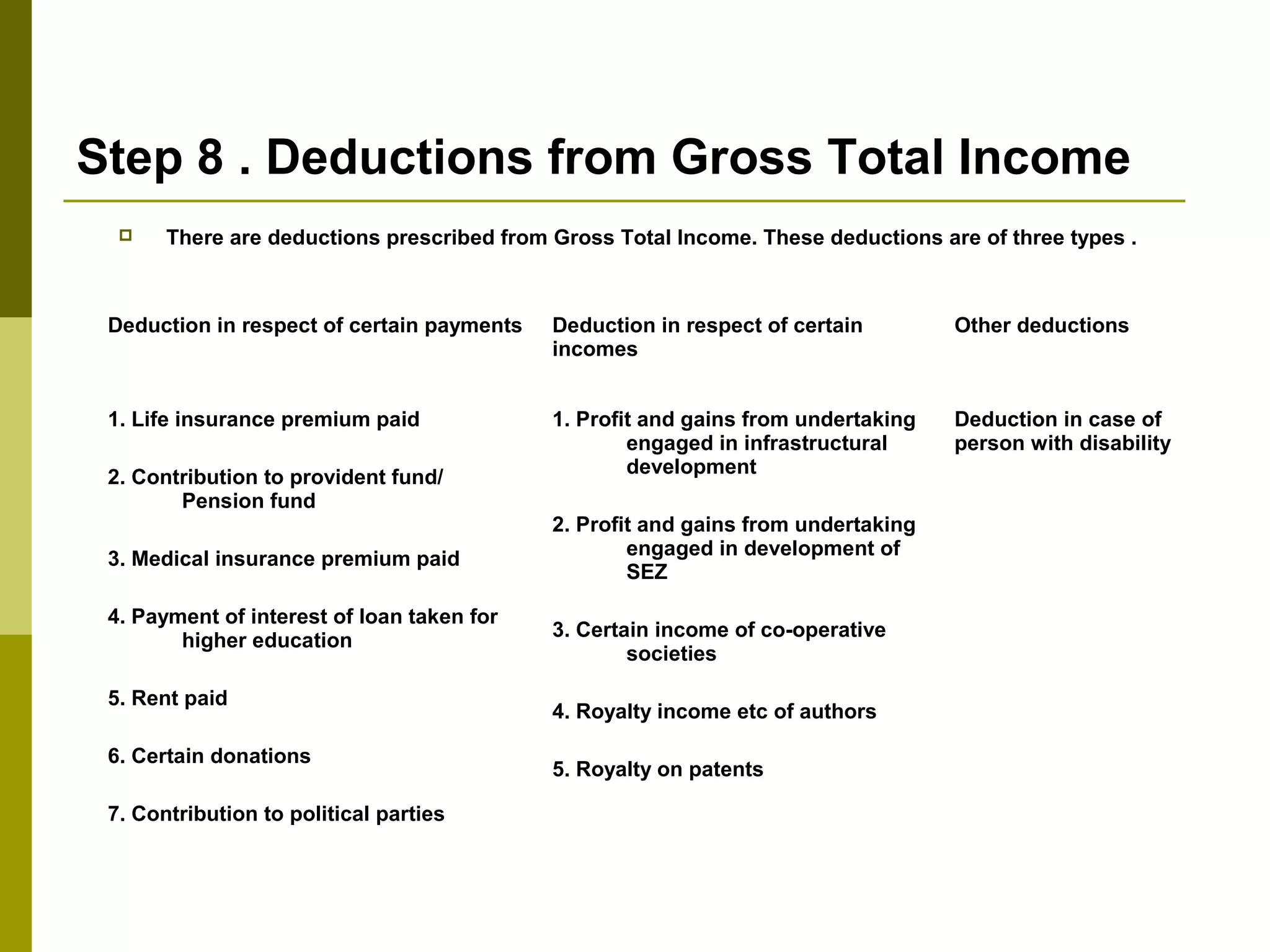

This document provides an overview of basic income tax concepts in India. It defines what a tax is and the different types of taxes. It then explains why taxes are levied and provides an overview of India's income tax law, including the key components like the Income Tax Act, Finance Acts, rules, circulars, and legal decisions. It also outlines the process for computing total income and tax payable, which involves determining residential status, classifying income under different heads, excluding non-taxable income, computing income under each head, setting off losses, deductions, and applying tax rates.