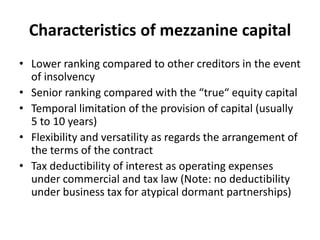

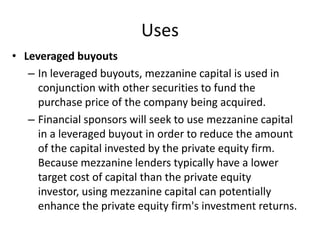

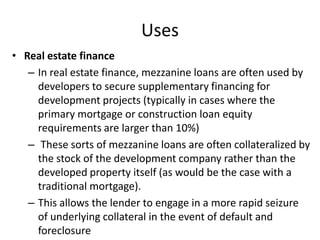

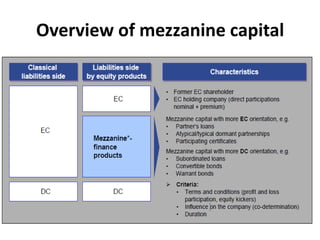

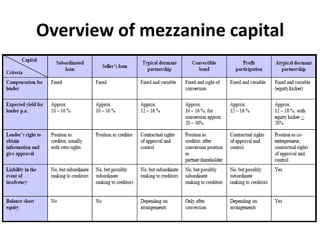

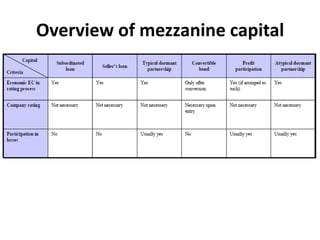

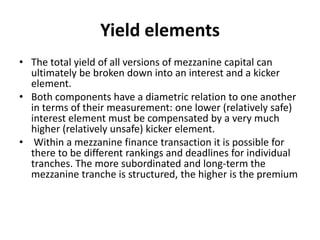

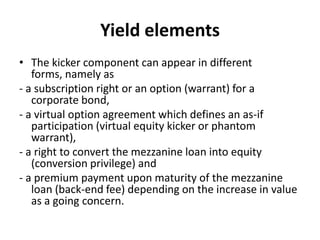

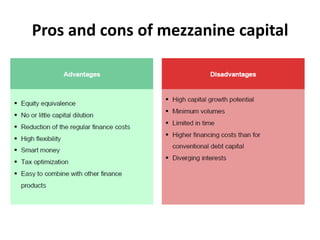

Mezzanine capital is a form of financing that ranks between debt and equity. It has characteristics of both, being senior to equity but junior to other debt. Mezzanine financing is often used in leveraged buyouts and real estate development to provide supplementary funding. It typically takes the form of subordinated loans with an interest payment as well as an equity kicker component like warrants, options, or profit sharing that provides an additional return. While offering flexibility, mezzanine financing also carries higher risk than senior debt.