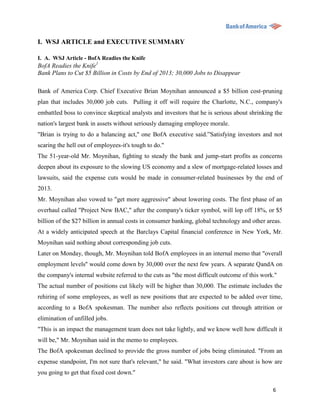

The document discusses Bank of America's (BofA) strategic challenges, detailing a plan called 'Project New BAC' aimed at cutting costs by $5 billion through significant layoffs and asset divestitures to stabilize profitability amidst economic pressures and litigation risks. It provides an in-depth analysis of the banking industry's competitive landscape, highlighting BofA's primary competitors and assessing the low attractiveness of various banking segments due to several market dynamics. The document emphasizes the need for BofA to restructure and adapt its operations to remain viable and regain investor confidence.

![III.B.2 Employee Controls, Values, and Ethics

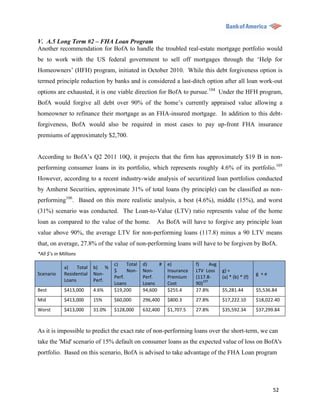

While appraisal methods differ across lines of business, the firm monitors employee performance

through annual 360 Performance Reviews. BofA also trains personnel annually on its Code of

Ethics. Included in the document are its core values to: “deliver for our customers, clients and

shareholders, trust in our team, embrace the power of our people, act responsibly, and promote

opportunity”.64 As stated in the BofA 2010 Annual Report, “… [W]e has developed employee

incentive, reward and recognition programs that align with our customer experience goals.”65

Though BofA has received criticism in the media since the financial crisis, overall it can be

assumed, because of the current awards and accolades that it has received, that the company is

well aligned with the core values that it puts forth. Honors such as, World’s Most Admired

Companies, Top 50 Companies for Diversity, and Top 200 of the Global 2000, demonstrates that

BofA supports its people and fosters a safe, ethical environment in which to work.66

III.C. BofA – Strategic Position Definition

III.C.1 BofA - Corporate Level Strategy

Business Portfolio

BofA‟s business portfolio under CB includes Deposits, Global Card Services, Home Loans and

Insurance, and Global Commercial Banking. The CB scope of product offerings includes a

portfolio targeted to mass-market consumers and small-to-mid size businesses:

1. The Deposits group offers products and services that represent traditional retail banking

offerings; these include checking, savings, money market accounts, and CDs and IRAs.

2. Global Card Services is a leading credit card issuer in the US and provides consumer

and business cards, consumer lending, and international credit/debit cards.

3. Home Loans and Insurance provides consumer real-estate products, including first-lien

home mortgages, home equity loans and lines of credit, and insurance-related products

Global Commercial Banking offers customer lending-related products, working capital

management, commercial loans, and asset-based lending.

BofA IB provides a portfolio geared towards large corporations, institutions, and high-net-worth

individuals:

35](https://image.slidesharecdn.com/missionpeaksuperstarsbofa-130310235519-phpapp01/85/Bank-of-America-s-Project-New-BAC-For-Good-or-for-Bad-35-320.jpg)

![Integrated/Diverse

Y N ---- Y PARITY

product offerings

Y - Spends significant % of revenue

maintaining, upgrading, and expanding

IT Y N technology offerings. Major competitors Y PARITY

can match this, but smaller competitors

cannot afford similar investments.

Y - The company provides unmatched

convenience in the United States, serving

approximately 58

million consumer and small business

Convenience Y N Y PARITY

relationships with more than 5,900 retail

banking offices, more than 18,000 ATMs

and award-winning online banking with

nearly 30 million active users

N – Acquisition of Countrywide

Risk Management N N Financial and Merrill Lynch brokerage N Disadvantage

both led to significant expense

Y – But in BofA‟s case, U.S. government

Government forced it to acquire Merrill Lynch when

Relationship / Y Y CEO wanted to pull out of deal; N Disadvantage

Political Savvy government also suing over Countrywide

mortgage practices

N - They have continuously being ranked

Customer service Y N the worst. However the competitors do N Disadvantage

not do better either.

1

http://issuu.com/brandfinance/docs/september_update?viewMode=magazine&mode=embed

2

http://online.barrons.com/report/top-financial-advisors/100

3

http://www.investmentnews.com/apps/pbcs.dll/article?AID=/20110523/FREE/110529986

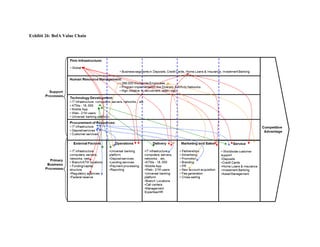

Exhibit 14b: Bank of America Value Drivers

DRIVER INDUSTRY

Technology CB IT infrastructure; Deposit-image ATMs;Mobile App;Web (21M users); SMS

banking; Unified, usable interface for customers across platforms

IB Integrated platform for wealth, commercial, corporate, investment products

Quality CB 24/7 customer service; Product usability (e.g. Clarity Commitment statements

describing products in „plain English‟);One stop shop;

Terms and conditions, Low interest rates; High customer retention

IB Convenience (easy access to capital/capital markets) ; Product usability (e.g.

Merrill Edge allowing banking + investing activity on same platform) High

customer retention

Delivery CB Convenience - large physical branch (700) and ATM (18,000) footprint, much

of the U.S. (32 states) ; Web and mobile device accessibility for many of the

most popular core products ; Integrated product delivery

IB ; Convenience ; Integrated product delivery/platform (wealth mgmt. +

commercial / corporate / investment banking services)

Breadth of CB ; Comprehensive & diverse commercial product offerings across consumer,

Line business, and institutional clients (one-stop shop)

; “We run the franchise in full, delivering all of the services [customers] may

have traditionally sought separately from a retail bank, commercial bank, an

investment bank, a wealth management firm, a brokerage or a private bank.”

(BOA Annual Report, 21010)

IB Large investment banking product line breadth; Specialized research of

investment opportunities

76](https://image.slidesharecdn.com/missionpeaksuperstarsbofa-130310235519-phpapp01/85/Bank-of-America-s-Project-New-BAC-For-Good-or-for-Bad-76-320.jpg)