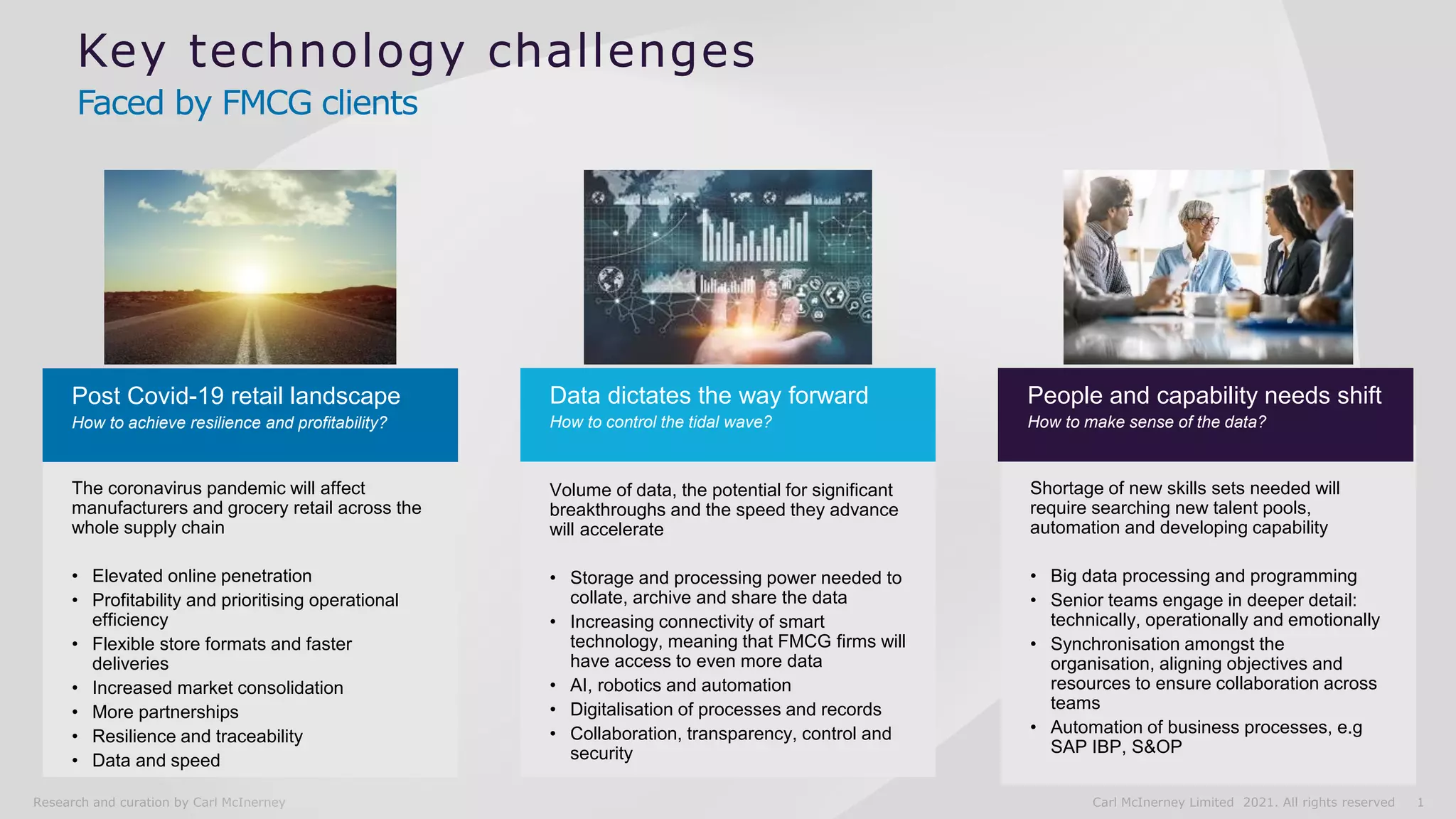

The document outlines key technology challenges faced by FMCG clients during the coronavirus pandemic, including increased online penetration, the need for operational efficiency, and enhanced collaborations. It emphasizes the significance of data-driven strategies, automation, and strategic partnerships to navigate complexities and achieve resilience in the retail landscape. The importance of building internal capabilities and leveraging technology for sustainable growth and competitive advantage is also highlighted.