Metso's Q2 2013 highlights include:

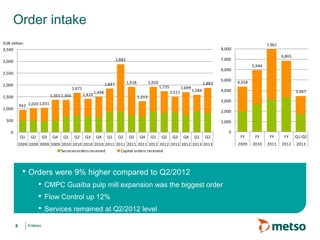

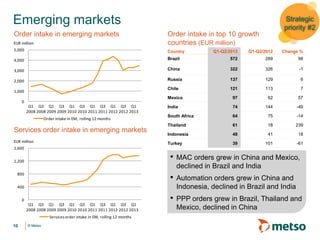

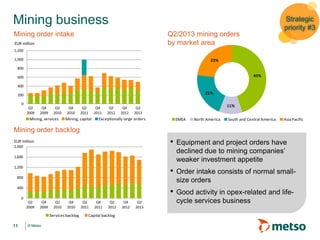

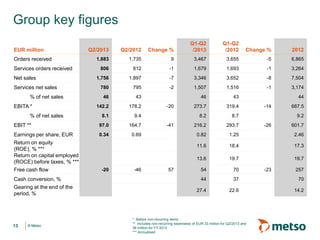

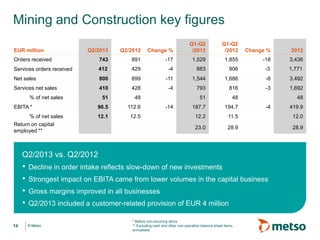

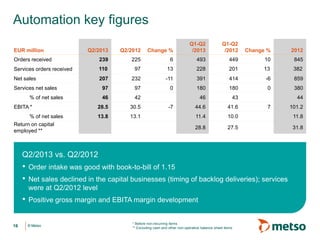

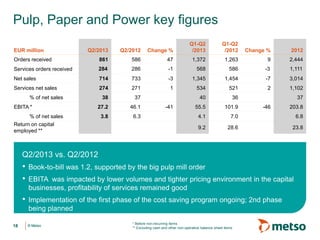

- Order intake was EUR 1,883 million, up 9% year-over-year. Net sales totaled EUR 1,756 million, down 7%.

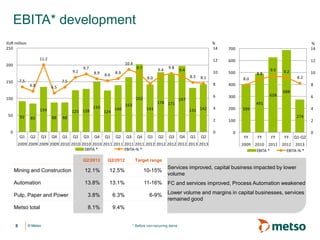

- EBITA before non-recurring items was EUR 142 million, down from EUR 178 million in Q2 2012.

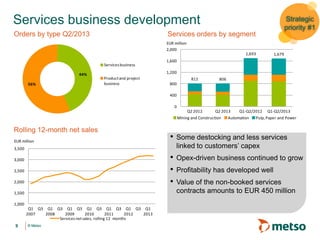

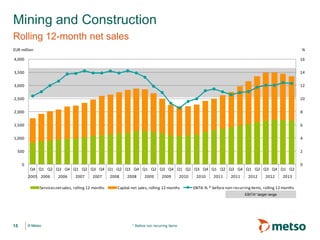

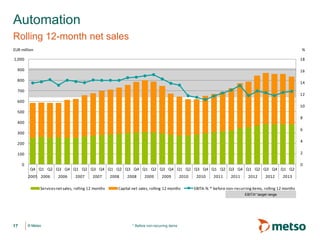

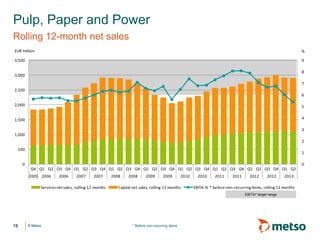

- Services business remained solid but capital expenditure-related services saw a slowdown.

- Cost saving initiatives will continue across business areas to improve profitability.

- The demerger process to separate Metso into two companies has progressed on schedule.