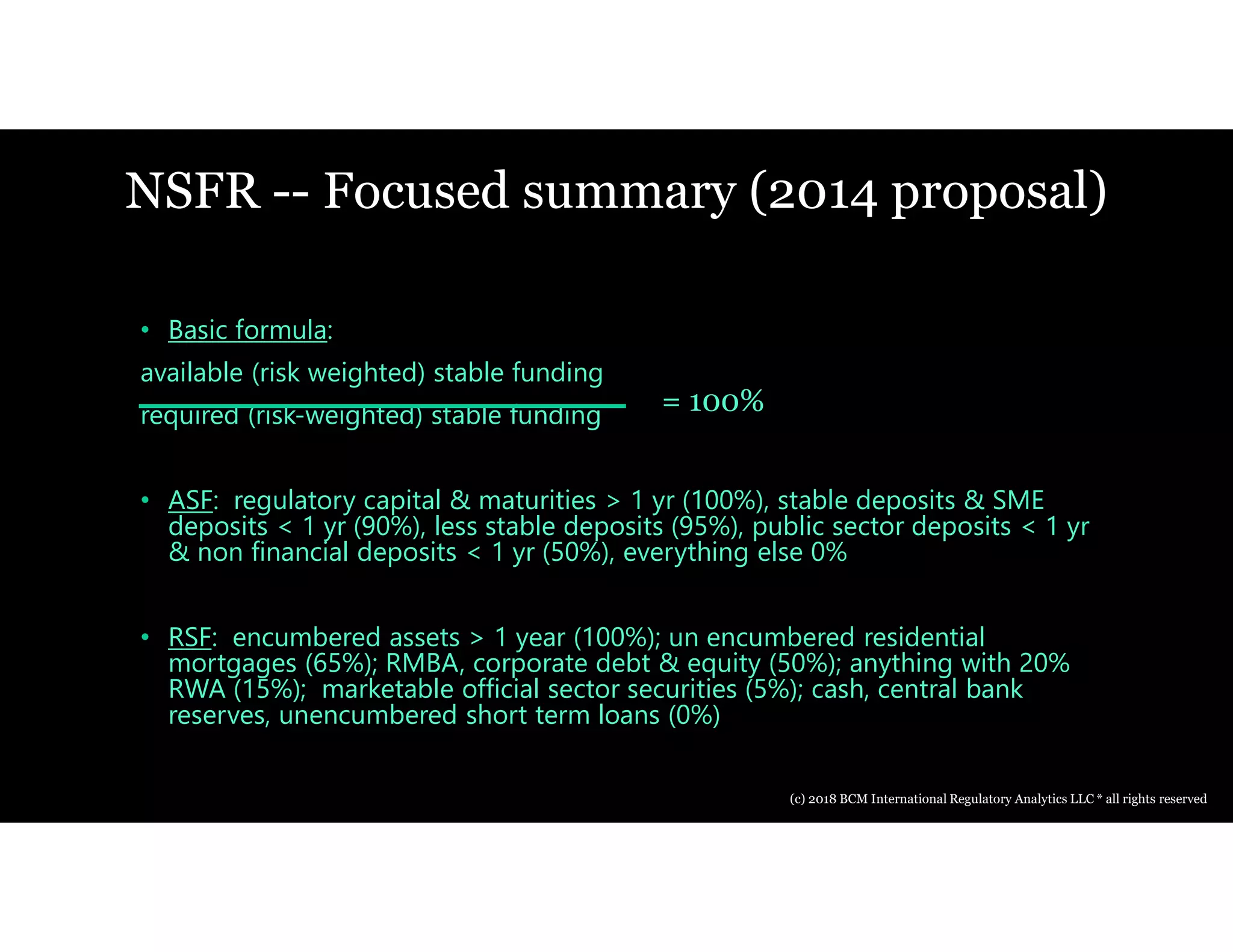

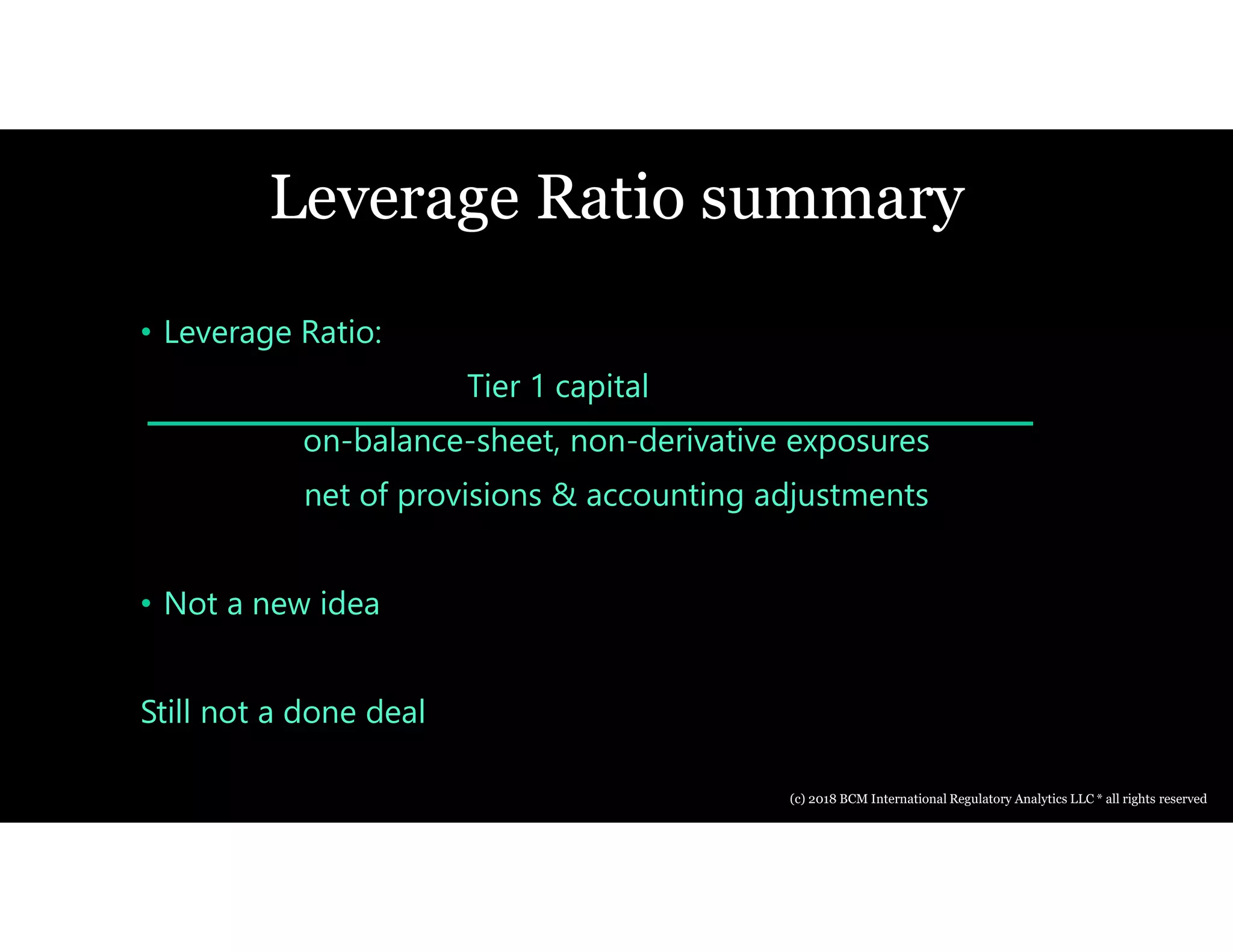

The lecture notes by Barbara C. Matthews discuss the evolving landscape of financial sector supervision, addressing topics such as the regulation of intermediation, the implications of cryptocurrencies, and international regulatory harmonization. It also highlights the changes in credit sources post-2008, the regulatory challenges posed by fintech, and the interplay between macroprudential and monetary policies. Key regulatory frameworks, including Basel III and its impact on capital requirements and financial stability, are examined alongside pressing questions about fintech and data privacy.