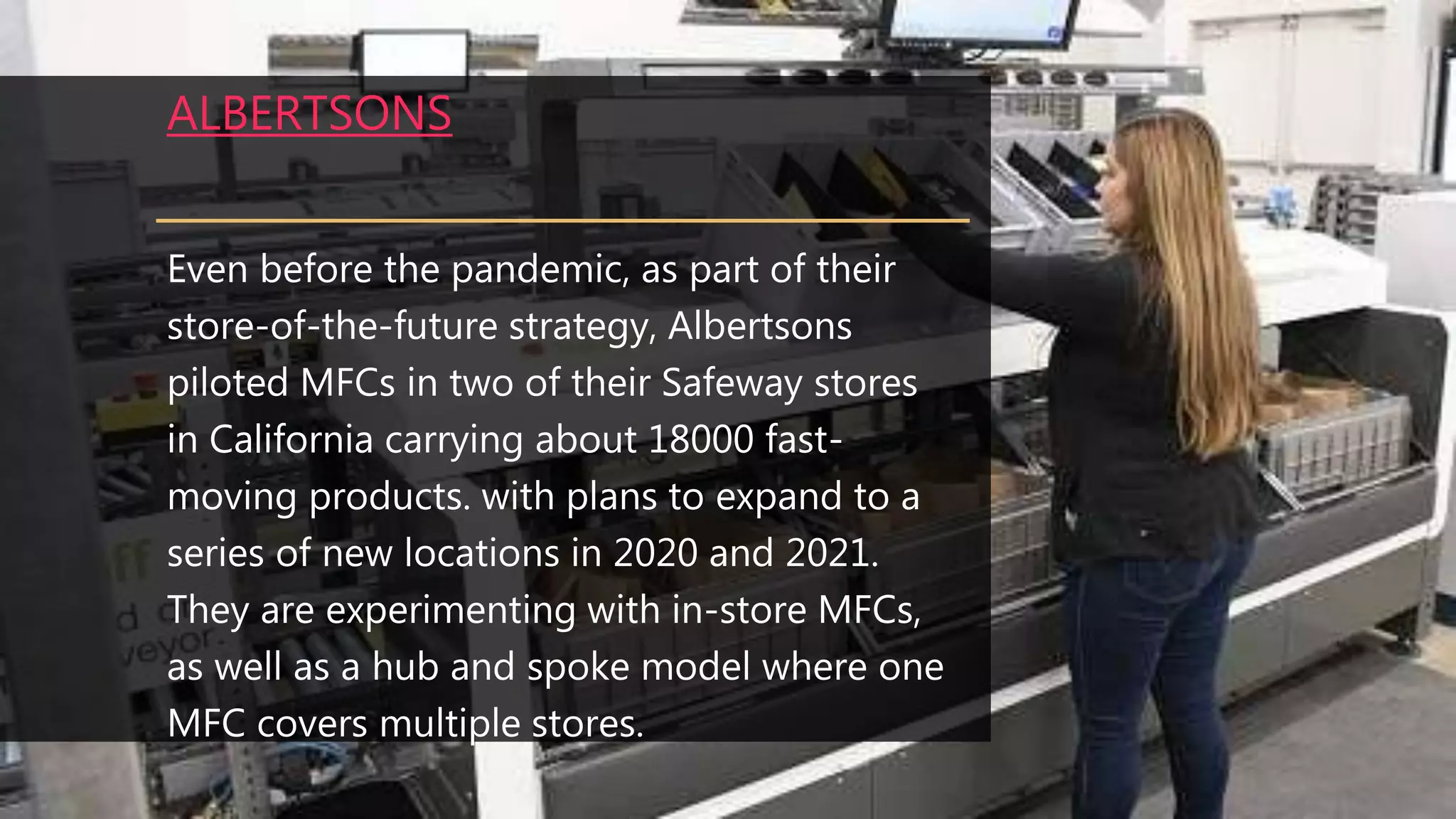

The document discusses the implementation of micro-fulfillment centers (MFCs) by various grocery chains to enhance e-commerce capabilities. Albertsons, Loblaws, Shoprite, Kroger, Walmart, and PepsiCo are exploring automated solutions to meet growing online grocery demand, improve fulfillment efficiency, and reduce costs. These initiatives include partnerships with technology providers and the adaptation of existing facilities for online order fulfillment.