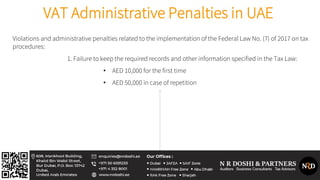

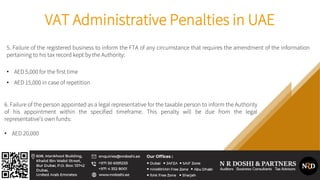

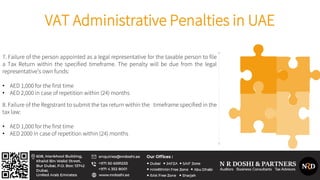

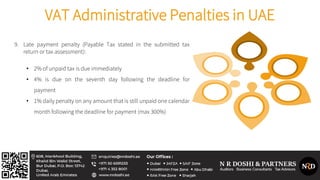

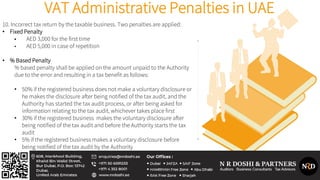

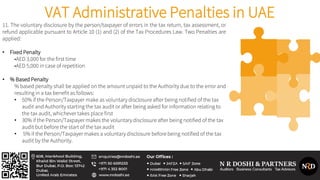

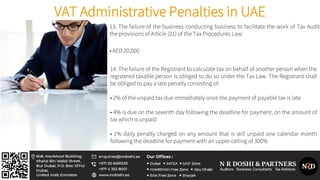

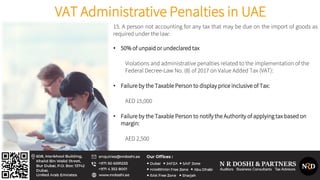

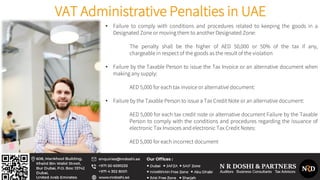

The document outlines the various VAT penalties under UAE federal tax law, detailing penalties for non-compliance with record-keeping, submission of documents, and tax payments. It specifies monetary penalties for different violations, such as failing to submit tax returns or incorrect tax filings, with varying amounts based on the severity of the infraction. Additionally, it promotes VAT consulting services provided by N R Doshi & Partners to assist businesses in complying with these regulations and avoiding penalties.