This document discusses Diageo, the world's largest producer of premium drinks. Some key points:

- Diageo has a market capitalization of £47B and sells products in over 180 countries.

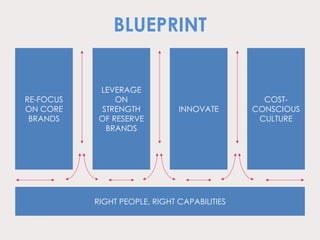

- Its goal is to be the best performing, most trusted, and respected consumer goods company.

- It has a diverse brand portfolio and generates a third of sales from North America.

- Diageo has strong brand equity and invests in health, well-being, and sustainability programs.

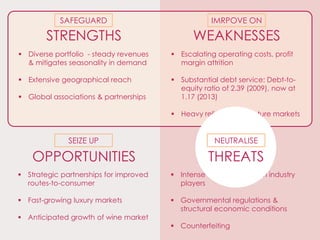

- An analysis identifies opportunities like partnerships and growing luxury markets but also threats like regulations and intense competition.