The document discusses equity markets, stock exchanges, and money markets. It provides details on:

1) What equity markets and stock exchanges are, including that they allow for public trading of company stock.

2) The main participants in equity markets, including individual and institutional investors such as mutual funds and corporations.

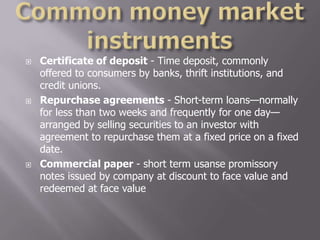

3) Key money market instruments like treasury bills, certificates of deposit, and repurchase agreements that facilitate short-term borrowing and lending.

4) Major participants in the money market, including banks, corporations, money market funds, and central banks.