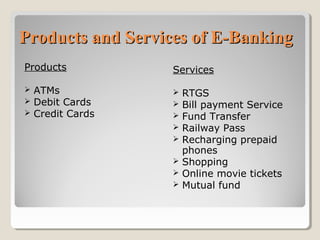

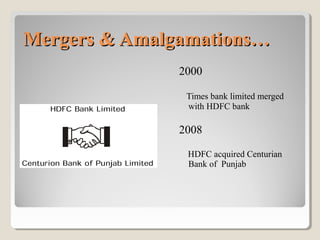

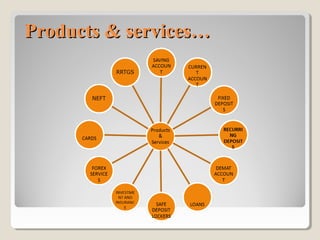

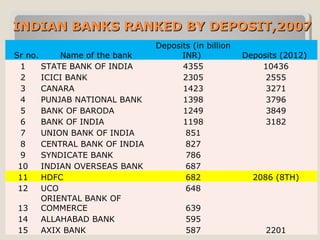

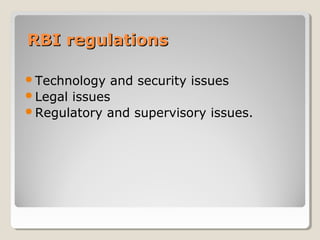

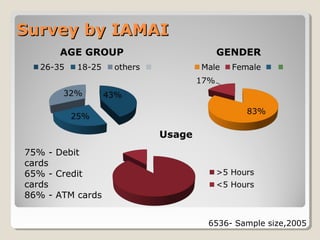

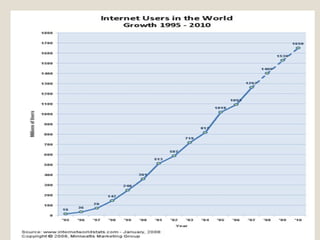

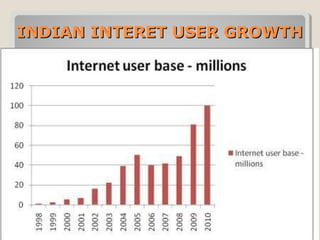

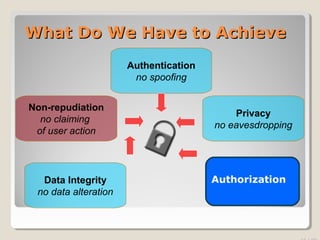

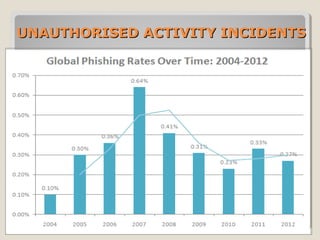

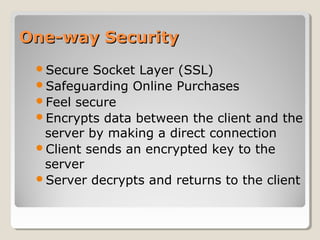

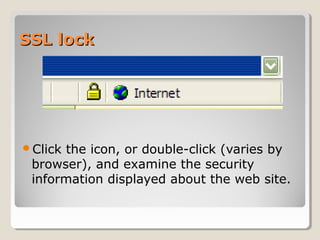

This document discusses different types of banking including direct banking, online banking, and wireless banking. It then focuses on electronic banking (e-banking) and its growth in India since the 1990s. The document provides details about HDFC Bank, one of India's largest private sector banks, including its history, mergers and acquisitions, products and services. It also ranks the top Indian banks by deposits in 2007 and discusses regulations and security issues related to e-banking.